Bitcoin Buying Pressure Increases Amid Concerns of Potential Pullback

A recent analysis by BaroVirtual, a CryptoQuant analyst, examines the Bitcoin market's current state.

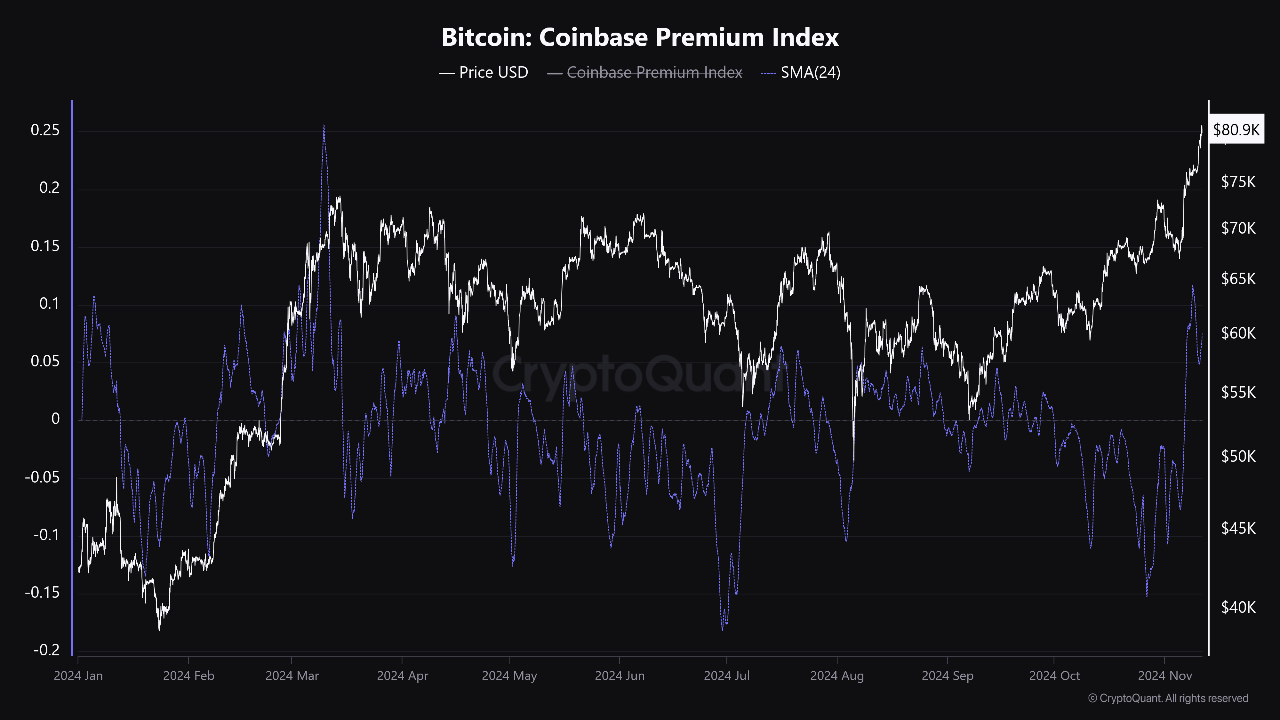

Fluctuations in the Coinbase premium—a measure of the price difference between Bitcoin on Coinbase and other exchanges—provide significant insights into market behavior.

Retail Leverage And Premiums: A Double-Edged Sword

Increased Coinbase premiums usually indicate strong buying pressure and medium-term bullish sentiment for Bitcoin. However, BaroVirtual cautions that high premiums may lead to short-term price declines due to market overheating. This is exacerbated by a high volume of leveraged retail positions and long contracts, increasing the risk of a market pullback.

This trend has been observed on some Asian exchanges, where aggressive trading positions have heightened market vulnerabilities. While soaring premiums reflect strong demand and investor confidence, they can also create instability due to high leverage, leading to sharp corrections from minor price changes.

The analyst emphasizes the importance of leverage dynamics in sustaining bullish trends. Increased risk appetite among retail traders on Asian exchanges could result in sudden market shifts if sentiment changes or premiums decrease.

Bitcoin Nears $100,000

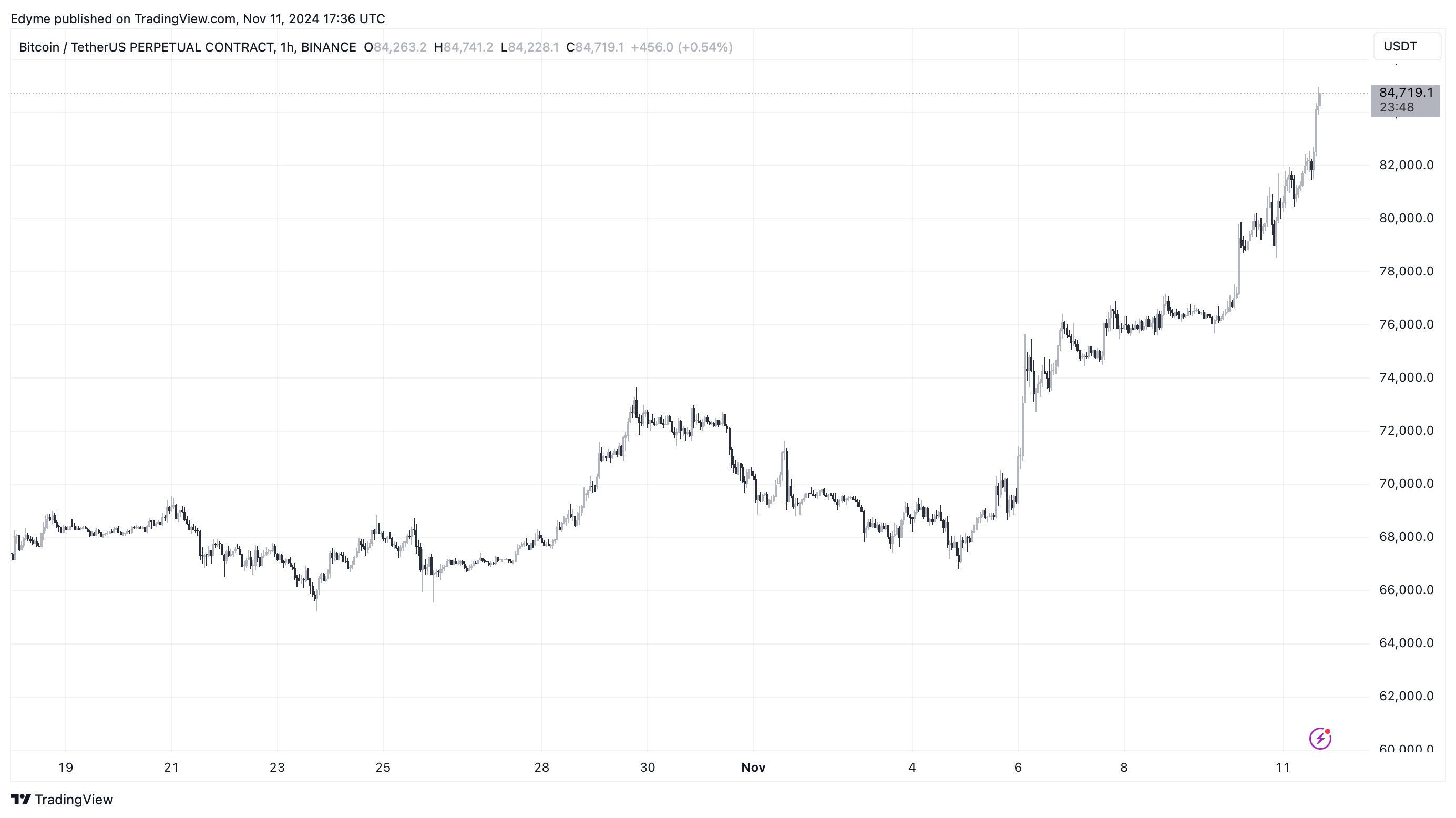

Bitcoin recently traded above $83,000 and reached an all-time high (ATH) of $84,929 before experiencing a slight correction to the same price at the time of writing.

Despite this pullback, Bitcoin's bullish momentum suggests potential for further gains, possibly exceeding $85,000 and approaching a six-digit ATH of $100,000.

Analyst Javon Marks noted on X that Bitcoin has "more upside coming," following its breakout from a descending broadening wedge pattern.

Prices of $BTC (Bitcoin), after breaking out of this descending broadening wedge pattern, have been climbing MAJORLY, moving roughly +24% since but there can still be much more upside coming!

The measured breakout target is another near 20% away just around the $100,000 mark and… https://t.co/F01HbCd1kv pic.twitter.com/k0bv9xqUwK

— JAVON

MARKS (@JavonTM1) November 11, 2024

Featured image created with DALL-E, Chart from TradingView