BEARISH 📉 : Bitcoin Drops Below $73K as Mining Stocks Face Heavy Losses

Bitcoin fell below $73,000 on February 4, 2026, marking its lowest point since April 2025. It briefly hit $72,039 before recovering slightly to around $73,020. This represents a roughly 40% decline from the all-time high above $125,500 in October 2025. Large holders sold over 50,000 BTC recently, maintaining selling pressure despite attempts by retail investors to buy the dip.

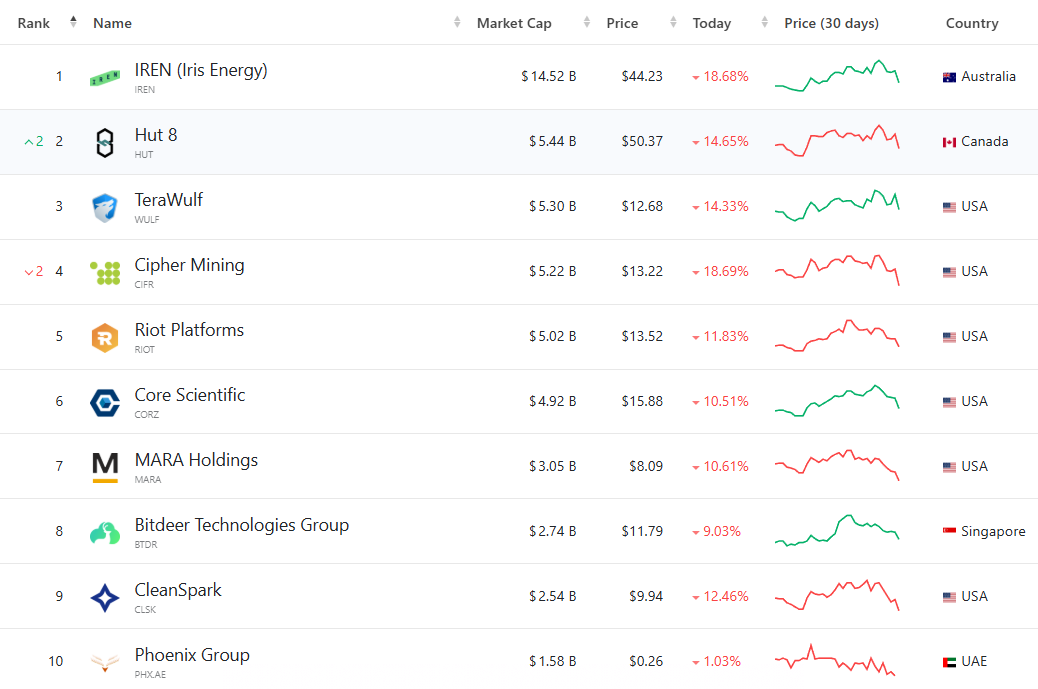

Impact on Bitcoin Mining Sector

- Mining stocks experienced significant losses: Marathon Digital Holdings at $8.09, Riot Platforms at $13.52, CleanSpark at $9.94, with drops over 10%.

- Phoenix Group in UAE showed a marginal 1% decrease.

- Mining profitability reached a 14-month low due to falling Bitcoin prices and increased network difficulty.

- Reported Bitcoin hashrate declined since June 2025.

Other crypto-related companies also faced challenges. Strategy, formerly MicroStrategy, saw its stock hit a 52-week low, with unrealized gains on its Bitcoin holdings shrinking below 10%, despite ongoing Bitcoin purchases.

Tech Selloff Contributing to Decline

- Bitcoin's fall coincided with declining tech stocks due to AI concerns and broader market selloffs.

- Bitcoin often correlates with tech equities like NASDAQ 100, making it vulnerable to sector trends influenced by Federal Reserve policies.

The sustained drop in BTC prices and mining profits may continue to pressure the Bitcoin mining sector until conditions like network difficulty or prices improve for profitability.