34 0

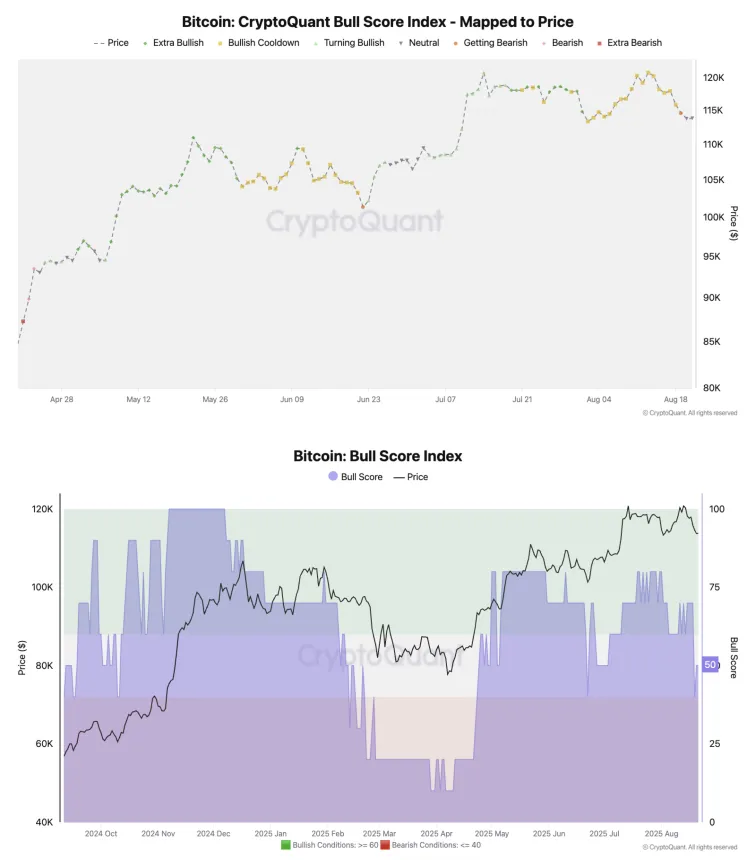

Bitcoin Bull Score Index Shifts to Neutral as Price Tests $112K Support

Current Bitcoin Status

- Bitcoin is trading around $112,837 after a decline from an all-time high of approximately $123,217.

- The price is testing the critical support level at $112,000, which bulls must defend to avoid bearish pressure.

- Momentum indicators indicate a short-term tilt toward weakness, with potential for further consolidation or correction.

Market Analysis

- Analysts view this moment as an inflection point; holding above $112K could reset sentiment and allow for consolidation.

- Failure to maintain this level may lead to a sharper correction, targeting deeper support levels.

- CryptoQuant’s Bull Score Index has shifted to a neutral signal, indicating weakened bullish momentum.

Technical Indicators

- Bitcoin's Bull Score Index declined from 70 to 50, reflecting a balanced state between buyers and sellers.

- Currently, BTC is below the 50-day SMA ($116,158) and testing the 100-day SMA ($111,224).

- A breakdown below $111K could lead to the 200-day SMA at $100,597, seen as final support for the current uptrend.

Future Outlook

- Broader market conditions remain constructive, with Bitcoin in a steady uptrend since 2023.

- Global macroeconomic factors will influence Bitcoin's trajectory in the coming days.

- If support holds, this neutral phase may represent a pause before another upward move; persistent weakness could signal deeper consolidation.