13 1

Bitcoin ETFs See $985 Million Inflow, Nearing All-Time High

Market Overview

- Bitcoin is nearing its all-time high of $124K, with spot ETFs observing five consecutive days of inflows totaling over $985 million on October 3.

- Ethereum ETFs also recorded $234 million in inflows, pushing ETH above the $4,500 mark, a 12% increase over the past week.

Institutional Accumulation

- The surge in ETF inflows indicates increased institutional demand after a September cooldown, suggesting large-scale investors are re-entering the market.

- Analysts describe the recent Bitcoin price dip from $117K to $108.6K as a "constructive reset," pointing towards potential for an all-time high retest.

- At present, Bitcoin trades at $122K, 1.6% below its record peak, indicating a strong rebound.

On-Chain Metrics

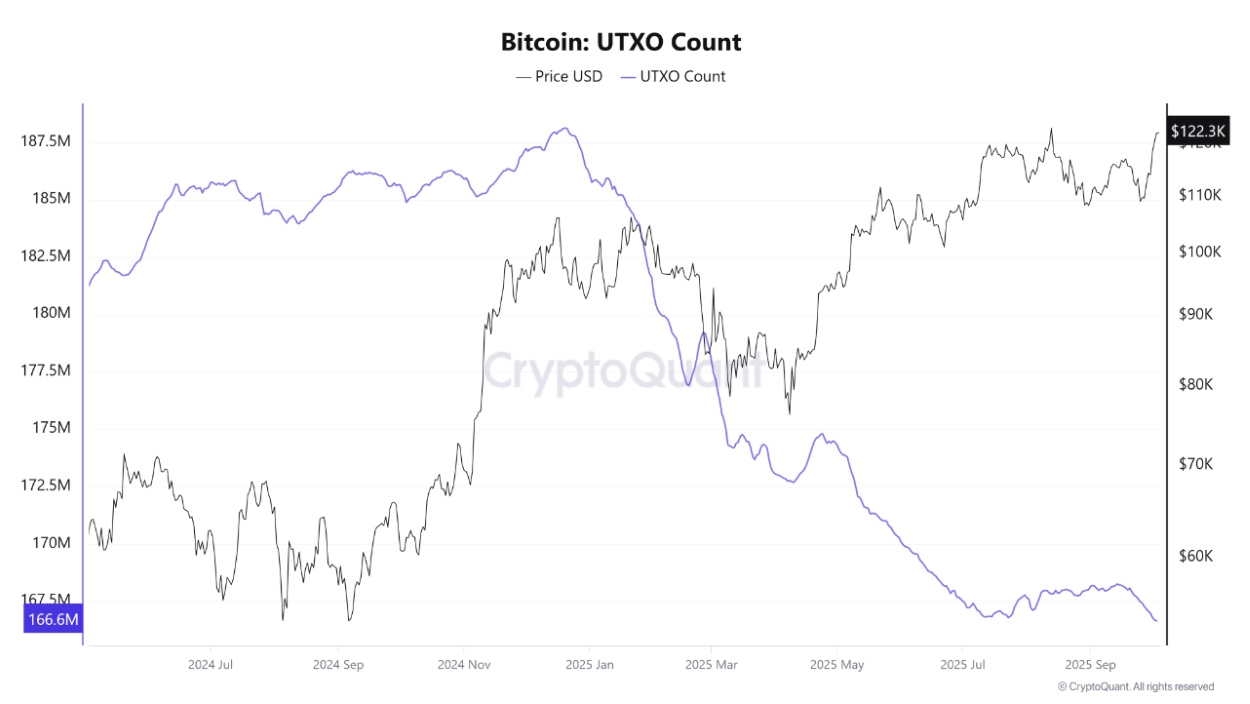

- Bitcoin’s UTXO count dropped to 166.6 million, the lowest since April 2024, signaling network consolidation and whale accumulation.

- This drop, alongside a price rise from $99K to $122K, reflects reduced retail activity and increased long-term holding.

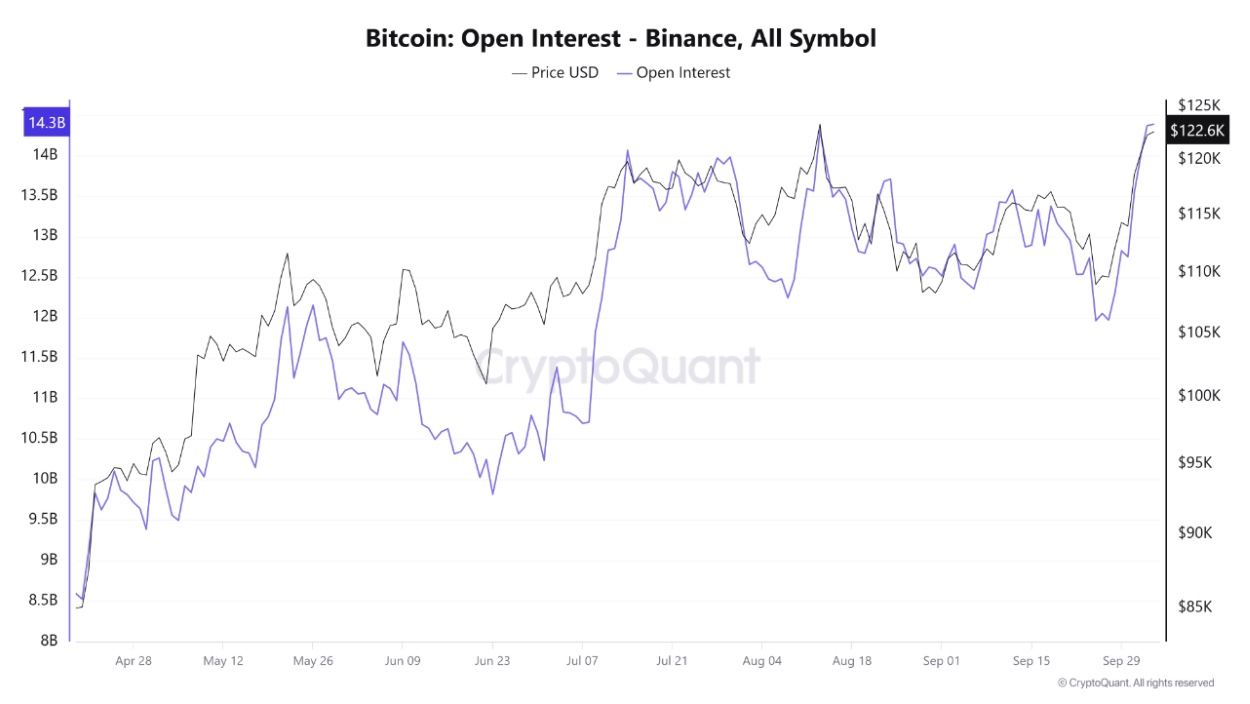

Derivatives Market

- Bitcoin derivatives open interest hit a record $14.37 billion on Binance, surpassing August's peak.

- The rise in open interest, coupled with price increases from $108K to $122K, highlights a rally driven by new inflows and positions rather than short covering.

- Analysts warn that persistent high open interest amid falling prices could lead to liquidations, although current structures support the rally.