9 1

Bitcoin Drops $2,000 in 35 Minutes, $132M Longs Liquidated

Bitcoin Price Movement and Concerns of Market Manipulation

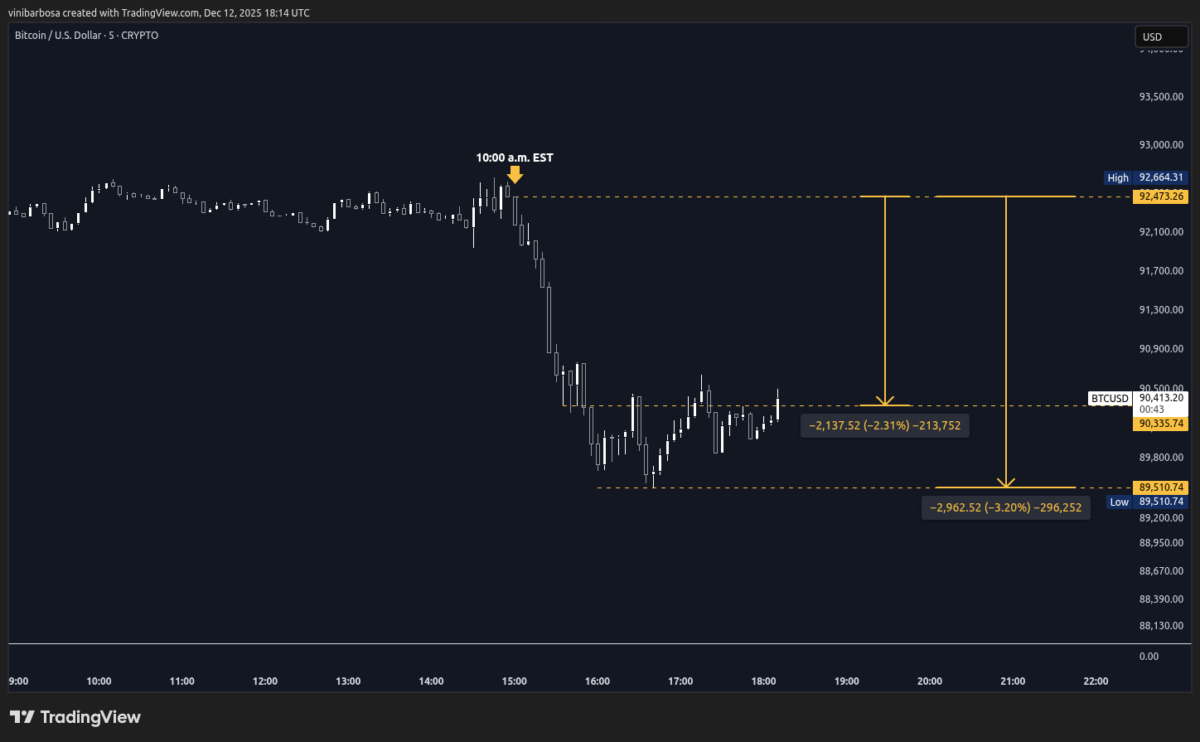

- Bitcoin dropped by $2,000 as the US market opened on December 12, leading to over $132 million in long position liquidations.

- This pattern, referred to as "10am manipulation," was identified by analyst Bull Theory and highlights a consistent price drop shortly after the US market opens.

- The suspected cause is attributed to high-frequency trading practices, with Jane Street, a major trading firm, being a potential player due to their capacity and holdings in Bitcoin-related assets.

- Bitcoin's price fell from $92,473 to $90,335 within 35 minutes past 10:00 a.m. EST, further declining to $89,510 between 11:35 and 11:40 a.m. EST.

- The total loss from the pre-market price reached nearly $3,000, reflecting a 3.2% decline.

- Before this drop, Bitcoin showed strength due to positive signals from the US Congress regarding crypto inclusion in 401(k) plans.

- Such patterns suggest potential manipulation and serve as a warning for traders, particularly those opening long positions that might be targeted by larger players for strategic gains.