15 0

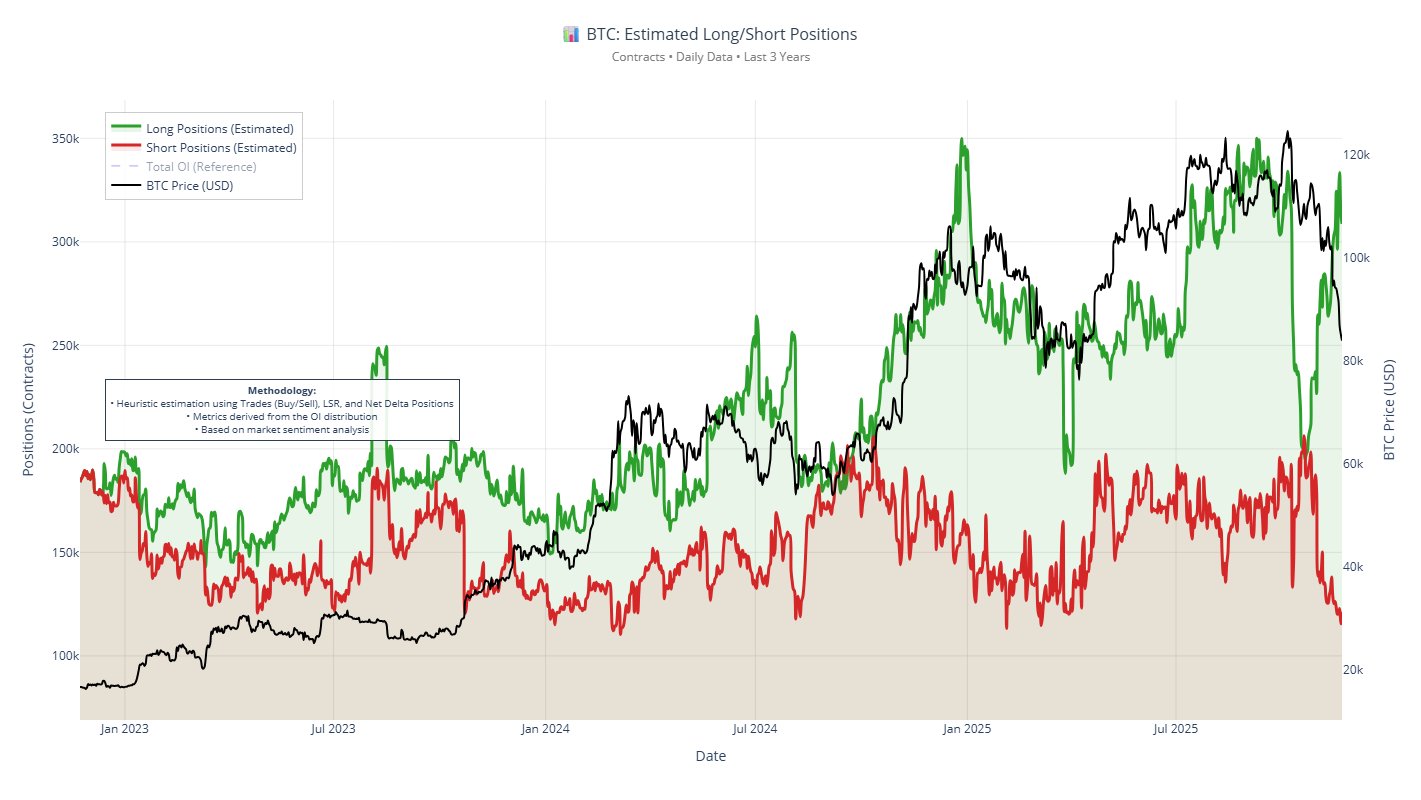

Bitcoin’s Sharp Decline Attributed to Imbalance in Long Positions

Recent on-chain data indicates a significant imbalance between long and short positions in Bitcoin, impacting its price.

Longs vs. Shorts Imbalance

- Joao Wedson, CEO of Alphractal, highlighted the large discrepancy between long (71,000 BTC) and short (27,900 BTC) positions across 19 exchanges.

- This imbalance has led to Bitcoin's recent price struggles, as clusters of long positions create market fragility.

- Cascading liquidations from these long positions result in further price declines, known as a long squeeze.

- Speculators targeted $100,000 and $90,000 as potential price bottoms, but both failed, leading to more liquidations.

- The current speculative target is $84,000, with closed short positions hindering price recovery.

- A decrease in long positions coupled with increased short exposure is necessary for recovery.

Important Price Levels

- Ali Martinez noted Bitcoin's 2-year moving average at approximately $81,250 as a critical level.

- Breaking below this average could signal the start of a bearish cycle.

- Currently, Bitcoin is valued at $86,251, with a recent 3% increase.