6 0

Bitcoin Struggles Below $90K as Bearish Momentum Persists

Bitcoin Struggles Below $90,000 Amidst Bearish Signals

- Bitcoin hovers near $89,000 after failing to maintain levels above $90,000.

- The market remains indecisive, with concerns over whether the recent pullback is temporary or signals a deeper correction.

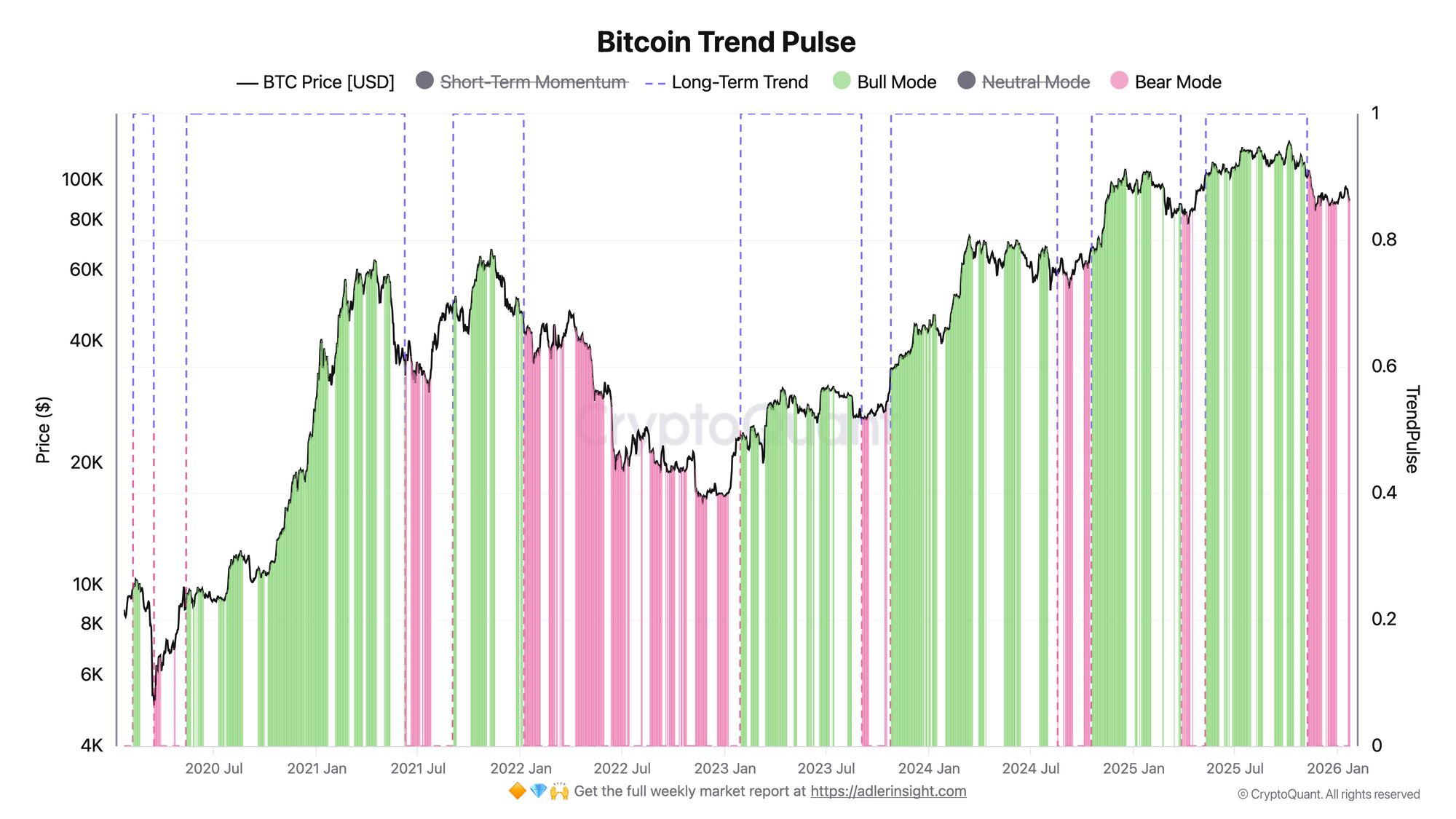

- Analyst Axel Adler highlights that Bitcoin has been in Bear Mode for 83 days, with momentum indicators turning negative since January 19.

- The Trend Pulse indicator shifted from Neutral to Bear Mode, driven by a negative 14-day return and SMA30 vs. SMA200 trend signal.

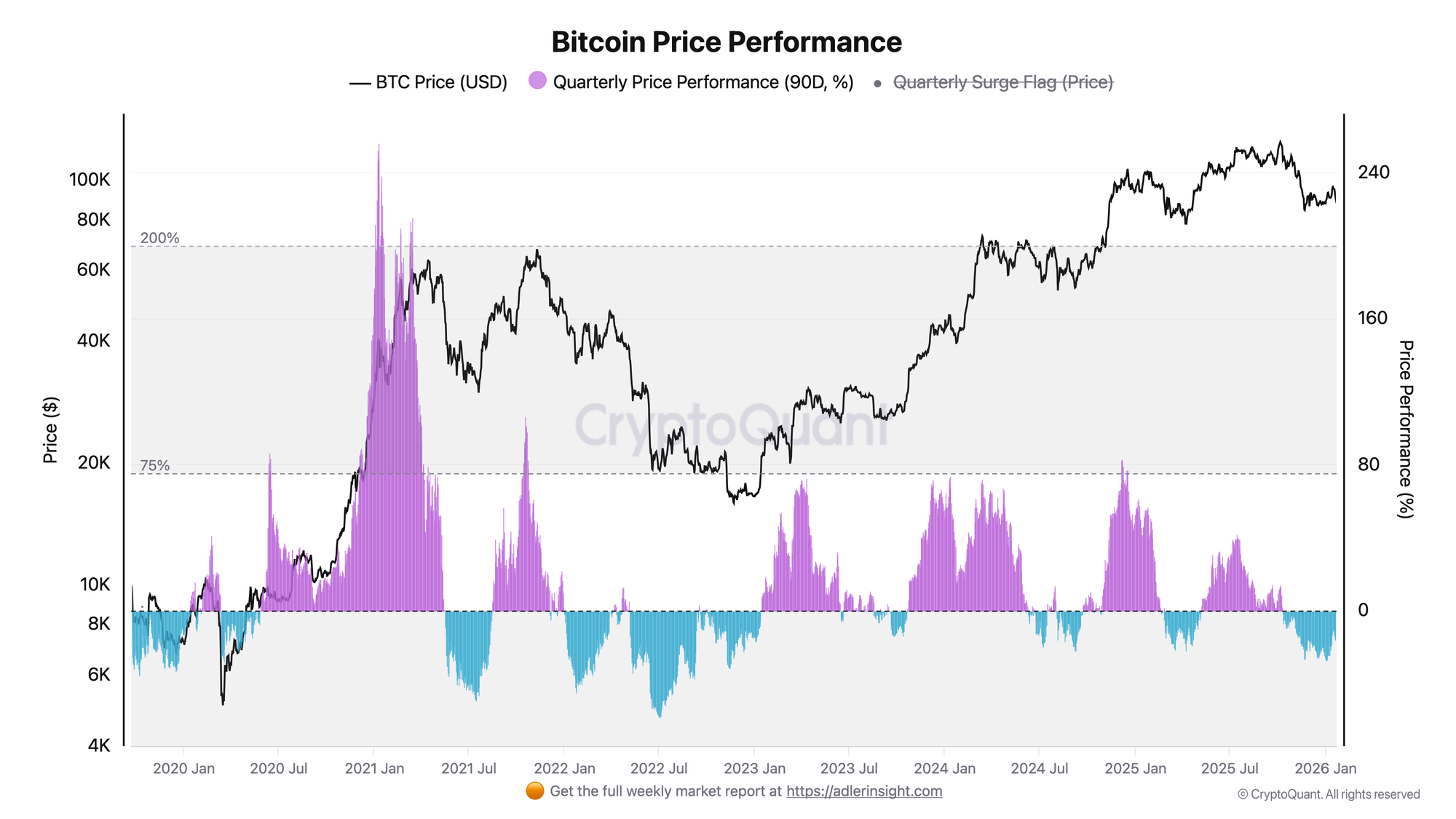

- Bitcoin’s quarterly return is at -19%, indicating macro weakness but not extreme enough to suggest a definitive bottom.

Indicators Highlight Ongoing Pessimism

- The last Bull Mode signal was on November 2, 2025, when BTC traded near $110,000.

- A shift from Bear to Neutral requires a 14-day return above 0, while returning to Bull Mode needs SMA30 crossing above SMA200.

- Bitcoin’s quarterly return at -19% suggests moderate pessimism without full capitulation.

- The 7-day change of -6.8% indicates accelerating downside momentum post-$90K breakdown.

Moving Averages Cap Bitcoin's Recovery

- Bitcoin trades below key moving averages, signaling bearish momentum.

- Recent attempts to push into the $95K–$97K range were met with rejection, leading to a price drop.

- Volume increases during selloffs suggest stronger downside pressure.

- Reclaiming $90K and maintaining above $92K–$94K is crucial for bulls to avoid further declines toward mid-$80K.