9 0

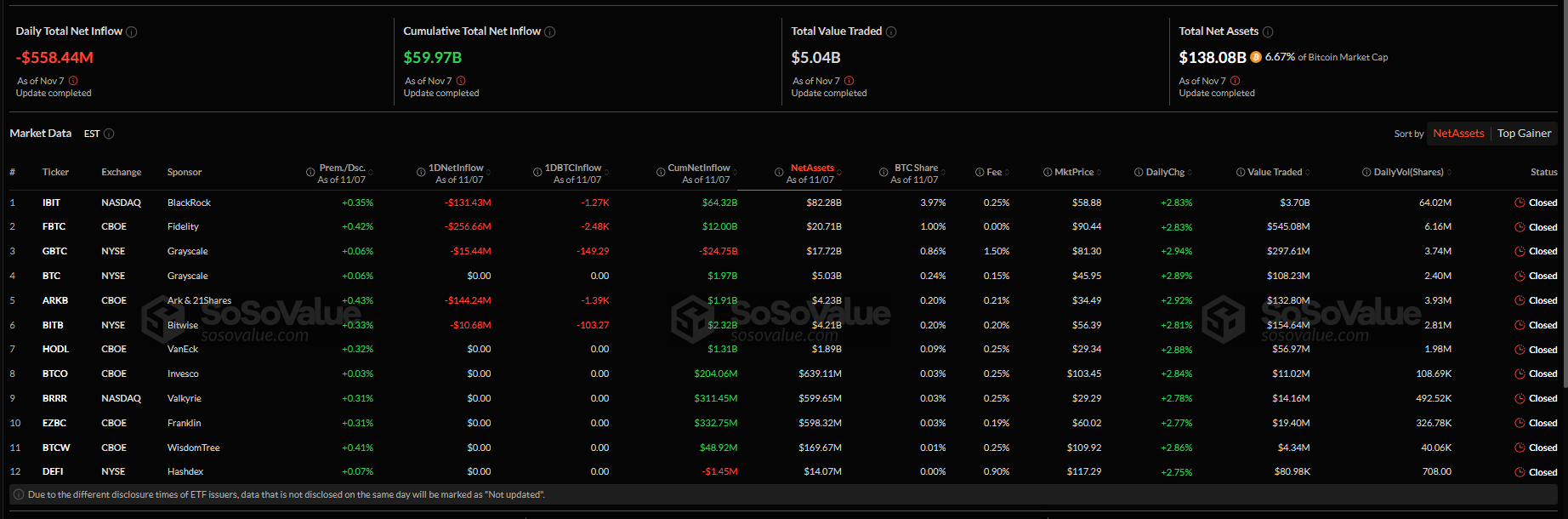

Bitcoin ETFs See $558 Million Outflow Amid Rebalancing Moves

Bitcoin ETF Outflows Surge

- Bitcoin-focused ETFs saw a withdrawal of $558 million, marking the largest outflow since August as prices hovered near $102,000.

- Fidelity’s FBTC experienced the highest outflow at $256 million, followed by Ark Invest And 21Shares’ ARKB with $144 million, and BlackRock’s IBIT with $131 million.

- JPMorgan increased its stake in BlackRock's ETF by 64%, totaling 5.28 million shares valued at $343 million.

Market Dynamics

- The large outflows are seen as position shifts rather than crashes, with some managers taking profits and others increasing exposure.

- Traders attribute these movements to macroeconomic uncertainties rather than a loss of confidence in Bitcoin.

Whale Activity and Long-Term Holders

- Long-dormant wallets have moved significant amounts, with sales ranging from $100 million to $500 million.

- K33 Research noted that 319,000 BTC held for six to 12 months were sold for profit.

- "Mega whales" sold approximately $45 billion worth of Bitcoin recently, indicating an organized exit by early holders.

Price Movements

- Bitcoin is trading within a tight range, with a demand block between $100K–$102K and resistance around $114K.

- The 100-day and 200-day moving averages act as overhead resistance, capping gains.

- A recent rejection near the 100-day MA at $110K led to a retest of the $101K support level.

Stabilization Observed

- Price stabilization at a high-volume node may indicate absorption, with support levels suggesting liquidity below $100K has been cleared.