7 1

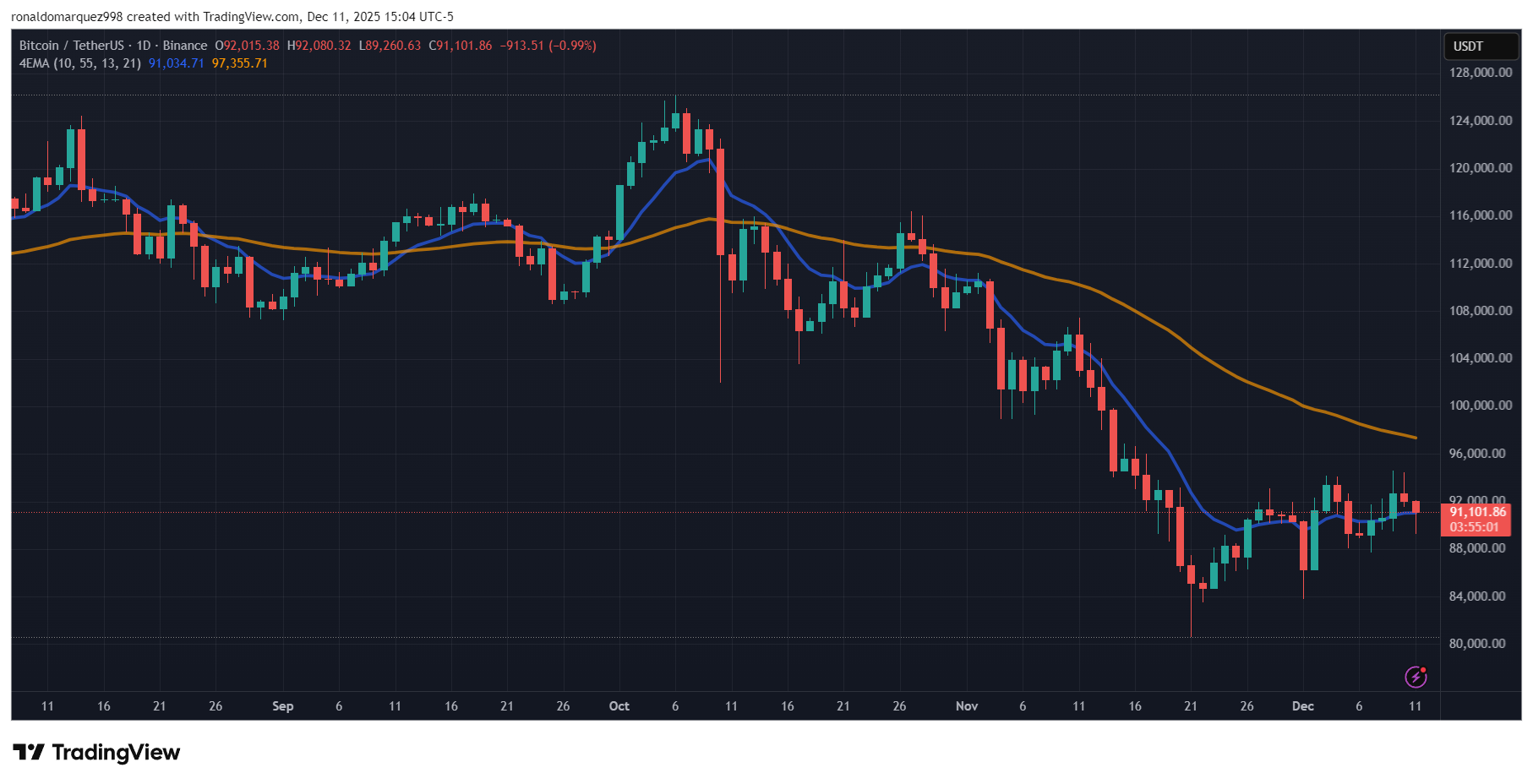

Bitcoin Falls Below $90,000 Amid Profit-Taking and Market Concerns

Bitcoin (BTC) fell below $90,000 despite a U.S. Federal Reserve rate cut of 0.25%. Several factors influenced this unexpected drop:

- Investors had already anticipated the rate cut, with a 95% probability priced in.

- Many large investors took profits after the Fed's announcement on T-bill purchases.

- Fed Chair Jerome Powell highlighted labor market weaknesses and inflation concerns.

- The Fed's projections suggest only one more rate cut by 2026.

- Oracle's disappointing earnings led to a broader market impact, affecting cryptocurrencies.

Bull Theory analysts argue this decline is not a shift to bearish conditions but rather an overreaction. The Fed's ongoing liquidity injections are expected to favorably impact Bitcoin and crypto prices next year, contrasting with less favorable conditions projected for 2025.

As of now, Bitcoin has recovered above $91,100, remaining 26% below its all-time high of $126,000 set in October this year.