7 1

Bitcoin Drops Below $120,000 After Reaching New All-Time High

Bitcoin reached a new all-time high of over $124,000 before retracting to $118,336, marking a 1.9% weekly loss and a 4.5% decline from its peak.

Key developments include:

- The Bitcoin Exchange Whale Ratio exceeded 0.50, indicating potential short-term volatility.

- Overall exchange data shows negative net flows, suggesting accumulation as more BTC leaves exchanges.

- Binance reported its largest single-day positive net flow in a year, contrasting with broader market trends.

- Binance's BTC spot trading volume hit $7 billion in one day, possibly reflecting institutional trades or macroeconomic influences.

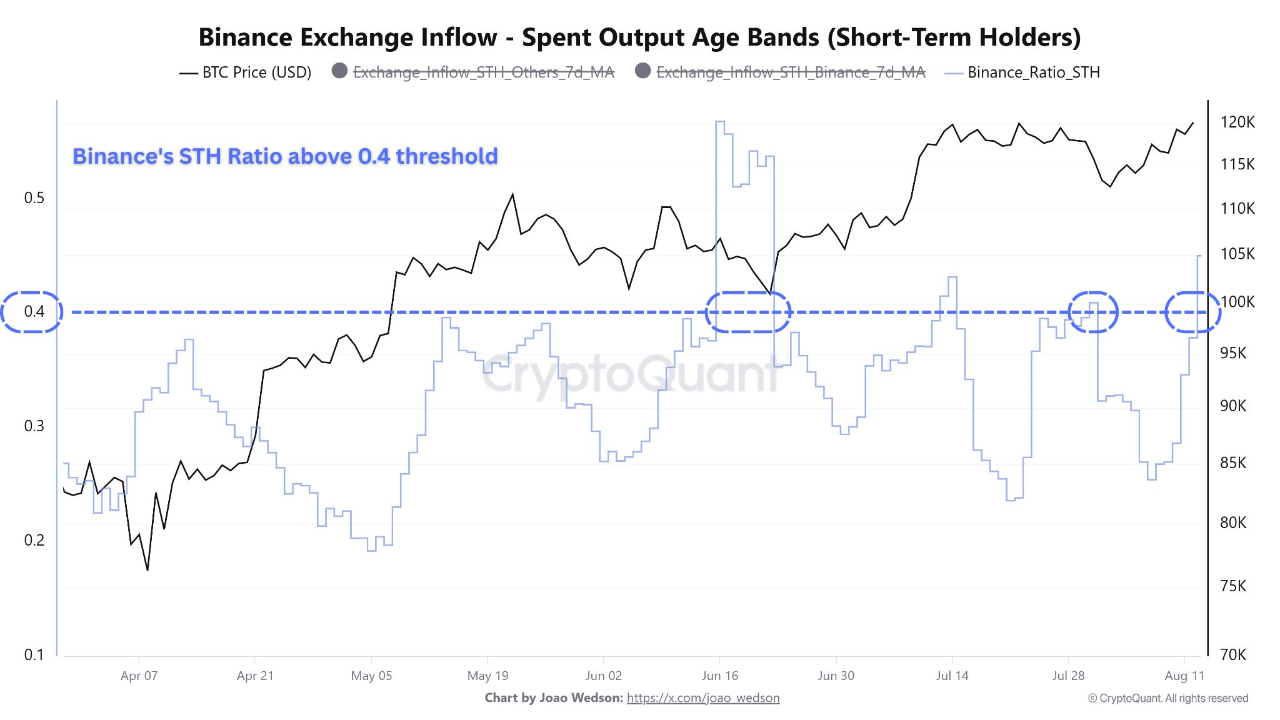

- Short-term holder inflows to Binance surpassed the 0.4 threshold, often linked to retail sell activity.

- Whale inflows are low at 1,170 BTC, significantly below previous levels, reducing immediate selling pressure.

The interplay of whale behavior, retail participation, and exchange flows creates a complex market structure. While net outflows support a long-term bullish outlook, the high whale ratio and influx to Binance suggest increased short-term volatility. Monitoring Binance’s order book and other metrics will be crucial for understanding price direction in the coming days.