Bitcoin Faces Bearish Pattern, ETPs See $2B Outflows Amid Investor Concerns

Key Points:

- Bitcoin's bearish ABCD pattern indicates potential price correction below $83K.

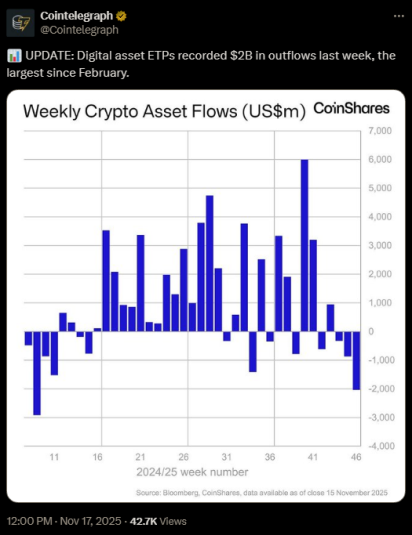

- ETPs experienced over $2B in outflows, the largest since February, suggesting reduced investor confidence due to whale sell-offs and declining risk appetite.

- Presale projects such as Bitcoin Hyper, PEPENODE, and Ionix Chain may offer investment opportunities amid a bearish market.

Details:

- Bitcoin is showing exhaustion signs with a bearish ABCD pattern, hinting at a possible decline towards the $83,800 support level. A failure to hold this level could trigger a broader market correction.

- ETPs recorded a significant $2B outflow last week, reflecting decreased investor confidence and ongoing whale sales.

Investment Alternatives:

1. **Bitcoin Hyper ($HYPER):** Raised $27.8M in presale; aims for scalability similar to Solana. Positioned to withstand market downturns.

2. **PEPENODE ($PEPENODE):** Combines DeFi with gamified staking. Raised $2.1M in presale; offers high staking rewards of 596%.

3. **Ionix Chain ($IONX):** Focuses on blockchain integration with real-world industries. Raised $1.5M in presale; targets sectors like supply chain and healthcare.

These projects provide potential growth and resilience against Bitcoin's current market dynamics.