8 0

Bitcoin Derivatives Market Sees Long Position Liquidations and Whale Withdrawals

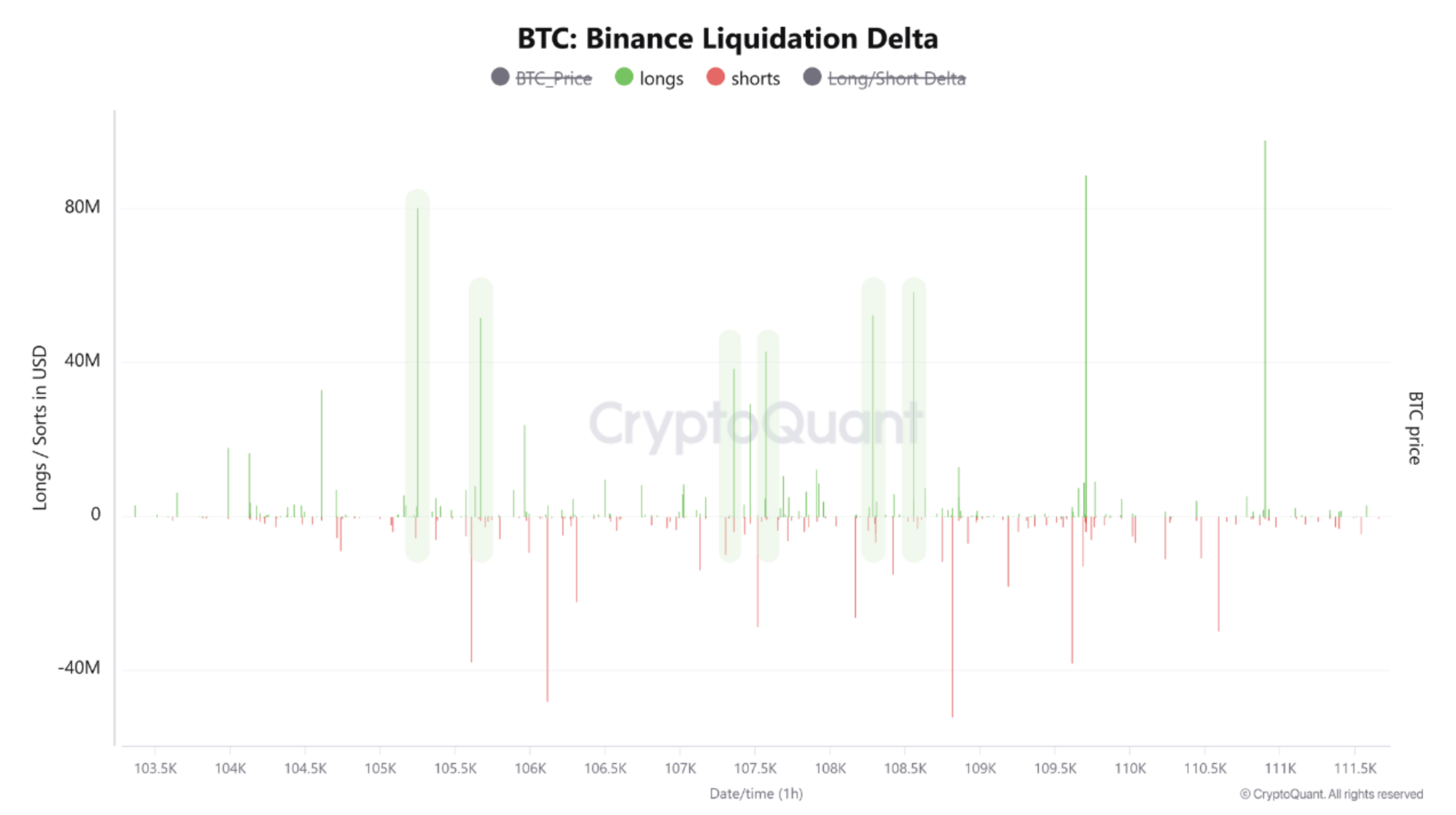

Bitcoin (BTC) is nearing its all-time high of $111,814, amidst signs of a reset in the derivatives market. The Binance Liquidation Delta indicates significant liquidations of long positions, often exceeding $40 million.

Market Dynamics

- The Binance Liquidation Delta shows a negative value, indicating more long positions are being closed, suggesting bearish pressure.

- Funding rates on Binance remain neutral, around zero, indicating cautious trader sentiment.

- Whale activity shows accumulation; notably, Bitfinex recorded the largest single-day BTC withdrawal since August 2019 with 20,000 BTC, valued at over $1.3 billion.

Analysts suggest that despite ongoing long liquidations and whale outflows, Bitcoin may be poised for an upward move towards a new ATH.

Price Projections

- BTC is currently trading 5.8% below its ATH.

- Technical indicators project a target of $112,000 following a bullish double bottom breakout.

- Coinbase recorded a withdrawal of 7,883 BTC, indicating potential institutional accumulation.

- Long-term holders are reducing exposure, potentially anticipating a price correction.

Currently, BTC trades at $105,308, up 1.4% in the past 24 hours.