6 0

Bitcoin Bullish Momentum Weakens as Inter-Exchange Liquidity Declines

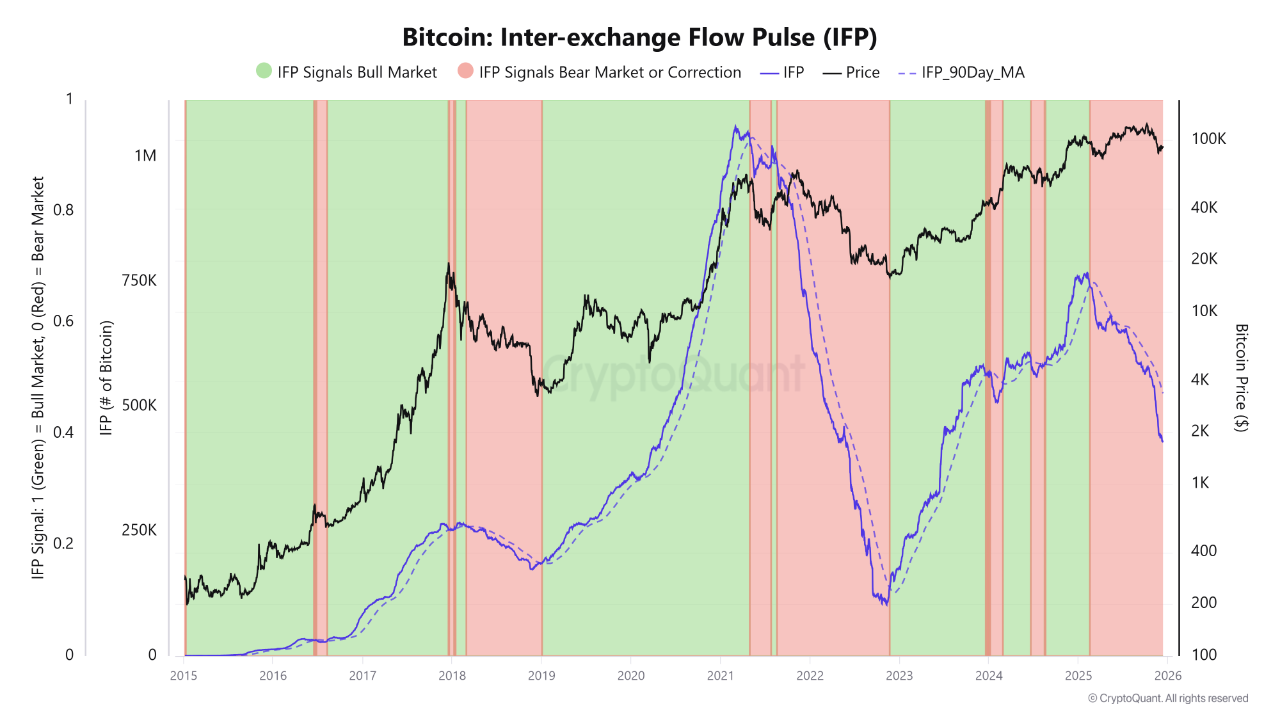

The Bitcoin market is showing signs of a trend reversal after a period of price correction. However, recent data indicates potential risks to BTC's bullish momentum.

Bitcoin IFP Indicator Insights

- Bitcoin experienced a 36.5% drop from its peak of $126,000 but recently rebounded from $80,000 to $94,000.

- The Bitcoin Inter-Exchange Flow Pulse (IFP) indicates that the upward price movement may not be sustainable.

- The IFP measures net Bitcoin movement between exchanges and has fallen below its 90-day moving average, signaling decreased market activity.

- The IFP is in the "red zone," often linked with upcoming corrections or weak structural growth.

Future Outlook

- Despite high prices compared to past periods, there's a disconnect between price and inflows.

- This may lead to prolonged price consolidation or sideways movement until exchange flows strengthen.

- Bitcoin's bullish structure isn't collapsing, but inter-exchange flows are slowing down.

- Market liquidity changes could trigger another correction.

- Bitcoin is currently trading at $90,338, down 1.82% in the last 24 hours, with daily trading volume up 34.64%, valued at $82.68 billion.

- A sustained price rebound depends on the IFP reclaiming its 90-day MA, indicating increased bullish flows.