11 4

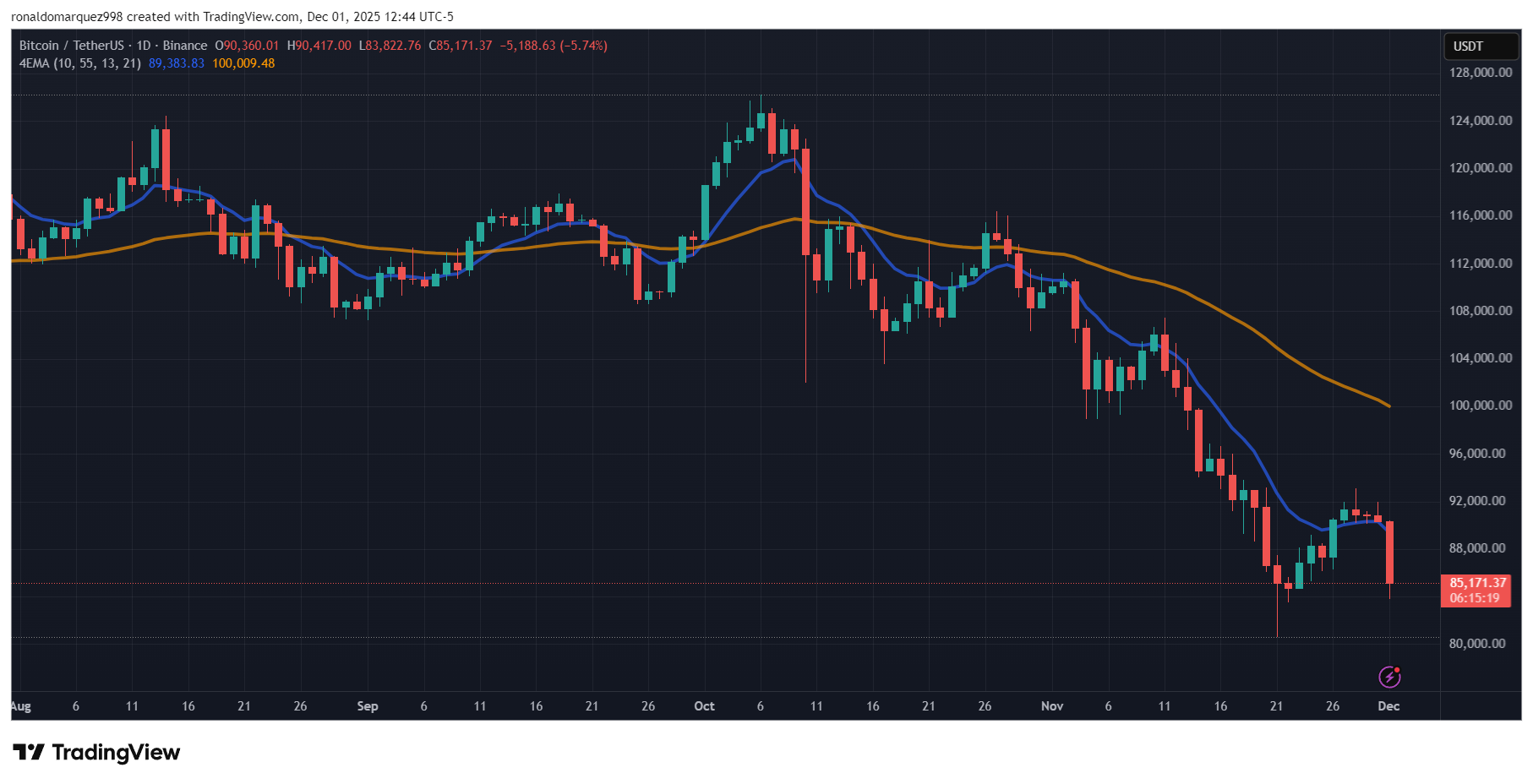

Bitcoin Drops to $85,000 Amid Japanese Bond Yield Surge

Bitcoin experienced a 7% drop, falling to $85,000 after a brief rise to $93,000. This decline is linked to the impact of rising Japanese government bond yields, which have led to the unwinding of the Yen Carry Trade.

- Japanese 10-year bond yield reached 1.877% on December 1, 2025, the highest since June 2008.

- The unraveling of the Yen Carry Trade, estimated at $3.4 trillion to $20 trillion, affects global investments in assets like stocks and cryptocurrencies such as Bitcoin.

- As yields increase, the yen strengthens, causing leveraged positions to become unprofitable.

- This triggered significant liquidations, with October 10 witnessing a $19 billion crypto wipeout and November seeing $3.45 billion exit from Bitcoin ETFs.

- Despite the decline, whale investors accumulated 375,000 BTC, and miners reduced sales significantly.

Market anticipation is focused on the Bank of Japan's policy decision on December 18. If rates are raised, Bitcoin might test the $75,000 level, indicating an additional 11% potential drop.