2 0

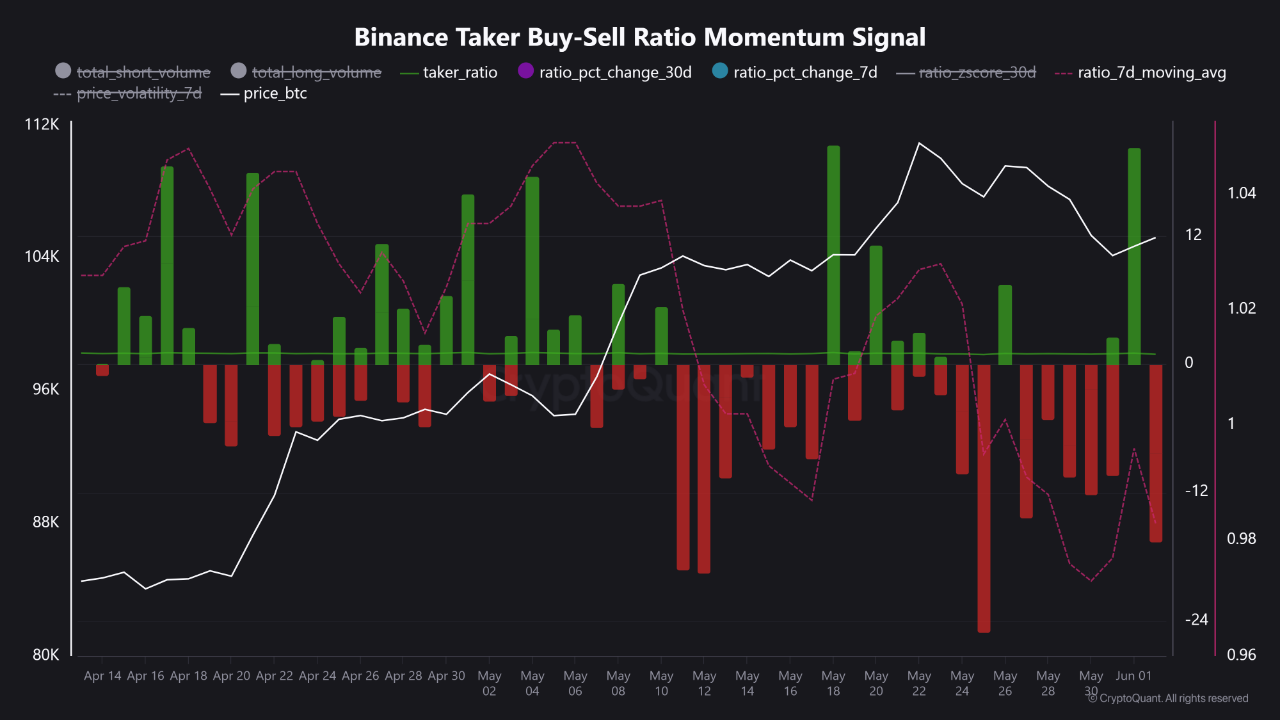

Bitcoin Drops 5.2% as Binance Taker Buy/Sell Ratio Falls Below 1.0

Bitcoin (BTC) has retraced from its record high of over $111,000 last month to a current price of $104,115, marking a 5.2% decline in the past week and approximately 7% from its peak.

Market Dynamics

- Recent analysis indicates significant selling pressure on Binance, which holds about 60% of global Bitcoin spot trading volume.

- Binance's Taker Buy/Sell ratio has dropped below 1.0, suggesting traders are more inclined to sell than buy.

- This trend contrasts with a temporary increase in overall buying activity across other exchanges.

Historical patterns show that divergences in Binance’s trading behavior often precede Bitcoin price corrections of 5% to 10%.

Near-Term Expectations

- Current Taker Buy/Sell ratio at Binance is around 0.98, down 12% weekly and 25% monthly.

- Despite a brief uptick in market buying, Binance's bearish sentiment has dampened potential bullish signals.

- Heightened volatility is expected unless Binance's Taker Buy/Sell ratio exceeds 1.05 consistently.

The analyst warns that ongoing net-selling by Binance could lead to a bull trap and increased likelihood of further price declines.