6 0

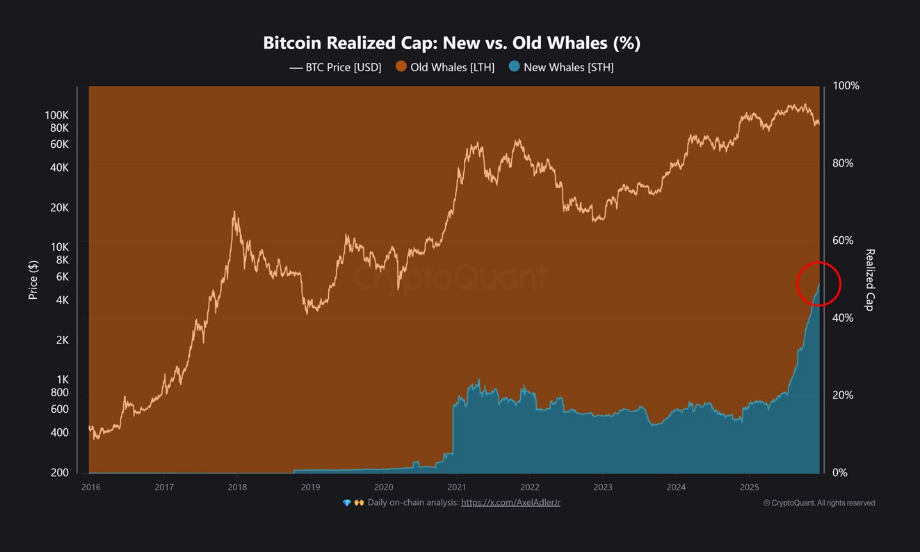

Bitcoin’s Cost Base Resets As New Whales Take The Lead

On-chain data suggests Bitcoin might be entering a new market phase rather than hitting a typical cycle top or bottom. Key observations include:

- New large entrants, referred to as "new whales," now account for nearly 50% of Bitcoin’s realized cap, a significant increase from pre-2025 levels where it rarely exceeded 22%.

- This shift indicates that capital is entering the system at higher price levels, reshaping the network's cost base.

Market Dynamics and Whale Activity

- Short-term holder supply has expanded by approximately 100,000 BTC over the past 30 days, signaling strong near-term demand.

- About 37% of BTC sent to Binance originated from whale-size wallets holding between 1,000–10,000 BTC.

- Larger players absorbed selling pressure with a $135 million positive delta in whale wallet volumes, while retail and mid-size traders showed negative deltas of $84 million and $172 million, respectively.

Derivatives Market Indications

- Bitcoin's price surged from $85,100 to $88,000 following an interest rate hike by the Bank of Japan.

- Open interest increased faster than the price, with positive funding rates suggesting new margin-driven long positions.

- This pattern indicates potential volatility if sentiment changes, even amid healthy spot demand.