10 0

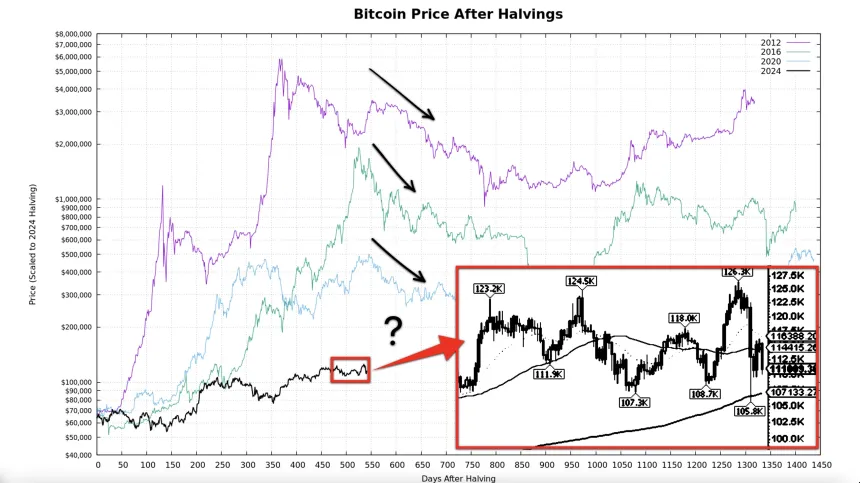

Bitcoin Downtrend Continues as Bull Cycle Nears 99.3% Completion

Bitcoin's price is declining, currently trading towards $111,000, down 12% from a peak of $126,000. Concerns arise about the potential end of the bull run.

Potential End of Bull Cycle

- Market analyst CryptoBirb predicts the bullish cycle may end in nine days.

- The Cycle Peak Countdown indicator shows Bitcoin's cycle is 99.3% complete over 1,058 days.

- The market is deep within its peak zone with 543 days since the last Bitcoin Halving, surpassing the typical 518 to 580-day window.

- Fear & Greed Index dropped from 71 to 38; RSI fell from 67 to 47, indicating potential for a final surge.

- Technical indicators show mixed signals: ATR at 4,040 (high volatility), RSI at 47 (reset momentum).

On-Chain Metrics and Institutional Behavior

- Institutional investors shift strategies: Bitcoin ETF flows reversed from $627 million inflows to $4.5 million outflows.

- Ethereum ETF outflows reached $174.9 million, indicating profit-taking before potential retail FOMO.

- NUPL decreased to 0.522 from 0.556; MVRV dropped to 2.15 from 2.45, suggesting profit-taking.

Bitcoin's October performance shows a 2.09% decline month-to-date, contrasting with the historical average increase of 19.78%. Despite weak October performance, a significant move could occur before the month's end.

In summary, the current cycle is nearly complete, with sentiment resetting, institutional distribution, and weak October performance potentially creating conditions for a final surge before a new cycle begins.