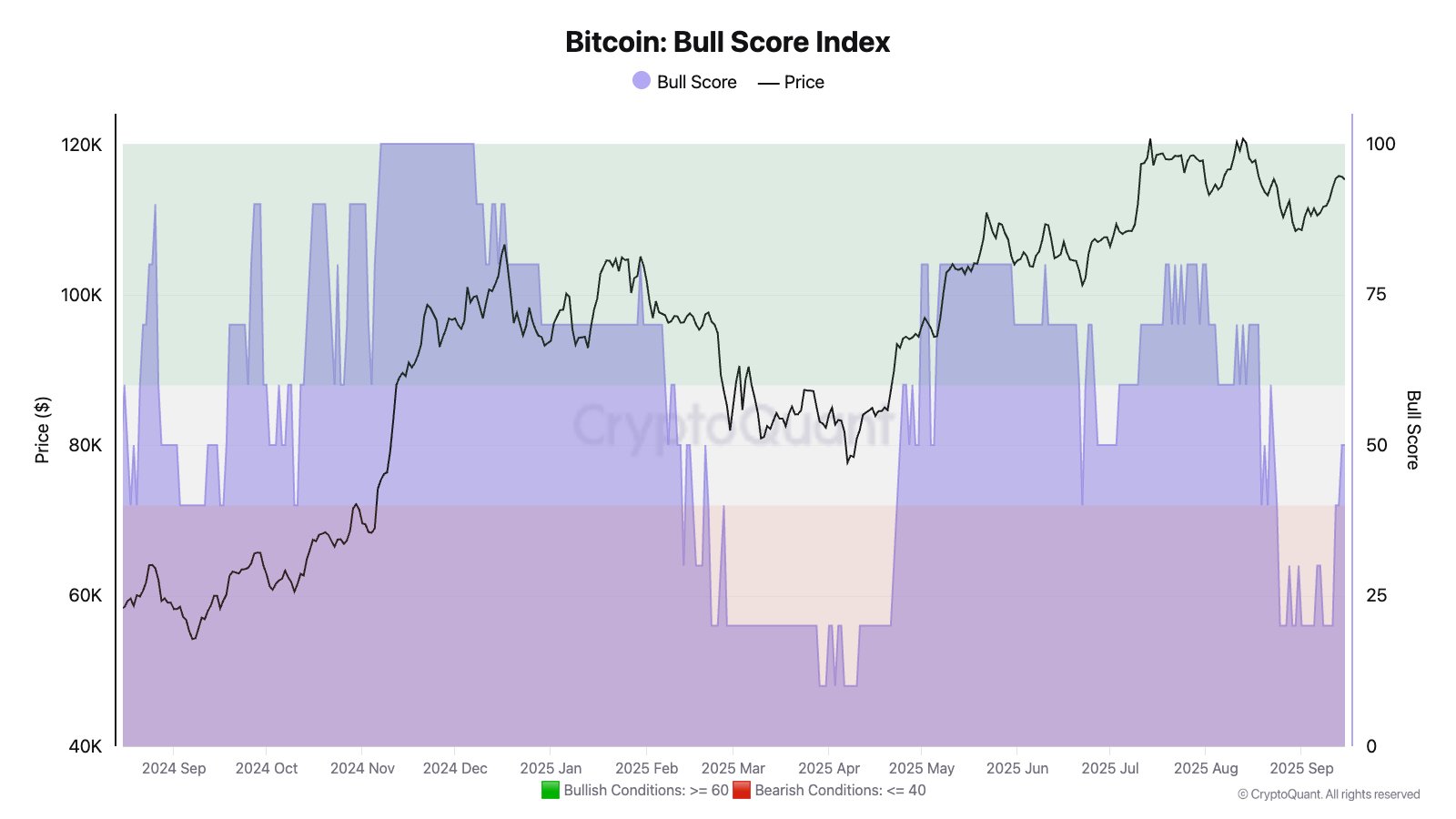

Bitcoin Bull Score Index Rises from 20 to 50 in Four Days

The Bitcoin Bull Score Index by CryptoQuant has increased from 20 to 50 within four days, indicating a move from bearish territory to neutral market conditions. This index assesses market phases using on-chain metrics such as the Market Value to Realized Cap Ratio and Stablecoin Liquidity.

- A value of 60+ signals bullish conditions, while 40 or lower indicates bearish phases.

- The current value of 50 reflects neutral conditions according to on-chain data.

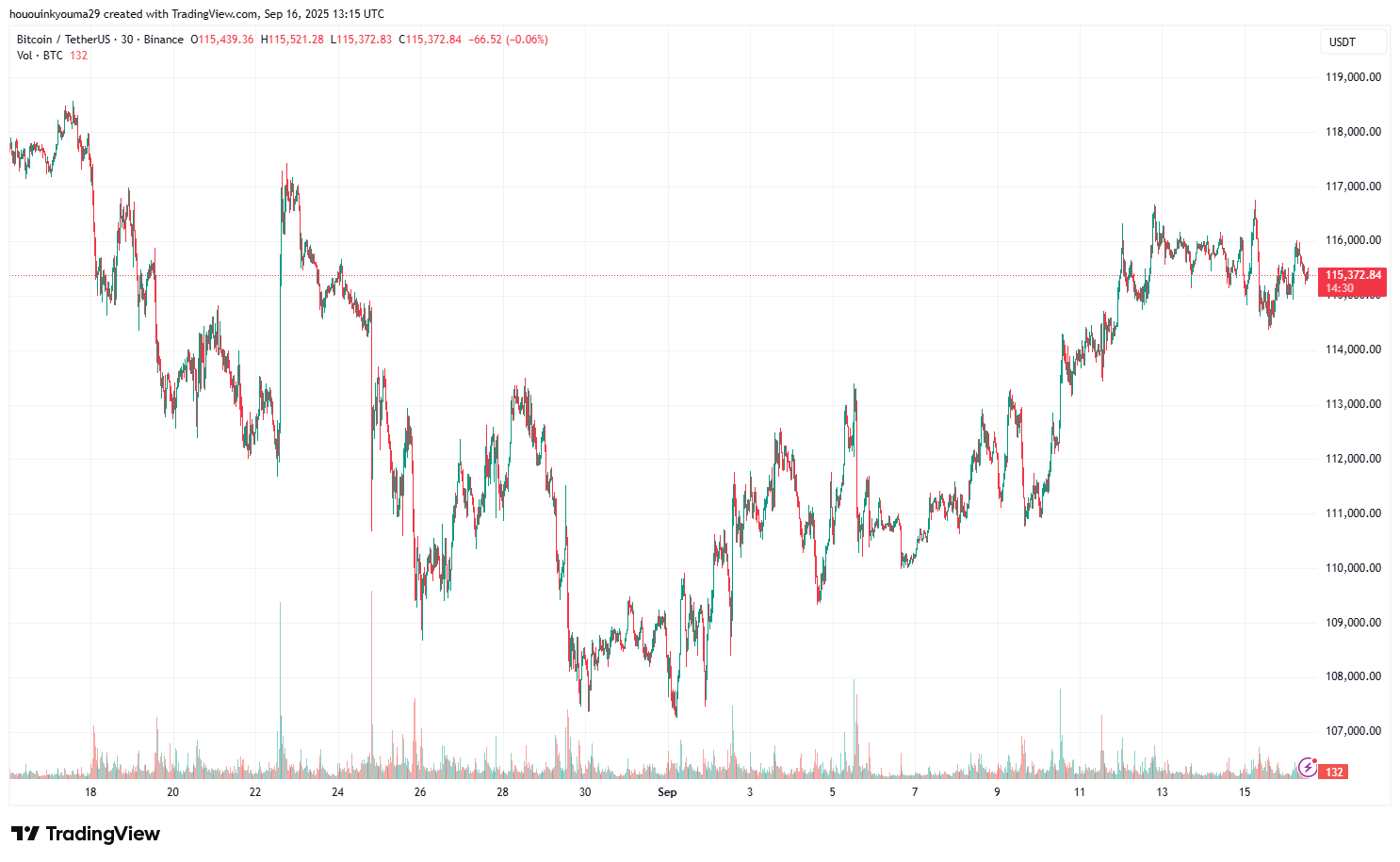

This shift coincides with the Federal Open Market Committee (FOMC) meeting, leading to sideways movement in BTC price, which suggests market uncertainty about the event's outcome.

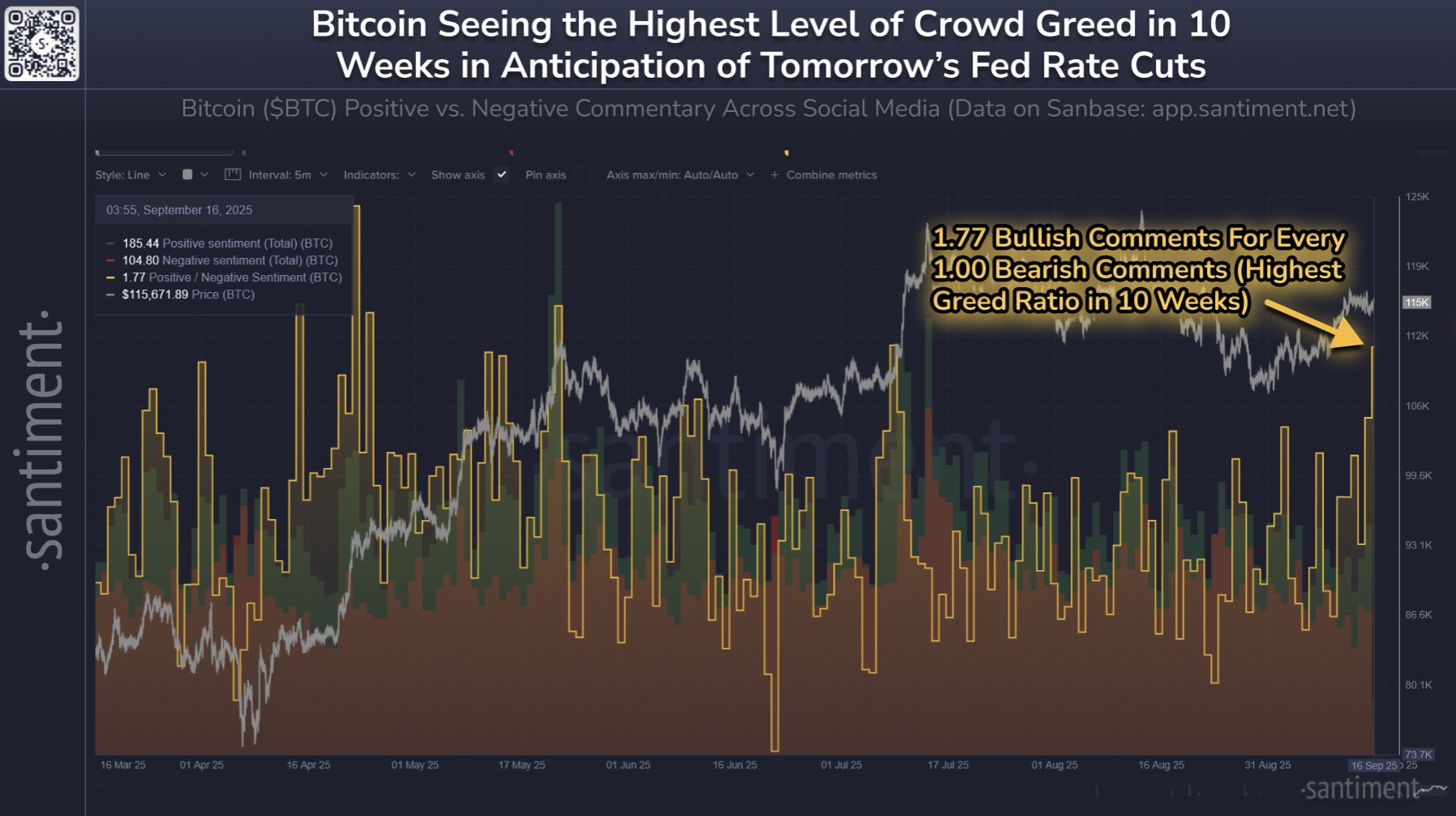

Analytics firm Santiment reports a surge in positive social media sentiment for Bitcoin, reaching a ratio of 1.77 positive comments per negative one. This marks the most bullish sentiment in 10 weeks, but historically, markets often move contrary to retail expectations.

Currently, Bitcoin trades around $115,700, up over 2.5% in the last week.