12 0

Bitcoin Faces Bearish Sentiment as Prices Dip Below $105,000

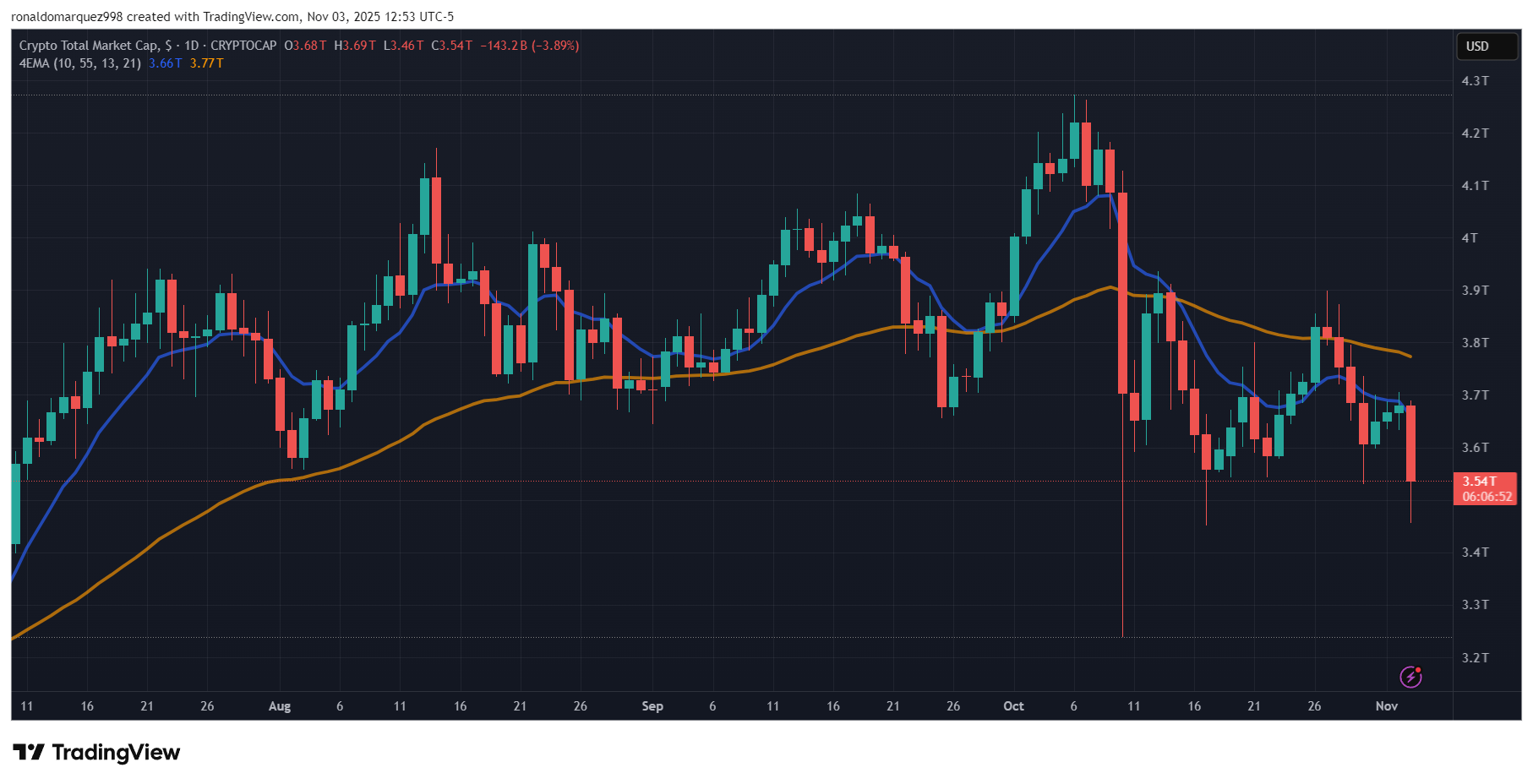

November has started negatively for crypto, with Bitcoin dipping toward $105,000. This drop has intensified bearish sentiment among investors.

Market Analysis

- CryptoBirb notes the market is in a 10-day bearish cycle, based on on-chain data.

- The cycle peak data shows it's 1,078 days since the low in November 2022 and 563 days since the last Halving.

- 17 days remain before the peak window closes on November 20, with no anticipated rally yet.

- Bitcoin's current cycle compares to 2017, where it peaked 1,068 days post-low. It now sits 16% below its all-time high of $126,200.

- Historically, November averages a 17.5% gain, but early red months suggest shifting cycles.

Challenges and Potential Bullish Factors

- DeFi researcher DeFiIgnas highlights complexities: speculative AI bubble, unresponsive bullish news, post-October crash uncertainty, cyclical market behavior.

- Selling by long-term holders and negative ETF flows add to concerns.

- Potential positive factors: easing liquidity, Fed interest rate cuts, slow institutional adoption, possible US crypto market structure bill.

- Fourth-quarter historical strength, stablecoin supply highs, and a US-China trade deal could counterbalance bearish trends.