6 0

Bitcoin Enters Disbelief Phase as Potential Short Squeeze Looms

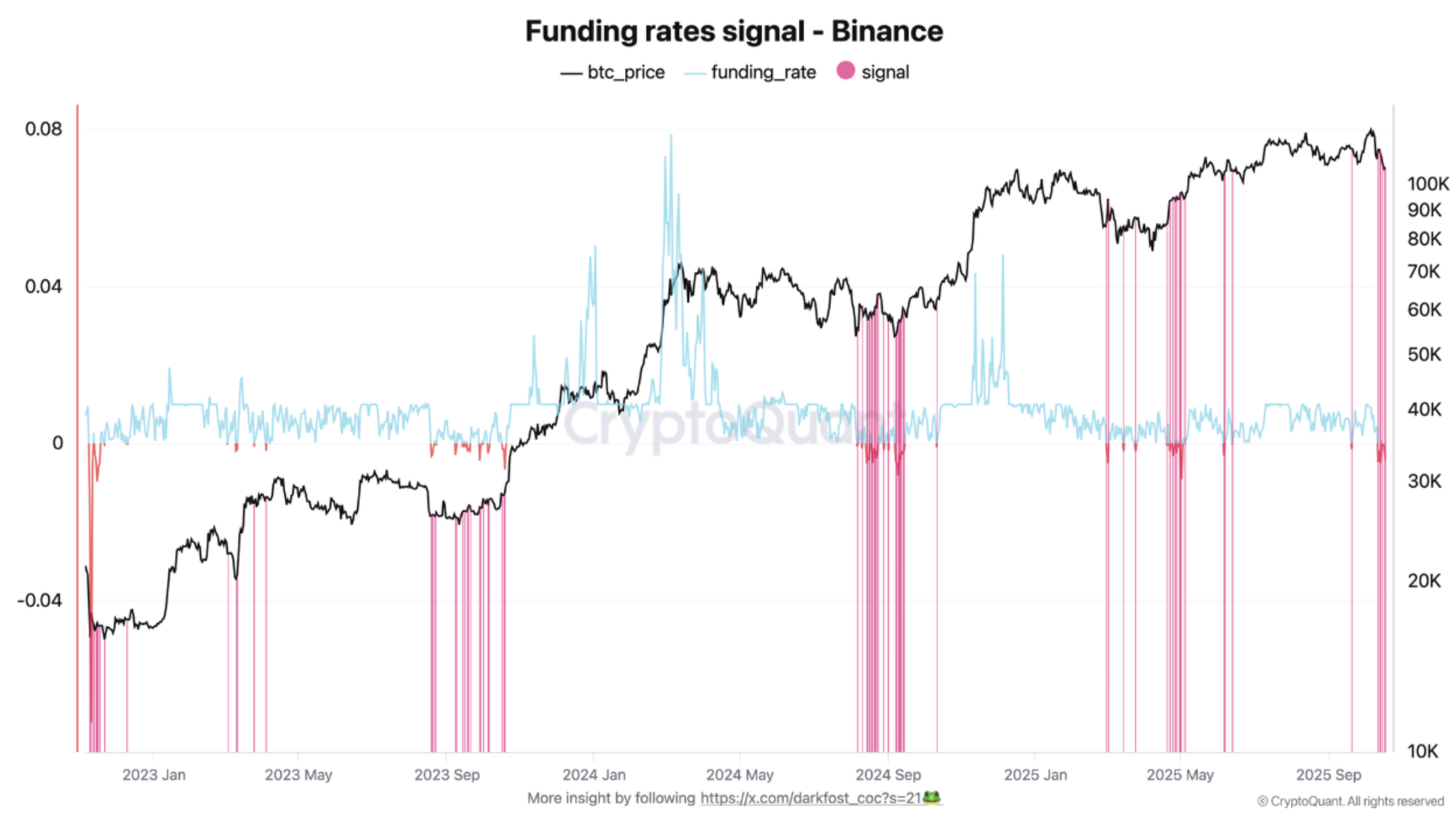

Bitcoin (BTC) recently experienced a significant crash on October 10, dropping to $102,000 before recovering. Analysts suggest that BTC might be entering the 'disbelief phase,' potentially leading to a bullish rally.

Key Points

- The 'disbelief phase' is marked by skepticism among investors about the sustainability of a recovery after a correction.

- Current negative funding rates (-0.004%) in the derivatives market indicate lingering bearish sentiment.

- The recent crash led to liquidations worth $19 billion, prompting traders to short the market.

- If BTC continues its uptrend, accumulated short positions could lead to a short squeeze, pushing prices higher.

- Potential price targets include liquidity zones at $113,000 and $126,000.

- Historical patterns show similar occurrences in September 2024 and April 2025 where BTC surged significantly after initial declines.

Caution Advised for Investors

- Despite potential for a short squeeze, caution is advised due to BTC's activity slumping below its 365-day average.

- Some analysts predict BTC has completed its correction phase and may surge soon.

- Currently, BTC trades at $110,814, reflecting a 2.8% increase over the past 24 hours.

Investors should monitor market signals closely and consider both potential gains and risks associated with current BTC trends.