7 0

Bitcoin Remains Below $120,000 Amid Increased Exchange Inflows

Bitcoin is currently priced at approximately $118,612, down 4.1% from its recent high of over $124,000, following comments from the US Treasury regarding non-purchase of the cryptocurrency.

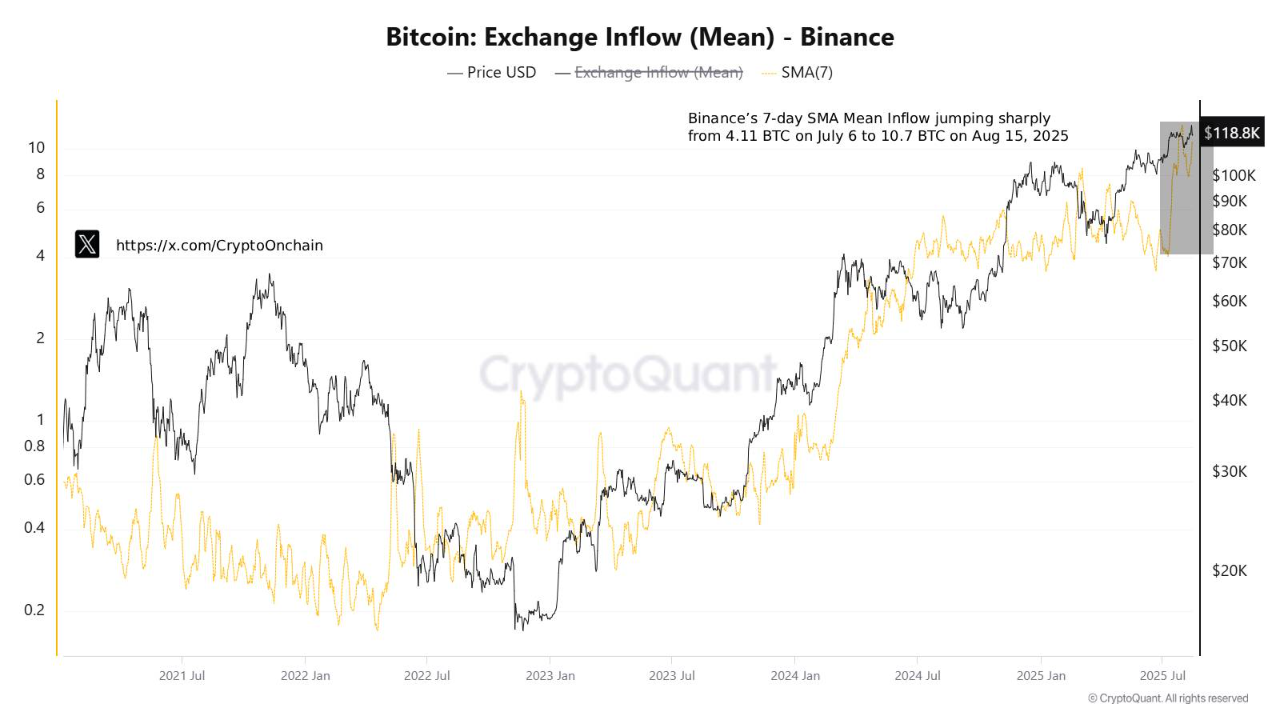

Exchange Inflows and Market Dynamics

- Record inflows to Binance indicate increased Bitcoin transfers into exchange wallets.

- This trend suggests potential selling activity or adjustments in institutional portfolios.

- High inflows without corresponding buying demand can lead to short-term selling pressure.

- Positive netflow shows growing reserves at Binance, typically associated with price volatility.

- The market may face higher downside risk if inflows continue without increased demand.

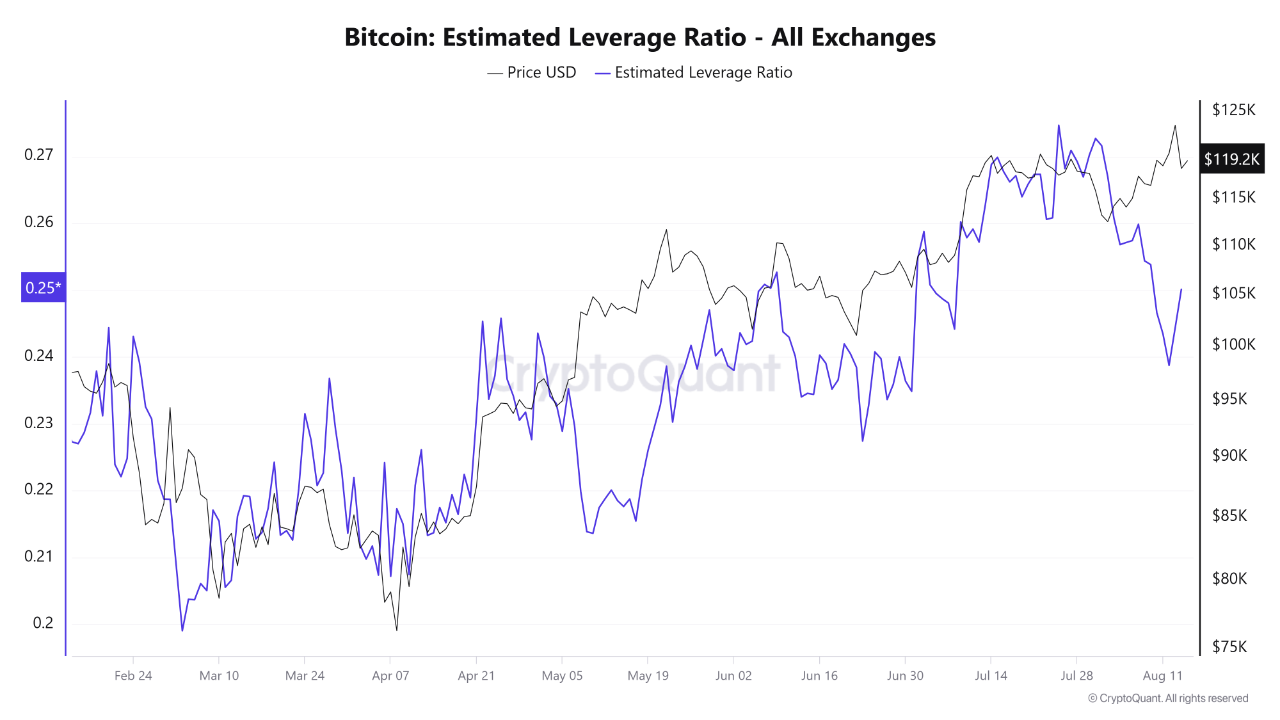

Leverage Ratio Analysis

- The Estimated Leverage Ratio (ELR) for Bitcoin has decreased from above 0.27 to around 0.25.

- A reduction in leverage indicates lowered speculative risk and broader market stability.

- Current market support appears driven by liquidity rather than speculation.

- If ELR remains between 0.24 and 0.25 while prices rise above $120,000, it could signal a sustained advance.

- A rise in ELR above 0.27 during tests of the $120,000–$124,000 range could heighten correction risks.