7 0

Bitcoin ETFs See $101M Outflows, Analysts Warn of Support Fragility

- U.S. spot Bitcoin ETFs experienced a net outflow of $101 million on Oct. 22, while BlackRock's iShares Bitcoin Trust saw an inflow of $73.6 million.

- Ethereum ETFs also faced a net outflow of $18.7 million.

- The decline is attributed to macroeconomic uncertainty and reduced confidence in risk assets following recent political events in the U.S.

Critical Support Levels Under Pressure

- Bitcoin is trading around $110,000, with challenges to break past $113,000.

- The $107,000–$108,000 range is considered fragile, with institutional buyers largely absent.

- From October 13-17, Bitcoin ETFs saw outflows exceeding $1.23 billion, indicating reduced demand.

- The current support level is around $108,300, acting as key mid-term support.

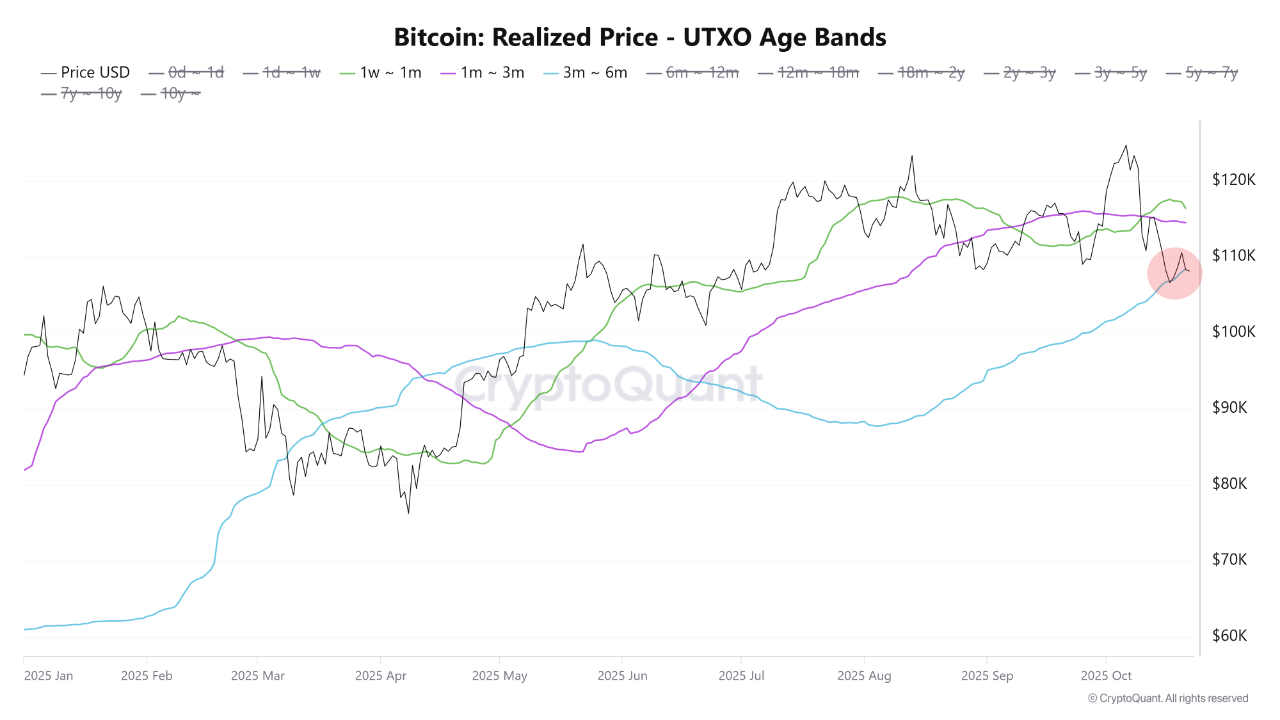

Market Data Indicates Demand Exhaustion

- Bitcoin trades below short-term holders’ cost basis ($113,100) and the 0.85 quantile ($108,600), signaling potential bearish phases.

- Long-term holders are selling into strength, with daily spending over 22,000 BTC.

- Options data indicates rising demand for put contracts as traders hedge against further declines.

- Implied volatility has increased, with open interest near all-time highs, reflecting market nervousness.

- Short-term rallies face defensive positioning, suggesting slow recovery momentum.

- If institutional inflows do not rebound, the market might consolidate below $110,000.

- A sustained defense of the $108,000 level, supported by renewed ETF demand, could stabilize prices.