12 2

Bitcoin Drops to $91,500 Amid 5% One-Day Decline

Bitcoin fell below $92,000, currently trading at $91,500 after a 5% drop, marking a 17% decline over the last 30 days.

- Market sentiment shifted to deep fear due to recent volatility and investors reassessing risk.

Winklevoss Perspective

- Cameron Winklevoss believes Bitcoin prices below $90,000 are temporary and sees this as a buying opportunity.

- The Winklevoss twins compare Bitcoin to gold, projecting it could reach $1 million in the future.

October Market Fluctuations

- Bitcoin hit a high of $126,200 on October 6, 2025, followed by significant liquidations.

- Analysts note this pattern aligns with post-halving cycles, predicting peaks 400–600 days later.

- The Kobeissi Letter reports current weakness as routine margin position unwinding.

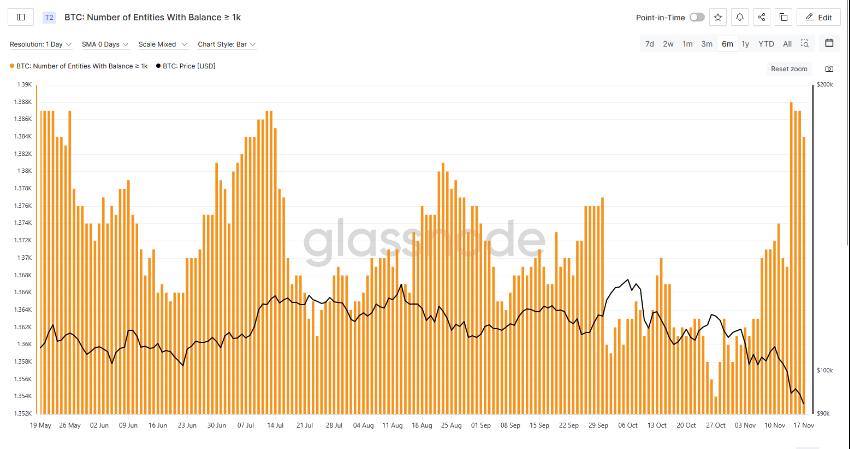

Whale Accumulation

- Glassnode data shows wallets with 1,000 BTC increased from 1,354 to 1,384 between October 27 and November 17.

- Smaller holders decreased; addresses with less than one BTC dropped from 980,577 to 977,420.

- Large holders are absorbing selling pressure, according to Markus Thielen of 10X Research.

Market Sentiment and Influences

- The Crypto Fear & Greed Index fell to 15, a level not seen since mid-2022.

- ETF outflows and geopolitical tensions contribute to market stress.

- Bitwise CIO Matt Hougan calls the current price a "generational opportunity," while acknowledging potential further downside.