7 0

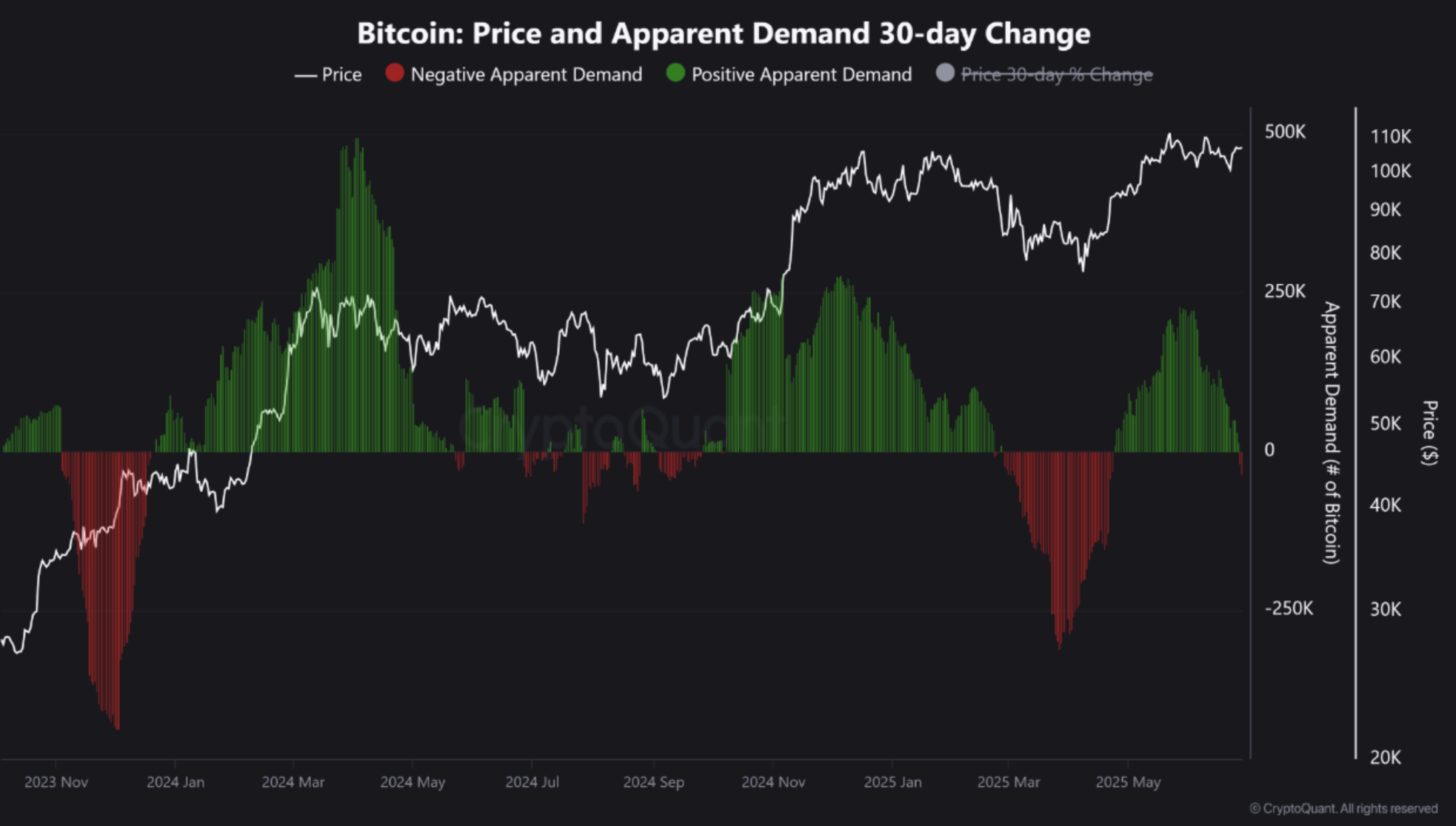

Bitcoin Apparent Demand Turns Negative Amid Increased Supply Pressure

Bitcoin (BTC) is up 3.6% over the past month, but is facing a decline in Apparent Demand, indicating potential market weakness.

Key Points

- Apparent Demand for BTC has turned negative due to insufficient new buyer interest against supply from miners and long-term holders (LTHs).

- This situation increases the available BTC supply, potentially leading to downward price pressure.

- LTH selling suggests experienced investors may believe the market has peaked, raising concerns about a significant downturn.

- The $100,000 level is identified as critical support for BTC.

- Despite current bearish signals, some analysts suggest ongoing healthy consolidation rather than a local top.

- Easing geopolitical tensions and positive macroeconomic trends may support a rally in cryptocurrencies.

- The short-term holder floor price has increased to $98,000, providing some bullish sentiment.

- At press time, BTC is trading at $107,500, down 0.5% in the last 24 hours.