24 1

Bitcoin Falls to $98K Amid $658M in Crypto Market Liquidations

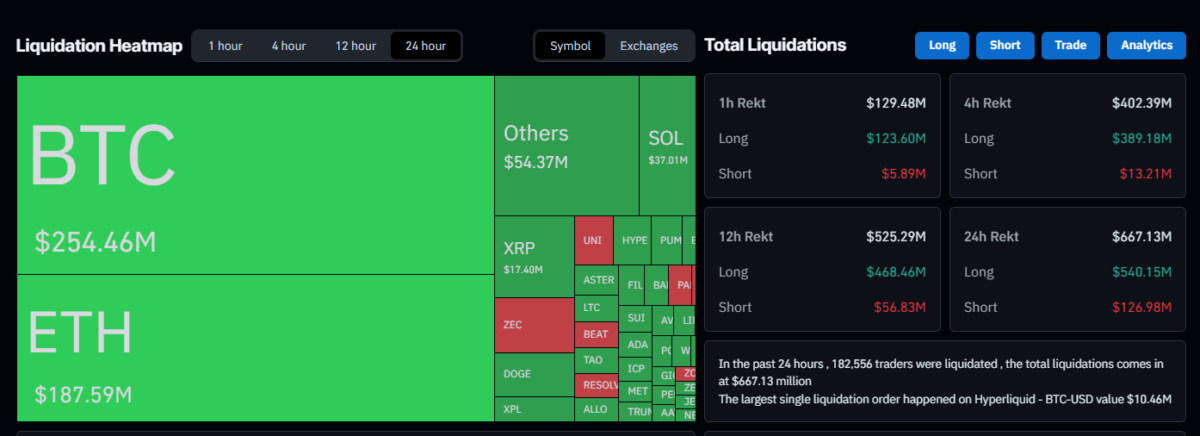

The cryptocurrency market experienced significant liquidations totaling $657.88 million in 24 hours as Bitcoin dropped to $98,377 on November 13, according to CoinGlass data.

- Long positions accounted for $533.57 million, while short positions were $124.31 million.

- Liquidation volume accelerated from $513.15 million at the 12-hour mark.

- The drop marked a 22% correction from Bitcoin's October peak of $126,080.

Other cryptocurrencies also saw volatility:

Factors Influencing Bitcoin's Decline

- US-based selling pressure contributed significantly, indicated by a discount on Coinbase.

- Bitcoin broke below the $100,000 level, ending a 189-day streak of closing above this mark.

- Analysts identified the $100,000 level as a crucial liquidity zone.

Strategist Liz Thomas noted that despite dollar weakness, Bitcoin did not benefit, unlike gold.

Market Sentiment and Predictions

- Polymarket traders see a 66% probability of Bitcoin reaching $95,000 in November.

- Kalshi participants assigned a 37% chance of another S&P 500 company purchasing Bitcoin this year.

- ETF redemptions added to market pressure, marking the largest liquidation day in Q4.