14 1

Bitcoin Bull Run Nears End as Analysts Predict Final Breakout

Bitcoin's Bull Run: Potential Endgame

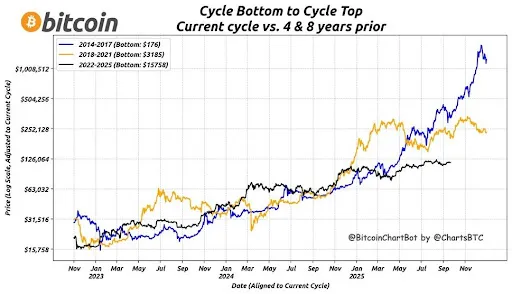

- Bitcoin (BTC) is at a critical phase in its cycle, with analysts debating if the bull run is nearing its peak.

- Market analyst 'CRYPTOBIRD' suggests the bull run could end within 30 days, as BTC has reached 97.5% of a standard cycle since the November 2022 bottom.

- Historically, the final 2.5% of a bull run sees dramatic price surges.

- Current market structure aligns with past cycles, indicating large accelerations before cycle completion.

- BTC is currently trading in a tight 5% range between $110,500 and $116,000, now slightly above $109,600.

- Key levels include the 200-week SMA at $53,111 and the 50-week SMA near $99,000.

- The Current Trend Framework (CTF) at $114,916 signals bearish periods, but bulls may stay in control if BTC holds above the 200-day BPRO at $112,250.

Halving Math & Volatility Analysis

- Bitcoin is 523 days post-halving, entering the "peak window" of 518-580 days after halving events.

- Volatility squeeze observed with ATR at 2,250 and 50-day volatility at 2,800, suggesting a potential breakout within weeks.

- Institutions are adjusting positions, with Bitcoin ETF flows showing distribution.

- Fear and Greed index at 44 indicates rising fear; RSI is neutral at 46.

- Despite September's weak reputation for BTC, it gained 4.4% month-to-date, defying historical trends.