6 0

Bitcoin Remains Below $110K; Altcoins Show Stronger Performance

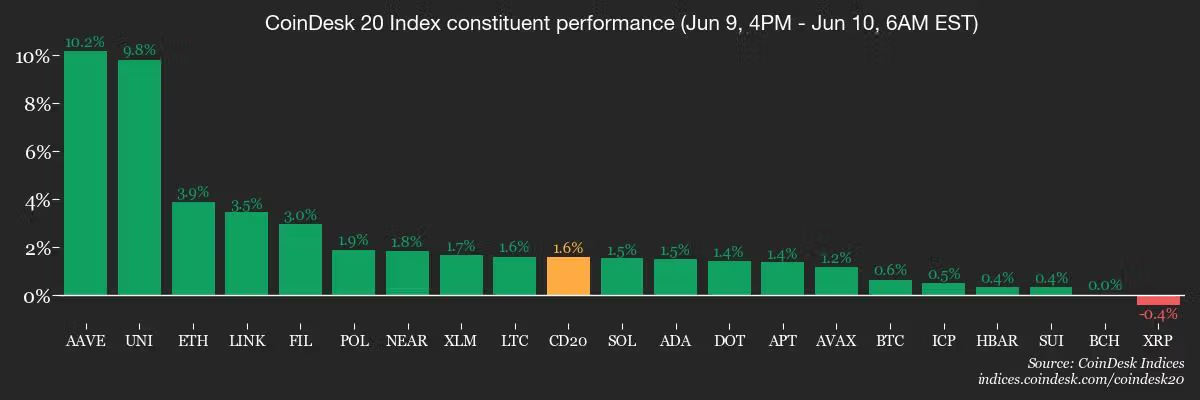

Bitcoin (BTC) is trading just below $110,000, marking a 2% increase over the past 24 hours but underperforming compared to the broader market.

- The CoinDesk 20 Index rose by 3.4%, while Ether (ETH) gained over 6%.

- The number of publicly listed companies holding Bitcoin as a treasury asset has increased to 126, owning approximately 819,000 BTC, a rise of 3.25% in the last month.

- Notable companies include MicroStrategy (MSTR) and BlackRock's iShares Bitcoin Trust (IBIT), which reached $70 billion in assets under management in just 341 days.

- Market volatility remains low, with BTC trading in a tight range. Analysts suggest a decisive move above $110,000 or below $100,000 is needed to reignite interest.

- Upcoming U.S. CPI data and news from U.S.-China trade talks may influence market direction.

Market Movements

- BTC is up 0.71% at $109,535.95.

- ETH is up 3.92% at $2,692.82.

- CoinDesk 20 Index up 1.52% at 3,210.97.

Derivatives Positioning

- Bitcoin options open interest rose to $44.33 billion, indicating strong demand for options.

- Traders maintain a bullish stance with a put/call ratio of 0.57 on Deribit.

- Actual BTC liquidations totaled $170.74 million recently, primarily from short positions.

Token Unlocks

- Aptos (APT) will unlock 1.79% of its supply worth $53.61 million on June 12.

- Immutable (IMX) will unlock 1.33% worth $12.82 million on June 13.

ETF Flows

- Spot BTC ETFs saw daily net flows of $386.2 million, with cumulative net flows at $44.61 billion.

- Spot ETH ETFs had daily net flows of $52.7 million, totaling $3.4 billion cumulatively.

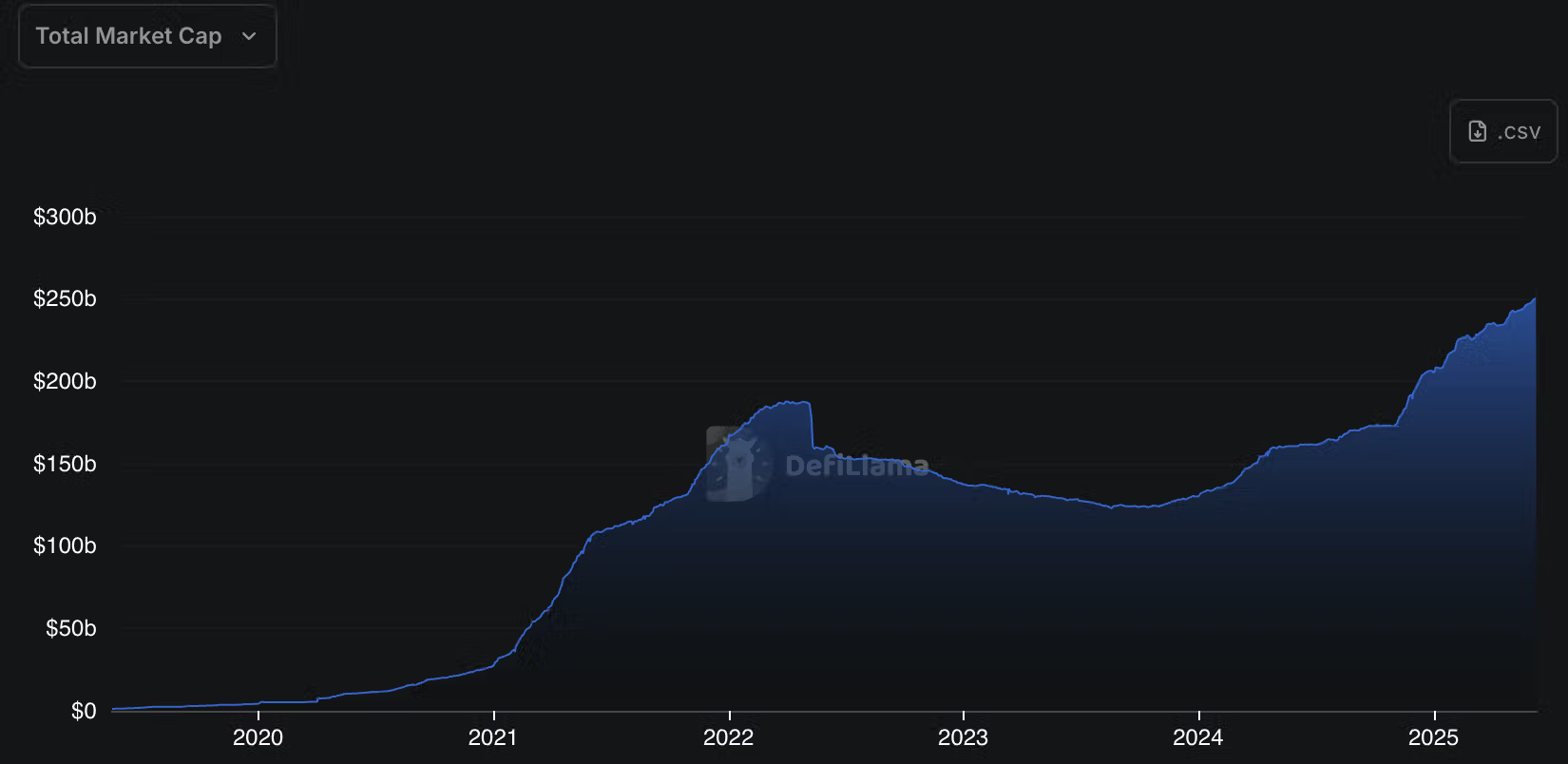

Chart of the Day

- Total stablecoins market cap surpassed $250 billion for the first time.

Recent developments include South Korea's ruling party proposing regulations for stablecoin issuance and SocGen launching a dollar stablecoin on Ethereum and Solana.