2 0

Bitcoin ETF Outflows Reach $1.22 Billion Amid Institutional Demand Dip

Key Highlights:

- US Bitcoin ETFs experienced significant outflows of $1.22 billion over the past week, marking the largest weekly decline in two months.

- Bitcoin dropped from a weekly high of over $97,000 to around $89,000, indicating waning institutional interest as it failed to surpass the $100,000 mark.

- The outflows were most pronounced on January 20 and 21, with $479.7 million and $708.7 million withdrawn, respectively.

- Recent macro volatility has disrupted a brief inflow streak, leading to the longest period of weakness for BTC ETFs since their inception.

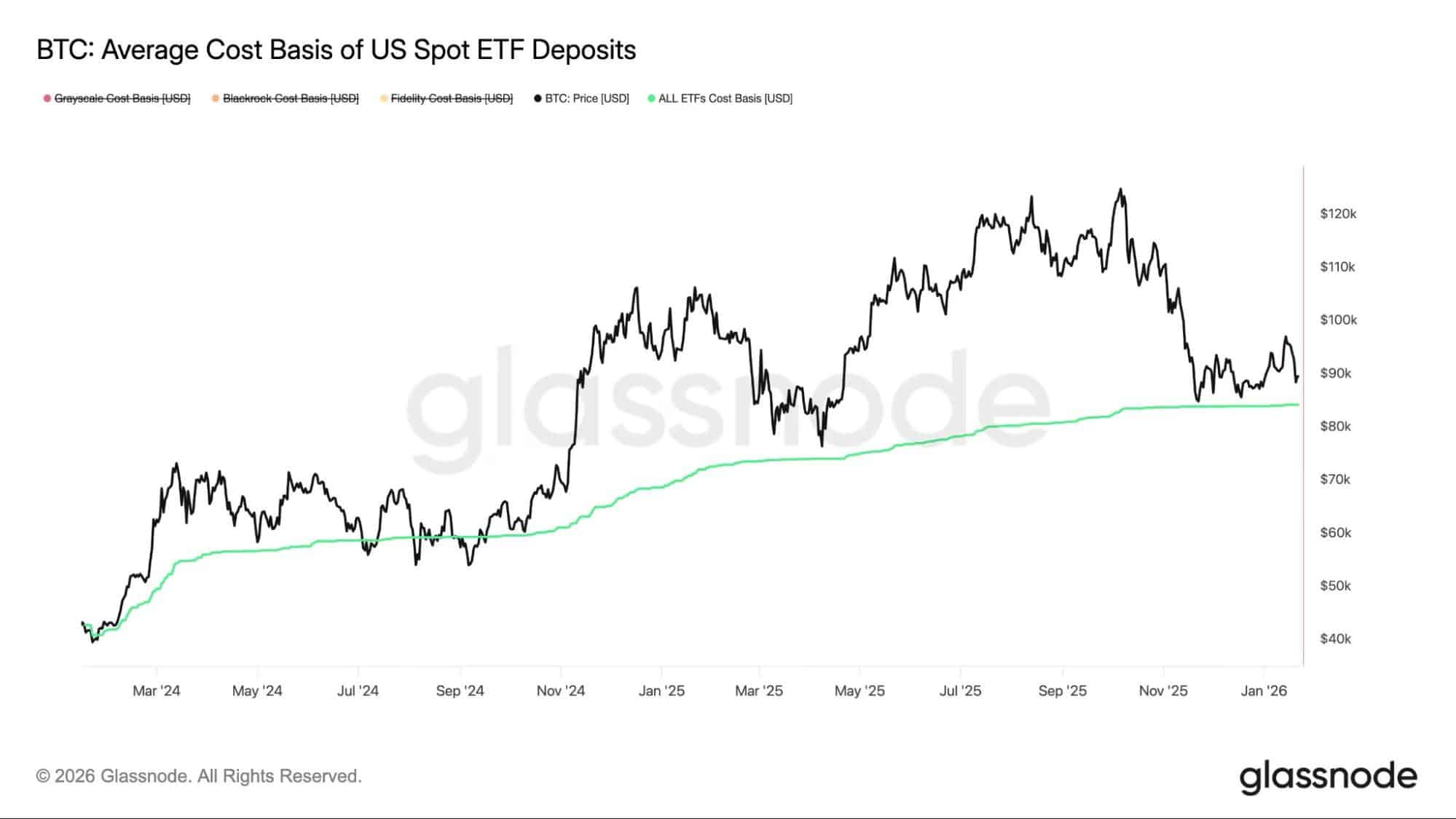

- Historically, heavy ETF outflows have coincided with local price bottoms, suggesting potential support near the average cost basis of $84,099.

- Analyst Ted Pillows noted that Bitcoin might retest the $87,000-$87,500 support range after losing momentum following a strong start to the year.

Investors should note ongoing pressure on BTC prices in the near term, with critical support levels playing a role in potential recovery or further declines.