12 0

– Bitcoin ETFs see over $5 billion in inflows since October start – Institutional investors increase holdings amid weak selling pressure – Current Bitcoin price around $121,400, recent high was $126,000 – Analysts predict potential rise to $150,000 this quarter – $110,000 identified as new structural bottom for Bitcoin – Financial institutions turning to Bitcoin amid weakening US dollar – Possible retest of $118,000-$120,000 support range expected

- Institutional investors are showing strong interest in Bitcoin as ETFs have seen over $5 billion in net inflows in October.

- On October 9, Bitcoin funds attracted $197 million, with BlackRock's IBIT leading with $255 million in inflows.

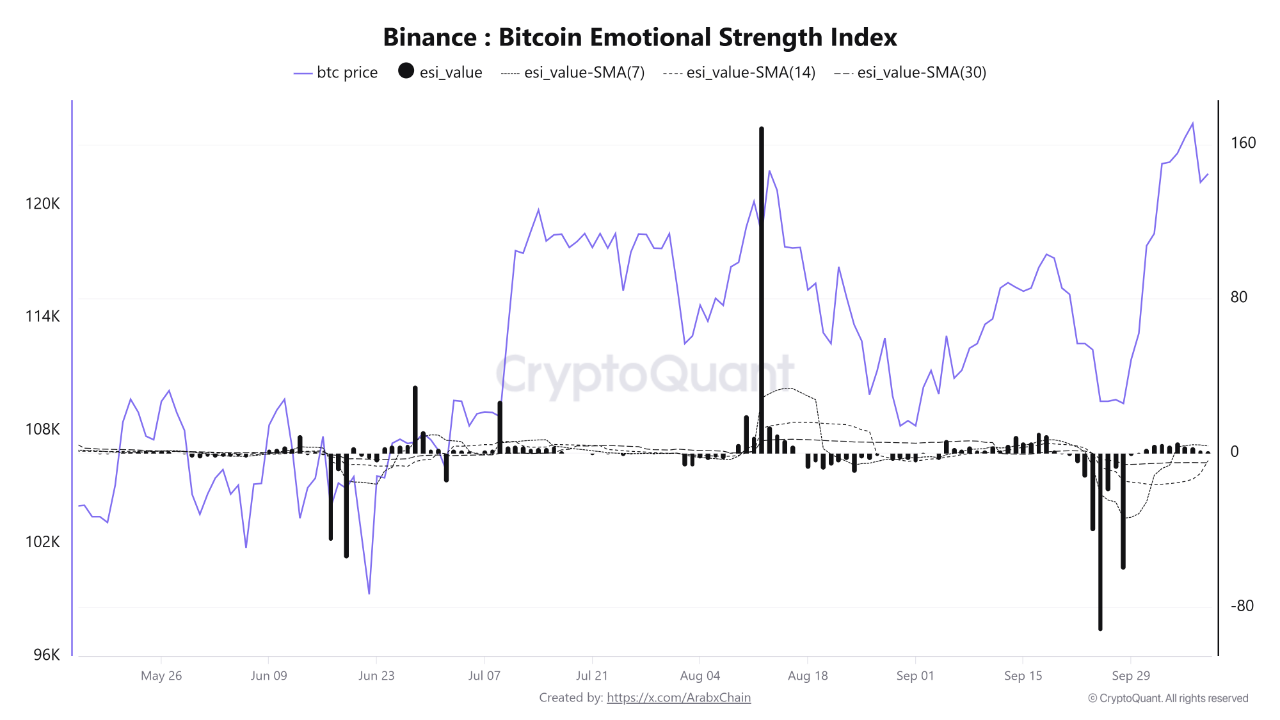

- Data from CryptoQuant indicates a positive shift in investor sentiment, potentially leading to an accumulation phase if Bitcoin remains above $120,000.

- Bitcoin is currently trading around $121,400, slightly down from a recent high of $126,000.

- Analysts forecast that Bitcoin could reach $150,000, especially if institutional investors shift from gold.

- Bitcoin's new structural bottom is considered at $110,000, with potential market cap growth to $3 trillion.

- The weakening US dollar is boosting interest in assets like Bitcoin and gold.

- Analyst Ted Pillows suggests Bitcoin may retest the $118,000-$120,000 support level before any potential rally.