15 0

Bitcoin Bull Run Predicted to Extend Until Q2 2026 Due to Key Factors

The price of Bitcoin has increased, reaching $110,000 from an initial $107,000. Despite this rise, there is speculation that the bull run may have peaked due to selling pressure.

Shift in Bitcoin's Cycle

- Analysts from The Bull Theory suggest a shift from a four-year to a five-year cycle for Bitcoin.

- Next peak expected around Q2 2026, influenced by global economic changes.

- Factors include extended debt rollover by governments, longer business cycles, and slower liquidity waves.

Monetary Policy and Global Liquidity

- Central banks' easing policies, like those indicated by the Federal Reserve, impact markets with delays.

- China's growing money supply (M2) surpasses the US, historically leading to Bitcoin rallies.

- Japan's economic measures also contribute to global liquidity.

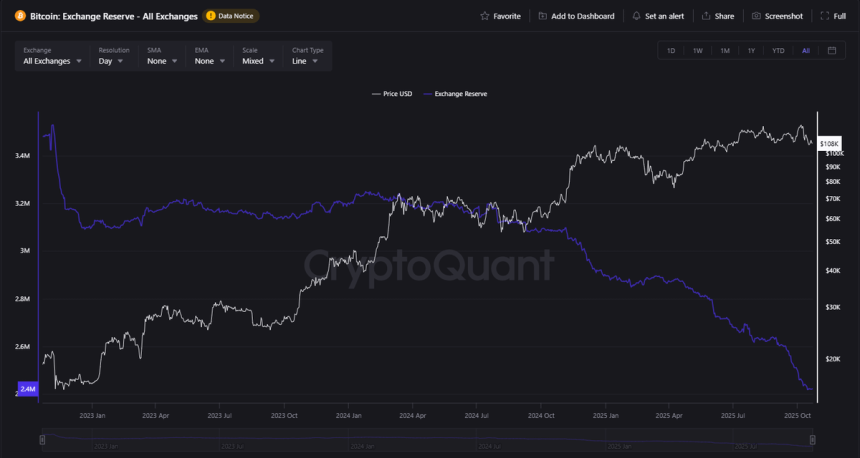

Institutional Accumulation

- Current cycle marked by institutional accumulation rather than retail hype.

- Exchange reserves are low, and miner selling pressure has decreased post-Halving.

- Retail interest remains low, indicating a quiet expansion phase.

The four-year Halving model is adapting to macro dynamics, with the bull run possibly peaking closer to Q2 2026.