Bitcoin ETFs See $2.71B Inflows, BlackRock Leads with $2.63B

From October 6 to October 10, spot Bitcoin ETFs saw $2.71 billion in net inflows, indicating strong institutional interest. BlackRock's iShares Bitcoin Trust (IBIT) led with $2.63 billion, raising its net assets to $94 billion.

- BTC ETFs have had consistent inflows in October, except for a minor outflow of $4.5 million on October 10.

- Total October inflows surpassed $5 billion in just two weeks.

Despite short-term volatility and a brief drop below $110,000 on October 11, BTC quickly rebounded to around $115,570, up 3.5% in the past 24 hours. Trading volume also increased by 15% to approximately $92 billion.

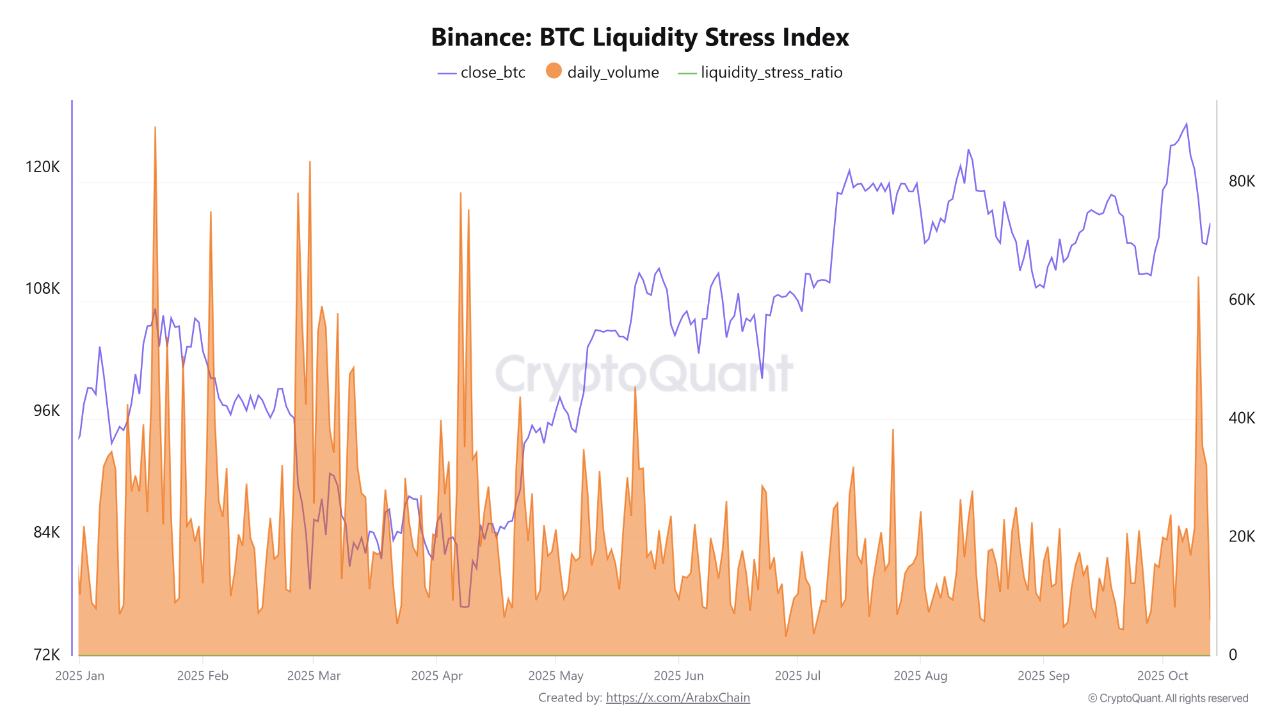

Liquidity Stress Peaks on Exchanges

Binance is experiencing high liquidity stress levels, complicating large trades without impacting prices. The liquidity stress index stands at 0.2867, indicating significant pressure due to stop-loss triggers and leveraged liquidations.

Analysts suggest recent price drops have shifted liquidity from short-term traders to institutional investors, who may have taken the opportunity to accumulate BTC at support levels. Market stabilization is expected if volumes decrease while prices maintain above $112,000.

What’s Next for BTC Price?

- Glassnode data shows funding rates have reached bear-market lows.

- Over $20 billion in positions were liquidated between October 10 and 12, before recovering slightly to $74 billion.

- Analysts are optimistic that BTC could reach $150,000 by the end of the quarter.