10 1

Bitcoin Faces Bearish Pressure Amid $1.6 Billion Crypto Liquidations

Recent data from Coinglass indicates over $1.6 billion in crypto liquidations within 24 hours, primarily long positions. This surge in exchange inflows threatens to push Bitcoin (BTC) below the critical $112,000 support level.

Bitcoin Volatility Amid Market Concerns

- BTC dropped from $116,000 to $111,800, influenced by concerns over a potential US government shutdown, with prediction markets suggesting a 70% chance of this occurring in 2025.

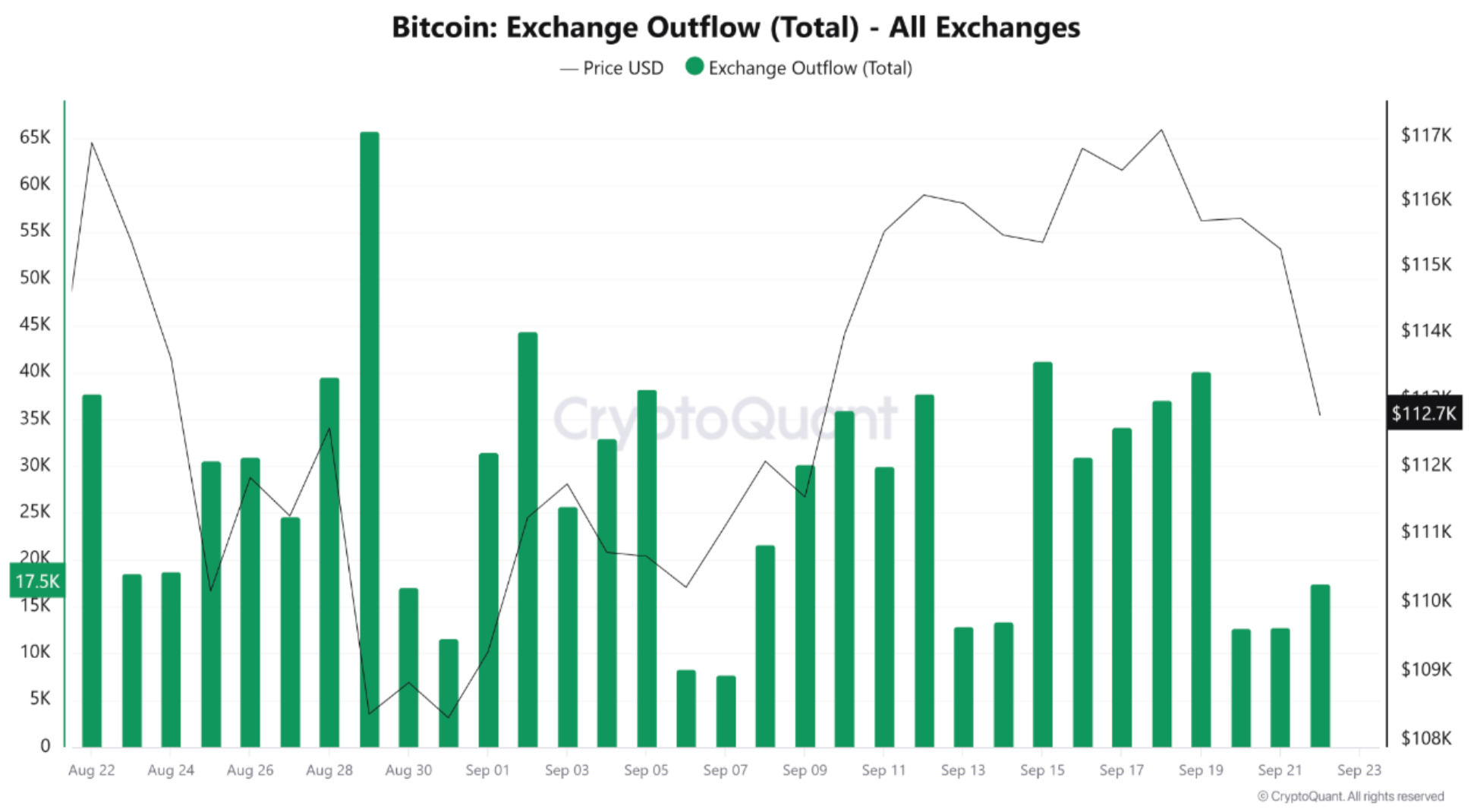

- CryptoQuant contributor PelinayPA noted that nearly 65,000 BTC were withdrawn from exchanges in late August and early September, coinciding with a price recovery.

- Recent trends show weakened outflows, as more investors are keeping their coins on exchanges since September 20.

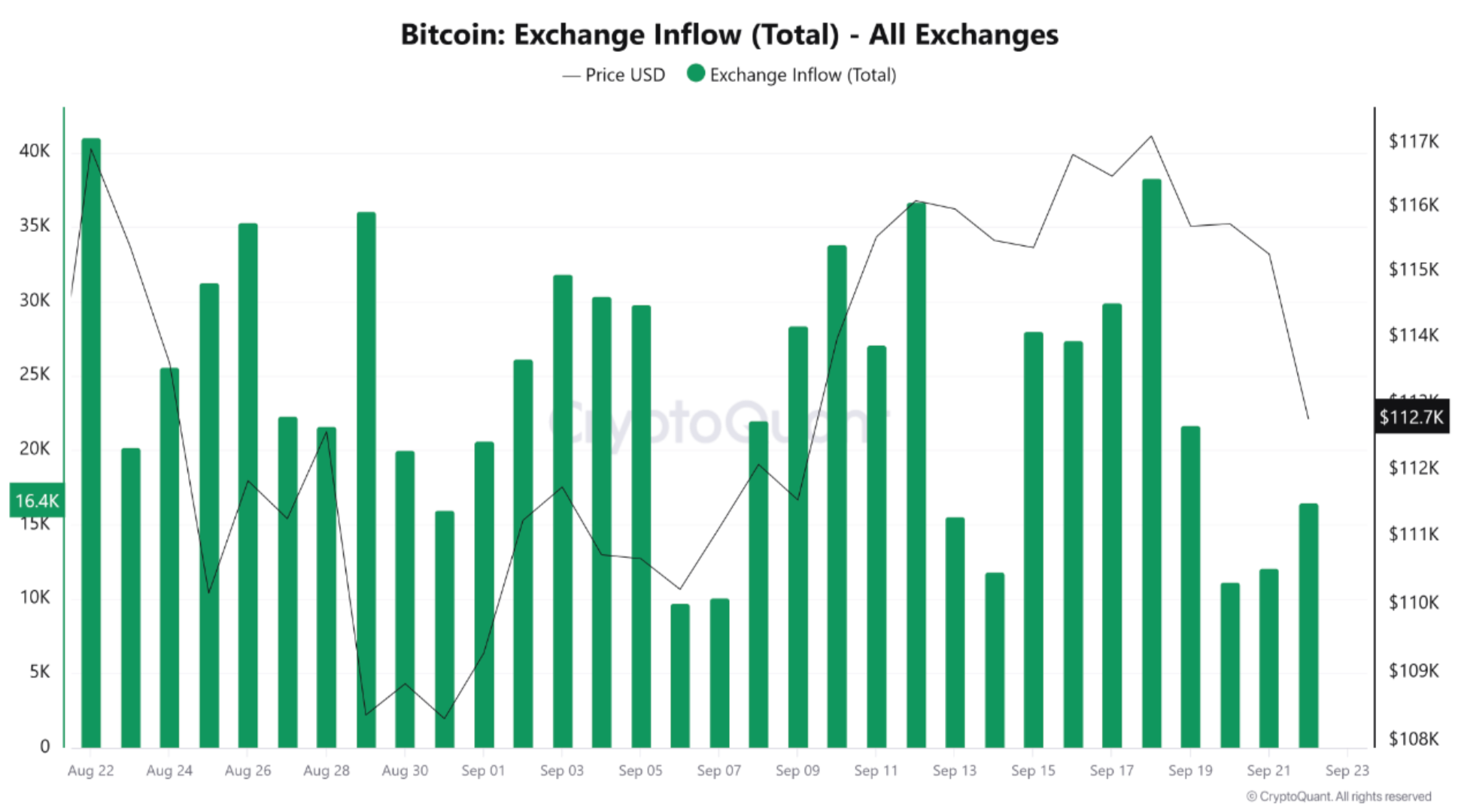

- Between September 17 and 19, BTC inflows to exchanges surged to nearly 40,000, leading to a price drop to $117,000.

- High inflows typically indicate increased selling intent, creating short-term bearish pressure.

- The recent rally saw more outflows than inflows, supporting bullish momentum until inflows surpassed outflows post-September 17.

Inflows remain high while outflows are weak, indicating short-term downside pressure. Increased outflows could signal accumulation, potentially rebounding BTC from the $112K zone.

Market Insights

- Bitcoin's decline to $112,000 aligns with on-chain data showing limited whale participation in recent rallies.

- The price drop followed a 25 basis point interest rate cut by the US Federal Reserve.

- Despite the fall, experts believe BTC is far from capitulation. CryptoQuant CEO Ki Young Ju predicts BTC could reach $208,000 in the current market cycle.

At present, BTC trades at $113,175, marking a 2.1% decrease over the past 24 hours.