1 0

BEARISH 📉 : Bitcoin falls below $67,000 amid Stifel’s bearish forecast

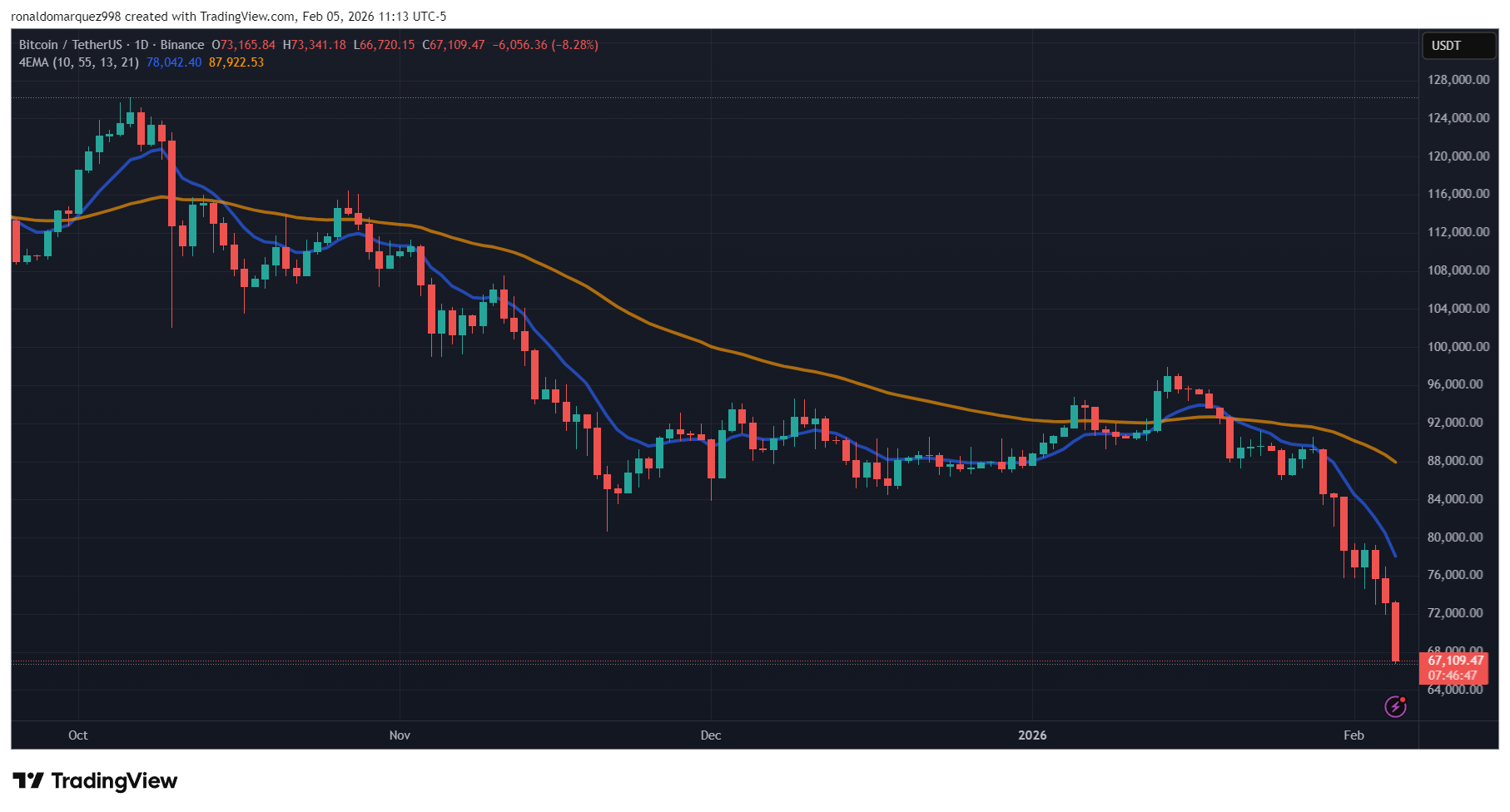

Bitcoin (BTC) experienced a significant drop, briefly falling below $67,000, marking its lowest price since November 2024.

Potential Further Decline?

- Investment bank Stifel projects Bitcoin could decline to $38,000, representing a 43% decrease from current levels.

- The forecast is influenced by tighter US Federal Reserve policy, uncertainty in US crypto regulation, reduced market liquidity, and sustained outflows from Bitcoin ETFs.

- Stifel notes that historical Bitcoin market cycles often see deep drawdowns following peaks.

- Market observer Walter Bloomberg highlights weakening demand, decreased ETF inflows, and stress in derivatives markets leading to "forced deleveraging."

Technical Analysis and Market Sentiment

- Spot Bitcoin ETFs recorded net outflows of approximately 7,925 BTC ($533 million) on the day.

- Over the last week, net outflows totaled roughly 19,090 BTC ($1.28 billion), indicating declining institutional demand.

- Analyst MartyParty emphasizes the significance of the $68,000 level, aligning with the 200-week exponential moving average.

- If Bitcoin fails to hold above this zone, it may move toward the 200-week simple moving average near $58,000.

Current trading price for Bitcoin is around $67,100, showing an 8% drop for the day and over 20% decrease over the past week, according to CoinGecko data.