Bitcoin ETFs Exceed One Million BTC Holdings Within First Year

Bitcoin (BTC) exchange-traded funds (ETFs) have acquired over one million BTC in under a year since their launch, indicating strong investor demand.

Bitcoin ETFs Surpass One Million BTC Milestone

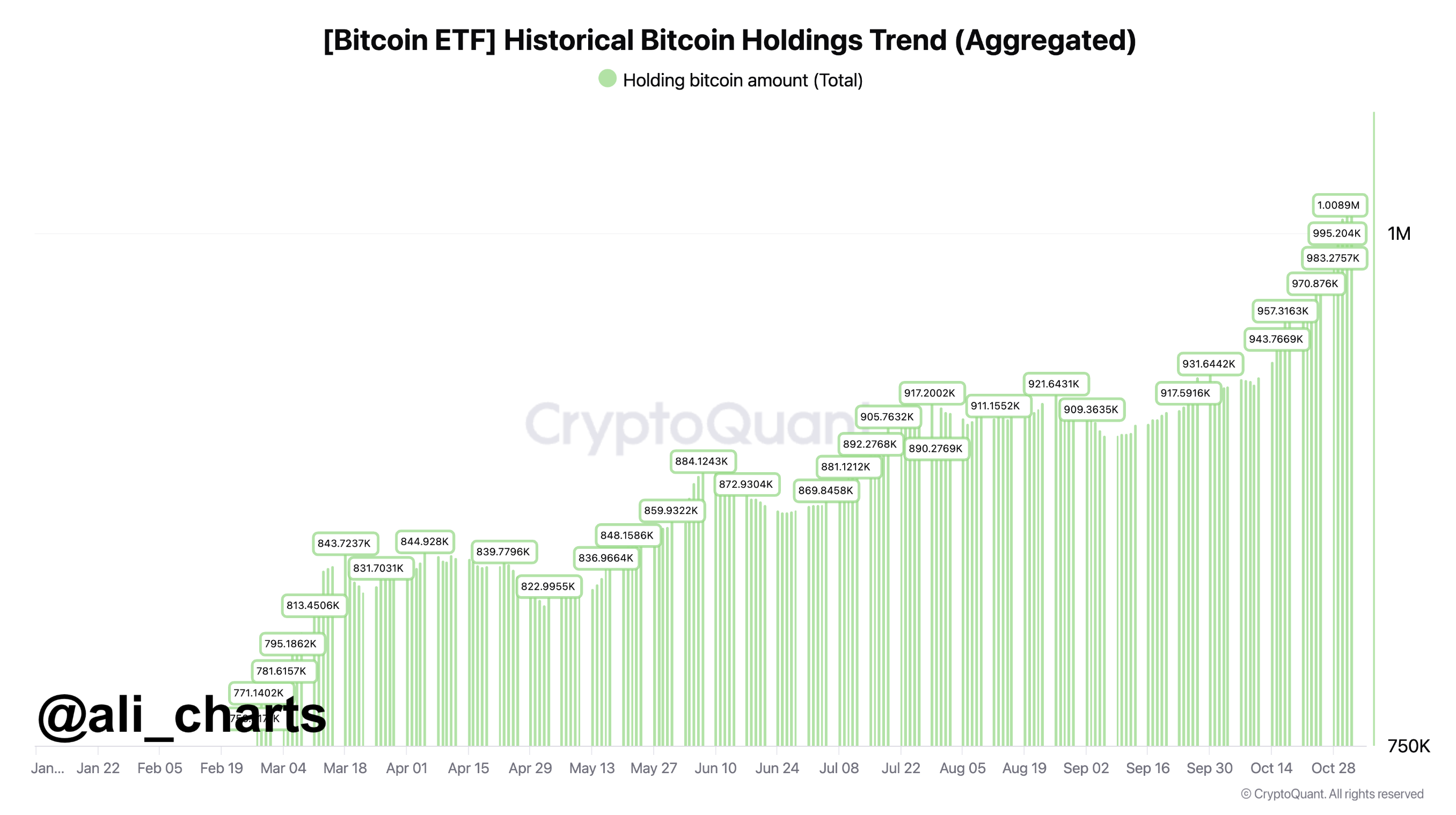

A chart by analyst Ali Martinez shows cumulative BTC holdings in Bitcoin ETFs exceeding one million BTC. The US Securities and Exchange Commission approved spot Bitcoin ETFs in January, leading to significant success.

Bitcoin ETFs have recorded total net inflows of $24.15 billion, with the value of BTC held by these ETFs around $70 billion. BTC's price rose from approximately $41,900 on January 8 to $68,941, an increase of nearly 65%, peaking at an all-time high of $73,737 in March.

With over one million BTC in ETFs, about 5% of the total supply of 21 million BTC is involved, reinforcing Bitcoin’s scarcity narrative. BlackRock’s IBIT spot BTC ETF leads with about $30 billion in assets, followed by Grayscale’s GBTC at $15.22 billion and Fidelity’s FBTC at $10.47 billion.

A CoinShares report highlighted that digital asset investment products attracted over $2.2 billion in inflows last week, attributed to speculation regarding the upcoming US presidential election. Initial inflows were higher at the week's start, while outflows increased as Democratic candidate Kamala Harris's chances improved.

Decentralized prediction markets indicate Harris has a 41.6% chance of winning, whereas Republican candidate Donald Trump holds a 58.5% chance.

Trump Win To Benefit Crypto, Experts Opine

Experts suggest a Trump victory may benefit BTC and other digital assets. JPMorgan noted retail investors view BTC as a way to protect purchasing power amid inflation, with a potential Trump win providing additional upside for BTC.

Conversely, Kamala Harris is reportedly exploring new digital asset policies, differing from the current administration's cautious approach. The impact of her stance on crypto-focused voter support remains uncertain.

As of now, Bitcoin trades at $68,941, up 0.8% in the past 24 hours, with a market dominance of 56.7% according to CoinGecko data.