Bitcoin Coinbase Premium Index Reaches Two-Year Low Amid Market Decline

Data indicates that the Bitcoin Coinbase Premium Index has recently dropped to two-year lows, which may impact BTC's price.

Bitcoin Coinbase Premium Index Decline

The BTC Coinbase Premium Index has experienced a significant decline into negative territory, as noted by an analyst in a CryptoQuant Quicktake post. This index tracks the price difference of Bitcoin on Coinbase (USD pair) compared to Binance (USDT pair).

This metric reflects the buying and selling behaviors of investors on these exchanges, particularly how American institutional entities on Coinbase differ from global whales on Binance.

A positive Coinbase Premium Index indicates higher trading prices on Coinbase, suggesting increased buying activity from US-based whales. Conversely, when the index is negative, it implies that Binance users are executing more buys at higher prices.

The following chart illustrates the trend of the Bitcoin Coinbase Premium Index over the past year:

The graph shows that the index was positive during Bitcoin's highs in late 2024, indicating strong American institutional investor influence. However, around mid-December, the index began to decline and has remained negative, coinciding with a decrease in BTC's spot value.

The current index value is lower than October's low and represents the lowest point since November 2022. Given the importance of Coinbase whales in influencing Bitcoin's price, this ongoing downtrend may suggest further declines for the cryptocurrency.

Historically, Bitcoin has often hit a bottom when selling pressure on Coinbase intensifies, leading to new buyers entering the market. A similar spike occurred during the FTX crash, resulting in a significant price bottom.

It remains uncertain whether current investor sentiment is sufficient to signal a bottom.

BTC Price Update

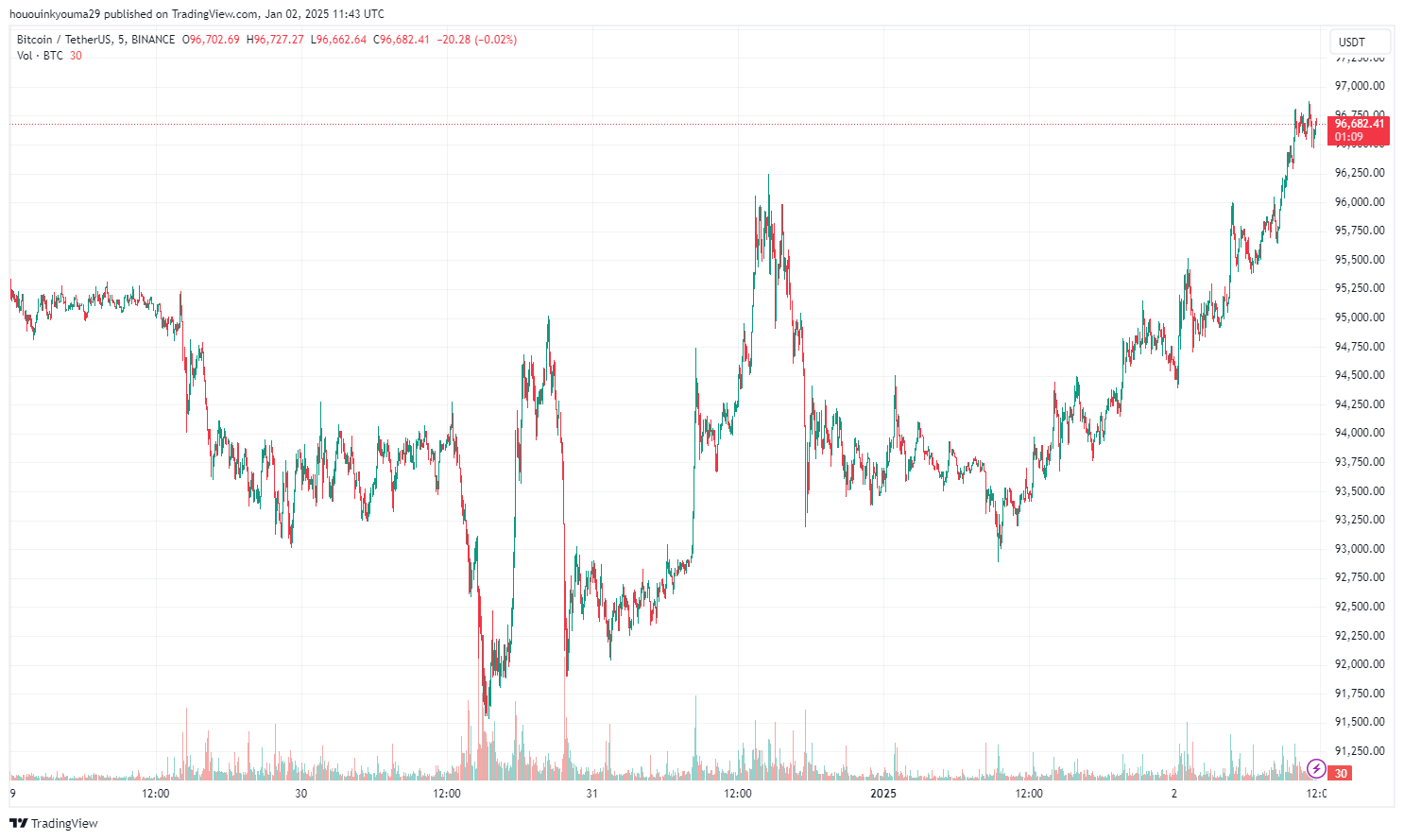

Currently, Bitcoin has started the new year positively, recovering to the $96,600 level.