11 0

Bitcoin Drops 2.2% to $109,500 Amid Concerns of Further Declines

Bitcoin (BTC) experienced a decline, dropping 2.2% to $109,500, reversing gains from a recent peak of $112,600 and a low of $107,000.

- Ether (ETH), Solana's SOL (SOL), and Cardano's ADA (ADA) fell over 3% in the last 24 hours.

- Corporate BTC holdings also suffered: Strategy (MSTR) down 3.2%; MetaPlanet (3355) down 7%; KindlyMD (NAKA) down 9%.

- BitMine (BMNR) and SharpLink Gaming (SBET) dropped 8%-9%.

Concerns about further declines are rising, as September is historically weak for Bitcoin. A report from Bitfinex indicated BTC has been in retracement since its all-time high of $123,640 in August.

- Average bull-market corrections are around 17%, suggesting the market may near typical drawdown limits.

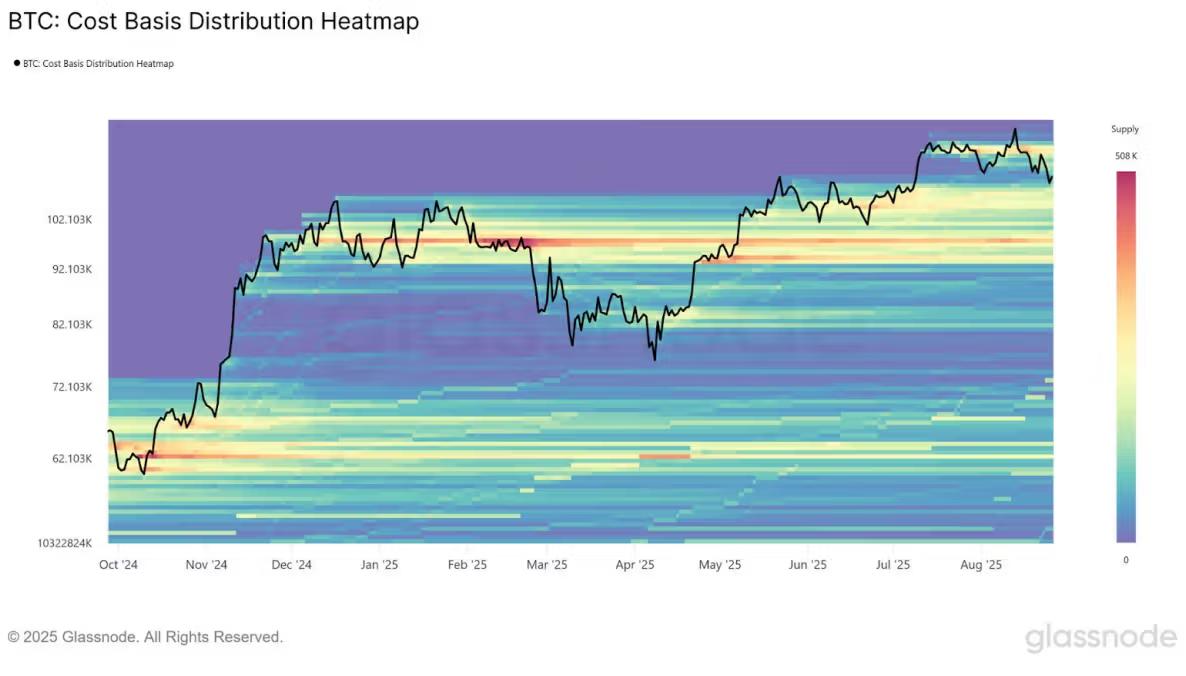

- If support at the short-term holder realized price of $108,900 fails, BTC could drop towards a supply cluster between $93,000 and $95,000.

Market strategist Joel Kruger noted that September often serves as a consolidation month before stronger performance in Q4, suggesting this correction might be shallower if ETF inflows and corporate treasury allocations increase.