6 0

Bitcoin Faces Downside as Gold and Silver Attract Defensive Capital

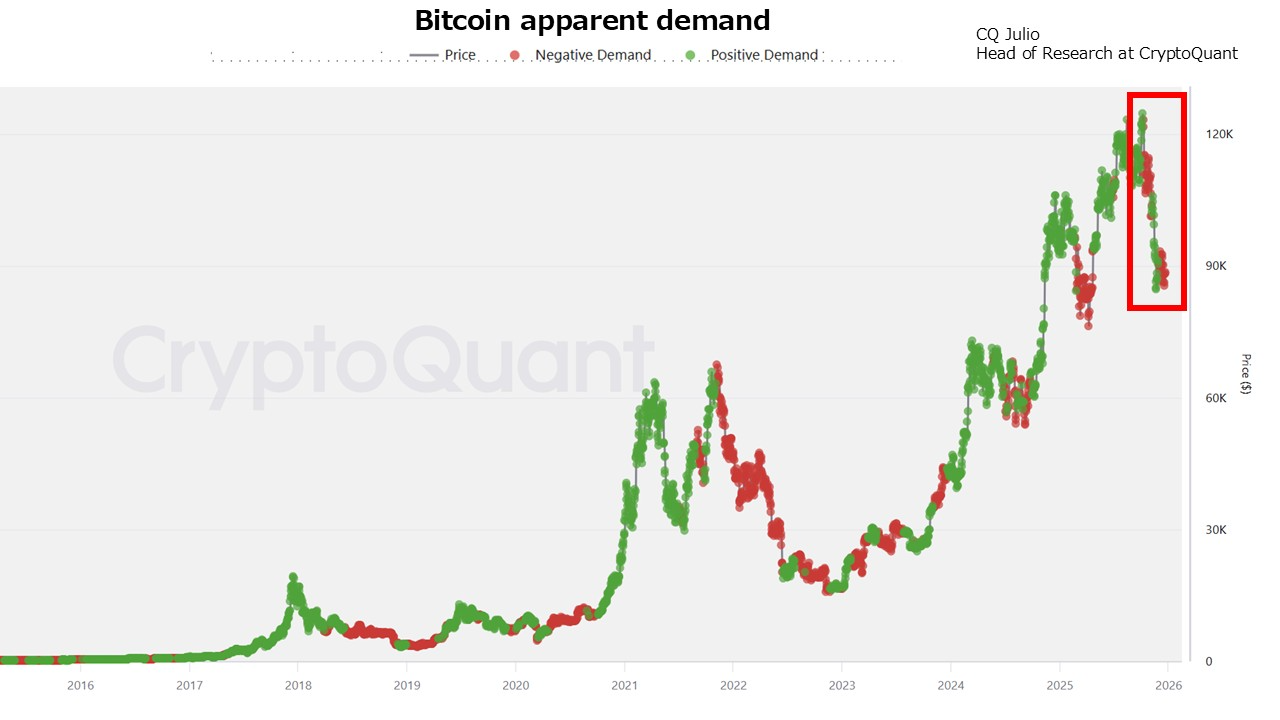

Bitcoin is struggling to reclaim the $90,000 level, with market confidence deteriorating as analysts suggest a prolonged bear market. Sentiment is cautious, with investors reassessing risk exposure.

- Current phase described as range-bound consolidation after a high-level correction, momentum tilted downside.

- Gold and silver are rising due to demand for defensive assets amid geopolitical tensions and policy uncertainty.

- Institutional capital favors precious metals over Bitcoin due to liquidity and established market infrastructure.

Bitcoin's Role as a Risk Asset

- Treated as a high-beta risk asset, not a pure safe haven like gold or government bonds.

- Demand has turned negative; short-term holders selling at losses adds selling pressure.

- Upside limited without sustained positive demand and Short-Term Holder SOPR above 1.

Price Holds Critical Support as Trend Weakens

- Trading near $87,000–$88,000 after a drop from highs above $110,000.

- Below the 50-day moving average, indicating negative short-term momentum.

- Testing the 100-day moving average, critical for stabilizing or risking further decline to the 200-day MA.

- Sustained hold above 100-day MA needed to form a base; breakdown could lead to more downside.

Volume dynamics indicate distribution rather than dip-buying; overall uptrend intact if above the 200-day MA, but short-term risks persist. Bulls need recovery above $90,000 to regain control.