11 3

Bitcoin Death Cross Often Followed by Significant Gains, Data Shows

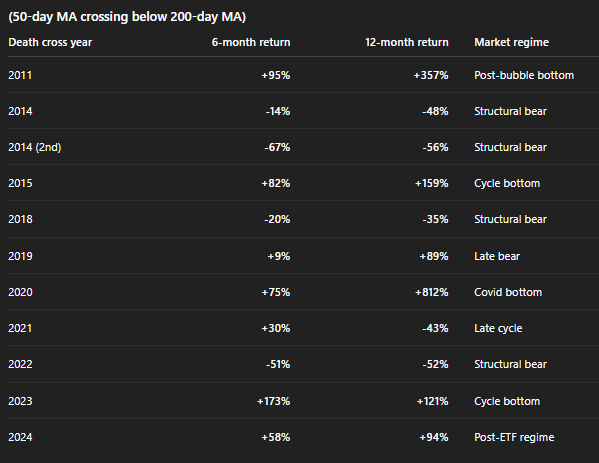

Bitcoin's recent "death cross" has sparked discussions among investors. A death cross occurs when the 50-day moving average falls below the 200-day moving average, often considered a bearish signal.

- Matthew Sigel of VanEck highlighted that historically, Bitcoin's performance post-death cross shows a median return of +30% over six months and +89% over twelve months.

- However, the impact of a death cross varies with market conditions: it may indicate a bottoming phase or a structural bear market.

- Historically, during bottoming phases like in 2011 and 2020, Bitcoin saw significant rebounds (+357% and +812%, respectively).

- In contrast, during structural bear markets (e.g., 2014, 2018, 2022), returns were negative, reflecting ongoing downtrends.

- The current cycle is tagged as a "cycle bottom," showing positive trends similar to past recoveries.

- Future projections, like those for 2024, suggest potential growth influenced by factors such as ETF demand and market liquidity dynamics.

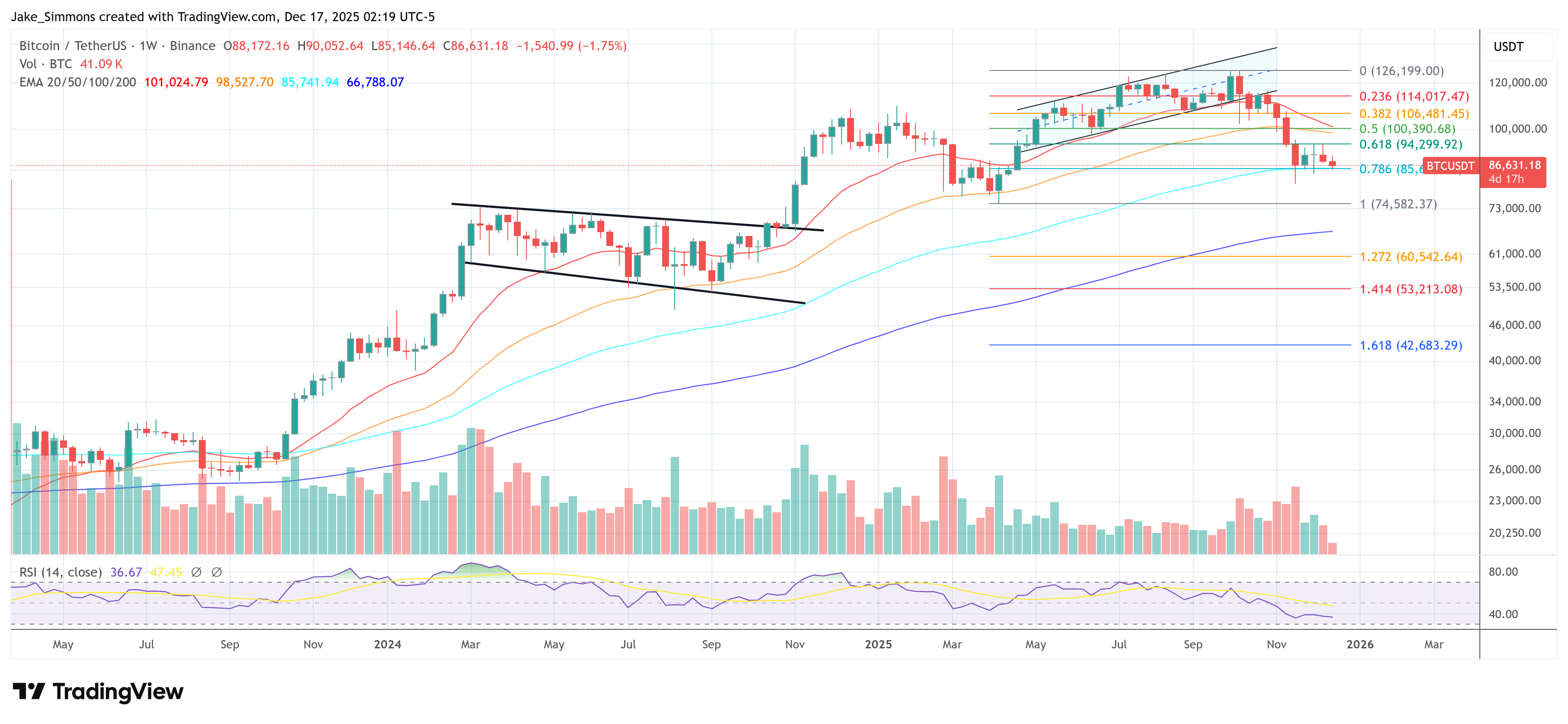

Bitcoin's current price stands at $86,631.