Bitcoin Dominance Surges to Over 59% as Altcoin Season Delays

As Bitcoin approaches its all-time high (ATH), the anticipated altcoin season appears unlikely in November. Bitcoin's price has risen from approximately $53,000 in mid-September to a recent peak, diverting investor focus from altcoins to BTC. This shift has negatively impacted the altcoin market, with smaller cryptocurrencies struggling for attention and investment.

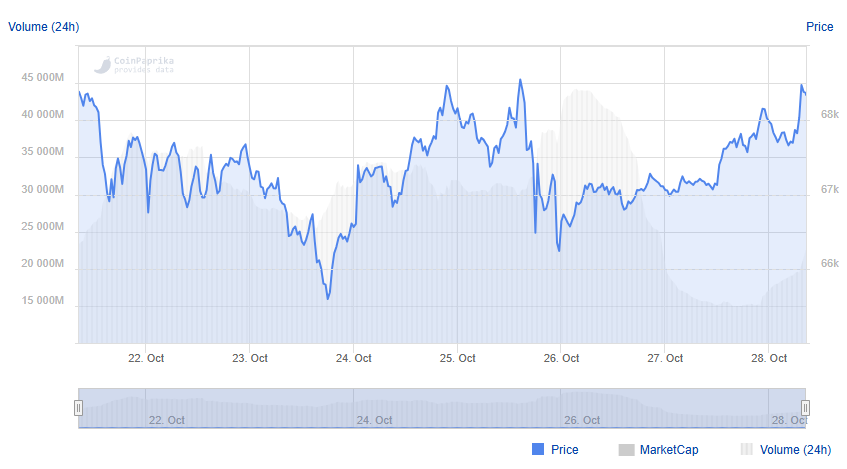

Bitcoin's market dominance has increased alongside its price, exceeding 59% by the end of October. This rise has sidelined altcoins as capital flows into Bitcoin rather than other digital assets. Institutional interest has significantly contributed to this trend, with substantial inflows into Bitcoin exchange-traded funds (ETFs) recently, indicating a growing preference for Bitcoin among larger investors.

A report from QCP indicated that ETF inflows demonstrate strong institutional demand for Bitcoin, with its dominance remaining robust. Their analysis suggests that Bitcoin's dominance has approached nearly 60%, likely continuing if Bitcoin maintains its upward momentum towards new price records.

If Bitcoin surpasses its previous ATH, its market dominance could exceed 60%, further postponing any potential broader altcoin rally. The current market sentiment favors Bitcoin’s stability, attracting both retail and institutional investors, limiting opportunities for altcoins to outperform.

For an altcoin season to begin, at least 38 altcoins must outperform Bitcoin over a 90-day period, but only a few have achieved this recently. This lack of momentum indicates an unfavorable environment for a broad-based altcoin rally, as Bitcoin continues to dominate trading volume and investment interest.

Bitcoin’s price has recently reached about $67,000, approaching the critical $70,000 threshold, just below its ATH. With consistent ETF inflows—nearly $1 billion in the last week—analysts believe that a new ATH is possible if trends persist through November.

However, market observers suggest that if Bitcoin nears $70,000, profit-taking may occur, potentially causing a pullback to around $65,000. Such a correction might temporarily halt its rally and provide altcoins a brief chance to gain traction. Nonetheless, without a significant change in market dynamics, the broader altcoin market may remain subdued under Bitcoin's dominant influence.

Overall, the altcoin market currently lacks the strength to outperform Bitcoin, and the increase in Bitcoin's dominance implies that a major altcoin rally remains distant. Attention and capital are focused on Bitcoin’s potential new highs, creating conditions where altcoins continue to struggle. Until Bitcoin experiences a notable correction or consolidation, the prospect of an altcoin season seems unlikely.