6 1

Bitcoin CME Futures Premium Drops to Lowest Since October 2023

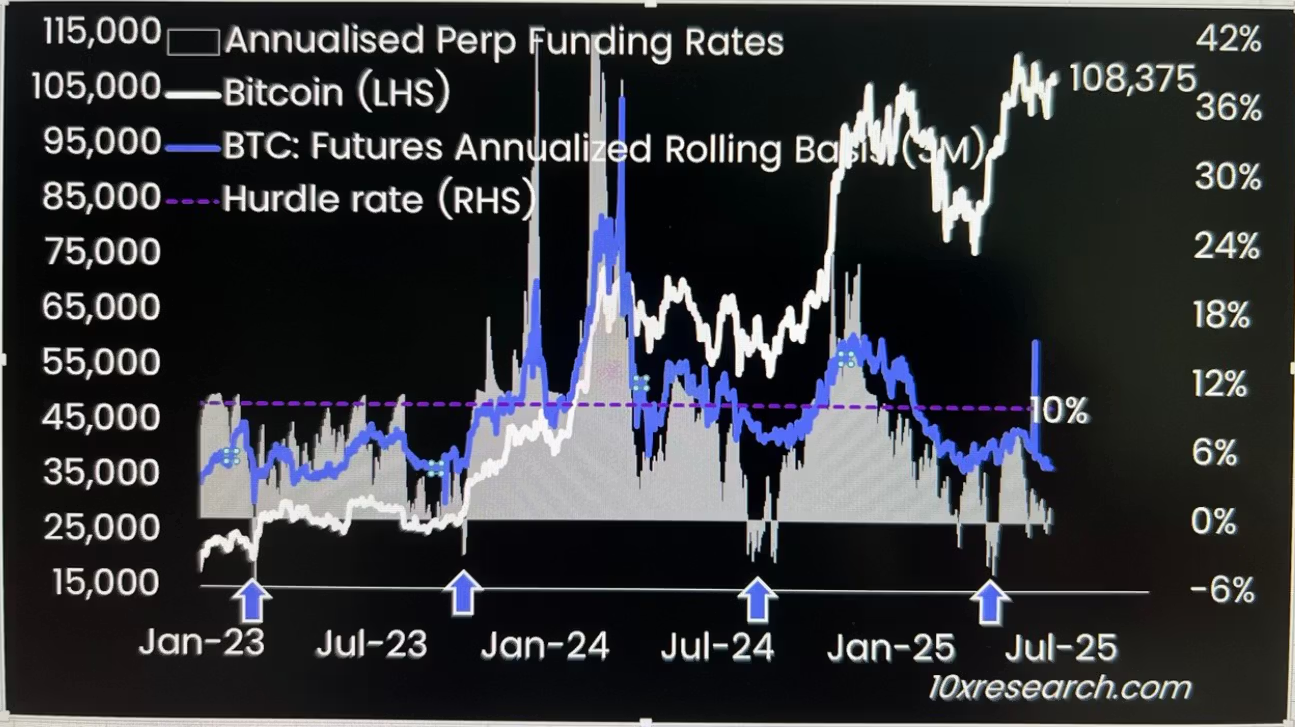

The premium in bitcoin (BTC) futures on the Chicago Mercantile Exchange (CME) has significantly decreased, indicating lower institutional interest.

- The annualized premium for rolling three-month futures is now 4.3%, the lowest since October 2023, down from over 10% earlier this year.

- This decline suggests reduced optimism about future BTC prices, despite the cryptocurrency remaining above $100,000.

- Funding rates in perpetual futures have also turned negative, indicating a bearish sentiment among traders.

- The narrowing price differential affects non-directional cash-and-carry arbitrage strategies involving spot ETFs and CME futures.

- Current spread rates are at 1.0% for perpetual futures funding and 4.3% for CME basis, highlighting a drop in hedge fund arbitrage activity.

- Muted retail participation is reflected in low spot market volumes and depressed funding rates.

- Padalan Capital reported an inversion into negative territory of the CME-to-spot basis for both Bitcoin and Ethereum, suggesting aggressive institutional hedging or unwinding of cash-and-carry structures.