8 0

Bitcoin Drops Below $100K Amid Sentiment-Driven Market Panic

Bitcoin's recent drop below the $100,000 mark has triggered market anxiety and prompted fear-driven selling. The downturn is believed to be psychological rather than based on fundamentals, as indicated by CryptoQuant data.

- The Fear & Greed Index fell to 21, a sharp decline from when Bitcoin briefly reached $107K.

- Bullish predictions of a surge to $150K–$200K have dissipated, replaced by concerns over further declines.

- Interest in Bitcoin searches on Google dropped post-October highs, reflecting waning retail enthusiasm.

- Altcoin sentiment hit extreme lows, with a score of -81, as traders exited positions.

On-Chain Data Indicates Market Strength

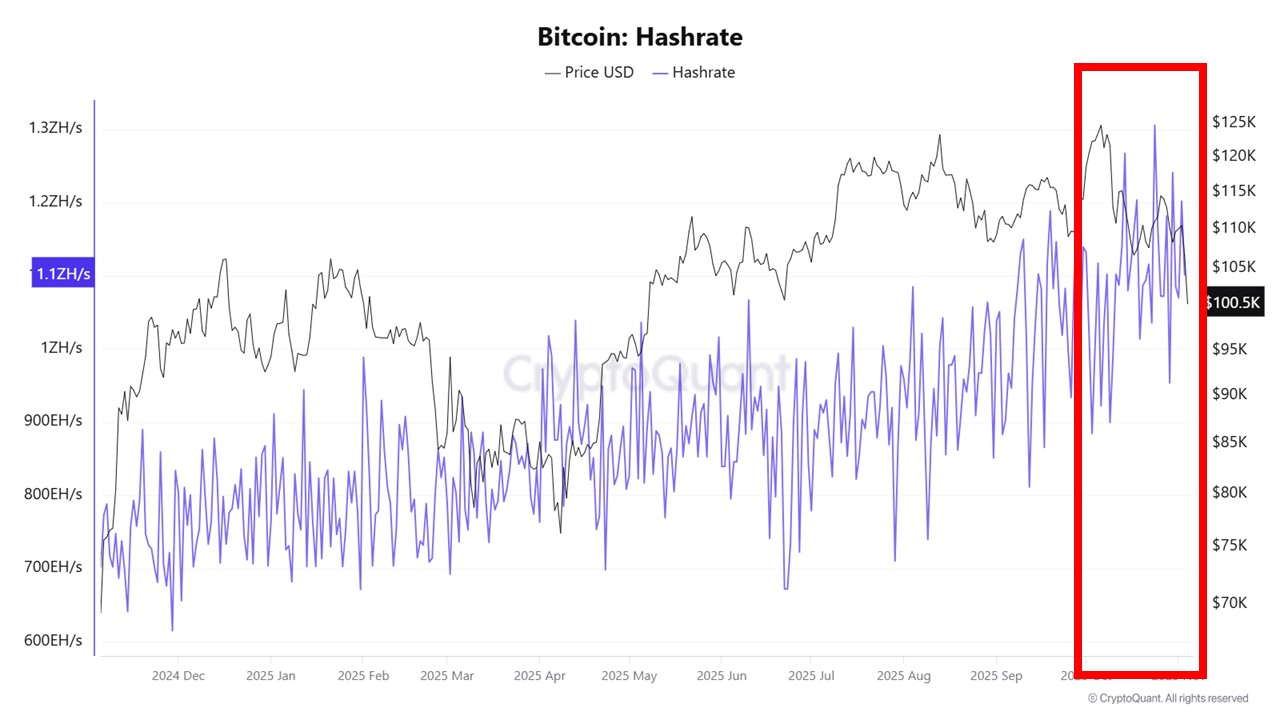

Despite the price drop, on-chain metrics suggest the correction is sentiment-driven:

- Exchange withdrawals increased, showing investors are holding Bitcoin rather than selling.

- UTXOs in loss rose to about 12%, indicating discomfort but not full capitulation.

- Bitcoin’s hashrate remains near all-time highs, suggesting strong network security.

- Whale ratio decreased, indicating less sell pressure from large holders.

- Over $10.7B in stablecoins moved to Binance, providing liquidity for potential accumulation.

Short-Term Trend Under Pressure

Bitcoin's breakdown from $110,000 created bearish momentum:

- Price is below key moving averages (50-, 100-, and 200-period), indicating bear control.

- A spike in volume during the drop suggests panic selling.

- Stabilization attempts are visible above the $100,000 area, which serves as a key support zone.

- A recovery requires reclaiming the $105,000–$107,000 range to alleviate short-term pressures.

Maintaining stability above $100K is crucial; losing this level could lead to further declines, while defending it might prompt a recovery.