Bitcoin Bears Face Short Squeeze Risk as Open Interest Reaches $22.6 Billion

Bitcoin approaches a significant milestone, recently surpassing $71,000. This breakout has generated optimism among analysts, who anticipate further increases as the US election nears, historically associated with market volatility.

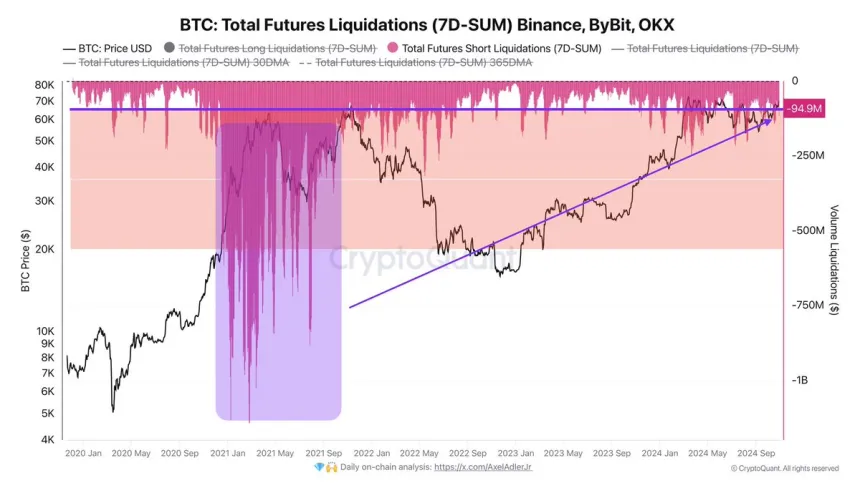

Data from CryptoQuant reveals Open Interest at $22.6 billion, with bears holding half of these positions. Continued price increases may lead to short liquidations, potentially heightening buying pressure as Bitcoin exceeds $71,000.

The upcoming days will be critical for BTC's ability to maintain its upward trajectory or enter a consolidation phase below previous highs. A confirmed breakout could indicate new record prices, while stagnation might necessitate further consolidation.

Bitcoin Bears In Serious Trouble

Bears face heightened risks of forced liquidations due to substantial short position liquidity above $71,000. Analyst Axel Adler suggests that mass liquidations could trigger a strong rally, propelling Bitcoin past its all-time highs. He highlights the current market structure as conducive to a major squeeze, indicating that liquidating short positions could drive prices higher.

Should this occur, Bitcoin's surge could catalyze growth across the broader crypto market, typically influenced by BTC movements. A rally past previous highs may attract retail and institutional investors, revitalizing interest in cryptocurrencies.

BTC Testing Crucial Supply

Bitcoin is currently testing a supply zone at $71,200, the last resistance before its all-time high. Price action suggests a potential breakout, with maintaining levels above $70,000 reinforcing bullish sentiment and encouraging buyer activity.

A temporary retracement to lower demand levels could benefit Bitcoin’s trend. A dip to around $69,000 or $66,500 would still align with a bullish outlook, allowing liquidity gathering for a stronger push toward new highs.

Traders recognize that a sustained move above $71,200 could facilitate price discovery beyond historical highs, potentially triggering renewed momentum across the market.

Featured image from Dall-E, chart from TradingView