3 0

Bitcoin Faces Bear Market Risk if Prices Drop Below $70,000

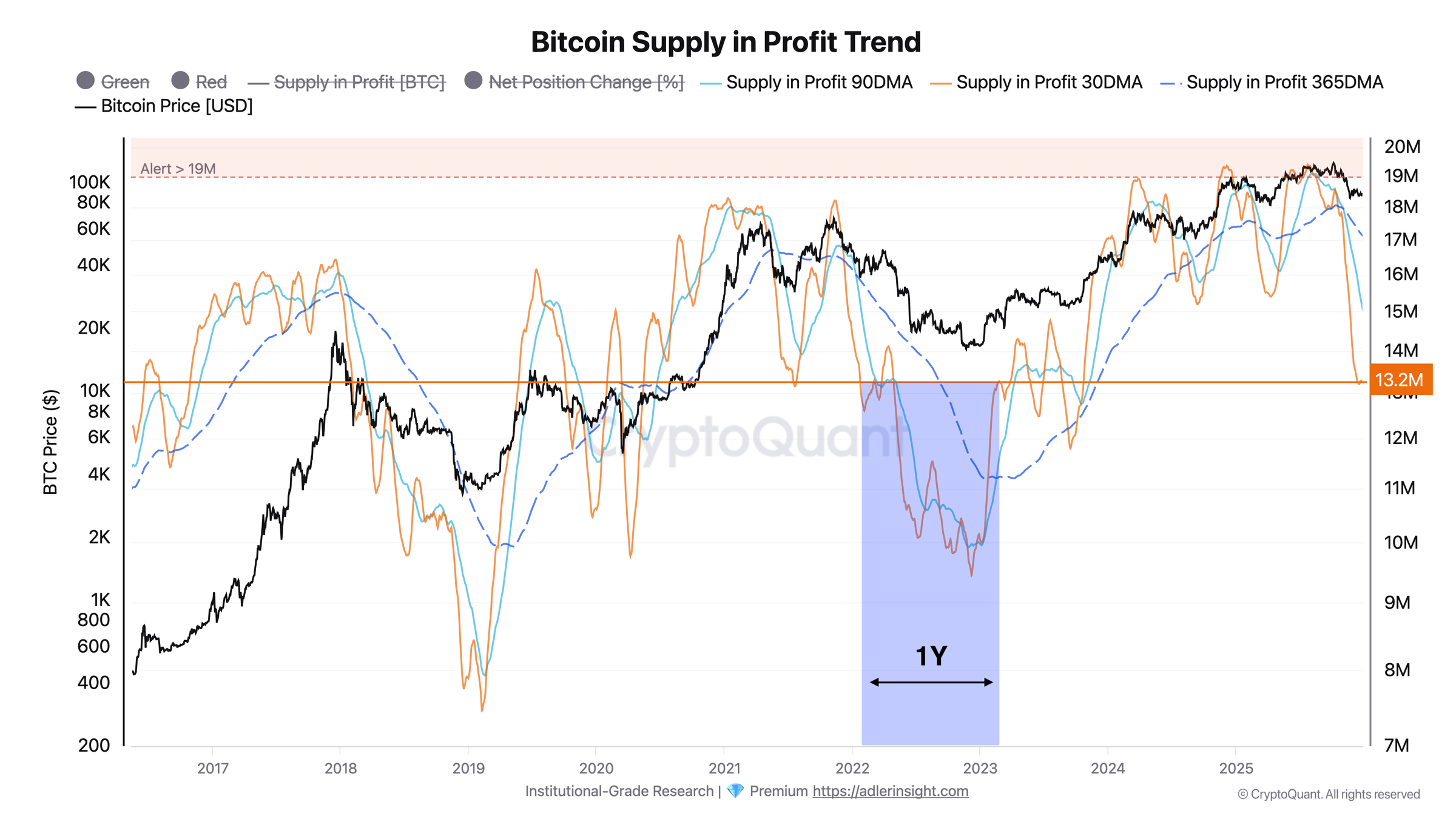

Bitcoin's price stability between $87,000–$90,000 has affected the "Supply in Profit" metric, tracking BTC held above acquisition price, which fell from October's 19 million to 13.2 million BTC.

- The 30-day and 90-day simple moving averages of Supply in Profit show a gap of about 1.75 million BTC, similar to a 2022 bearish setup.

- The 365-day average remains elevated, indicating long-term profit potential hasn't fully declined.

- Adler suggests a near-term bottom for the 30-day trend, with a recovery conditional on BTC maintaining current levels or higher.

The narrowing gap between the 30-day and 90-day averages is due to the latter being pulled down as high October values exit the window. This effect might allow a bullish crossover by late February or early March if current trends persist.

A key risk point is at $70,000, where Supply in Profit could drop to around 10 million BTC, potentially postponing a bullish signal. Maintaining above $75,000–$80,000 through January is crucial to support a positive outlook.

At present, Bitcoin is trading at $88,102.