Bitcoin Consolidates Below $70,000 Amid High Short Position Risks

Bitcoin has shown volatility, with prices ranging from a high of $69,500 to a low of $65,000. Currently, BTC is consolidating below the critical $70,000 level, as traders evaluate the next potential move.

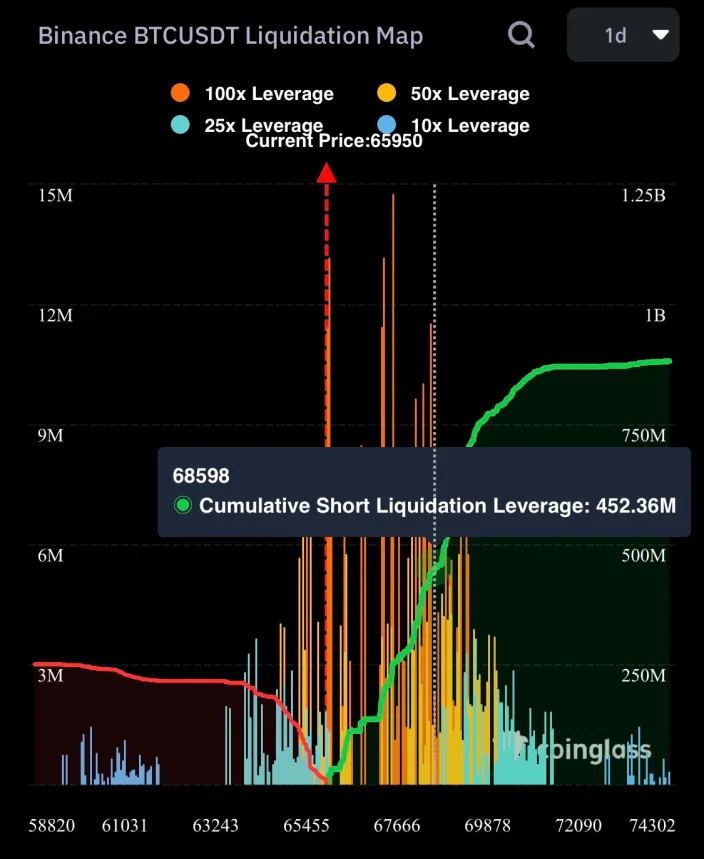

Analyst Ali Martinez provided insights from Binance indicating high risk for short positions at $68,500. Such risk levels often lead to price movements toward liquidity zones, suggesting possible fluctuations as the market targets areas with seller presence.

The balance between resistance and support levels will influence Bitcoin's trajectory. A decisive move above these levels could indicate the next phase for Bitcoin, making vigilance essential for investors.

Bitcoin Short Squeeze Looms

Bitcoin is at a crucial juncture, with expectations for a push toward all-time highs. Martinez highlighted that many short positions are at risk of liquidation near $68,598, with cumulative short liquidation leverage around $452.36 million. This indicates significant capital could be impacted if prices rise.

This situation may create a bullish outlook, as overleveraged short positions could attract buying pressure. If the price surpasses $69,000, it may trigger FOMO among traders and investors.

The liquidation of short positions could elevate Bitcoin's price, reinforcing bullish sentiment. Market participants are closely watching this threshold, as a break above $69,000 could lead to new highs.

Understanding market dynamics and key price levels is vital for traders amidst volatility. The upcoming days are critical as Bitcoin approaches this pivotal moment, and its response to overleveraged positions may shape its future direction.

BTC Liquidity Levels

Bitcoin (BTC) is currently priced at $67,100 after a week of volatility. The price has surpassed $66,000, indicating strength and potential for a rally. This upward trend reflects renewed market optimism as investors seek sustained bullish momentum.

It is crucial for BTC to remain above $65,000. Failure to hold this level may result in sideways consolidation, allowing the market to accumulate liquidity before advancing. This phase could lead to increased buying activity as traders look for opportunities.

A break above the $70,000 level would enhance the bullish outlook and potentially initiate an uptrend, attracting more investment and market excitement.

Featured image from Dall-E, chart from TradingView