9 0

Bitcoin Declines 6.4% to $82,000 as Analysts Raise Concerns

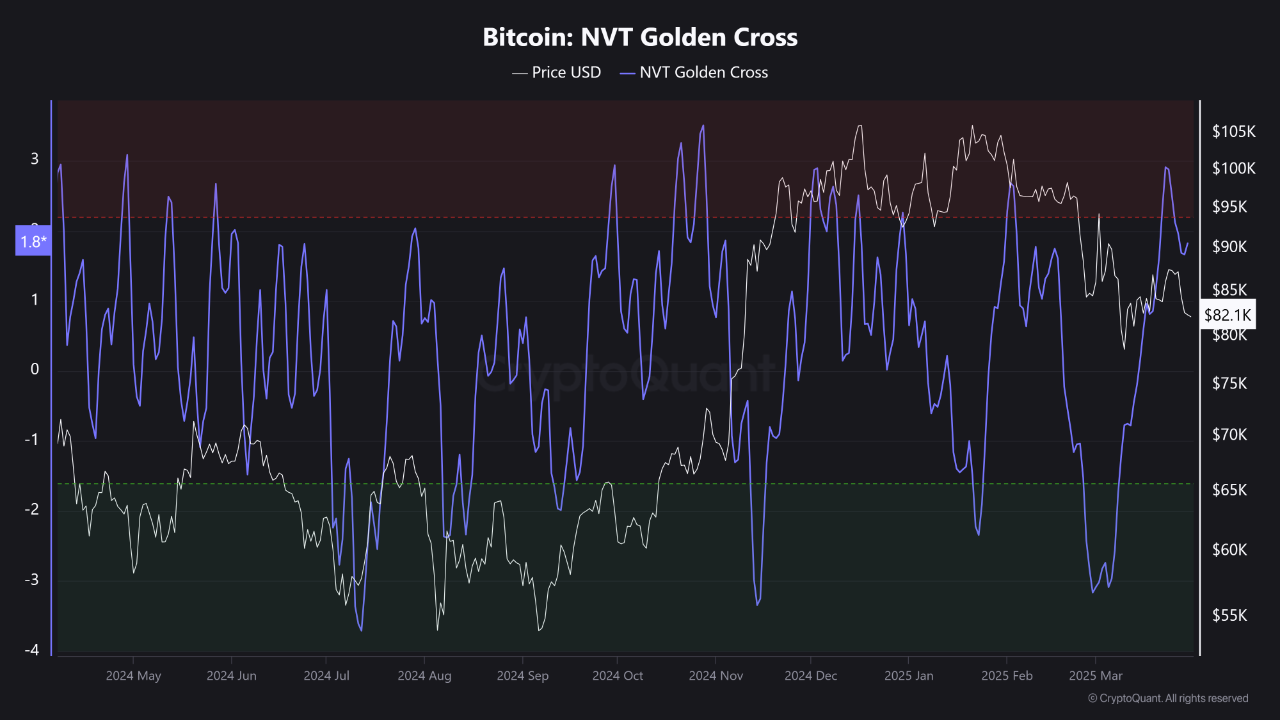

Bitcoin has lost upward momentum, declining by 6.4% over the past week to approximately $82,000 after nearing the $90,000 mark. This trend raises concerns about whether recent price movements reflect genuine demand or speculative activity.

NVT Indicator Signals Caution Amid Low Transaction Volume

The Network Value to Transactions (NVT) ratio is a key metric indicating potential market corrections. Current insights include:

- High NVT Golden Cross reading suggests price inflation driven by speculation.

- Periods of high NVT typically precede market corrections.

- Low transaction volumes indicate weak support for Bitcoin's recent price rise.

Continued pullbacks are likely unless transaction volume increases.

Bitcoin Speculators Absent, Sentiment Remains Cautious

Key points from CryptoQuant analysts include:

- Leverage plays a significant role in driving bull markets.

- Recent "dead-cross" of funding rates indicates bearish sentiment among traders.

- Speculators appear unwilling to take risks, essential for bullish movements.

Market sentiment may remain subdued, with sideways or declining trends more probable. Monitoring transaction volumes and funding trends will be crucial for assessing Bitcoin's potential for breakout or further consolidation.