16 0

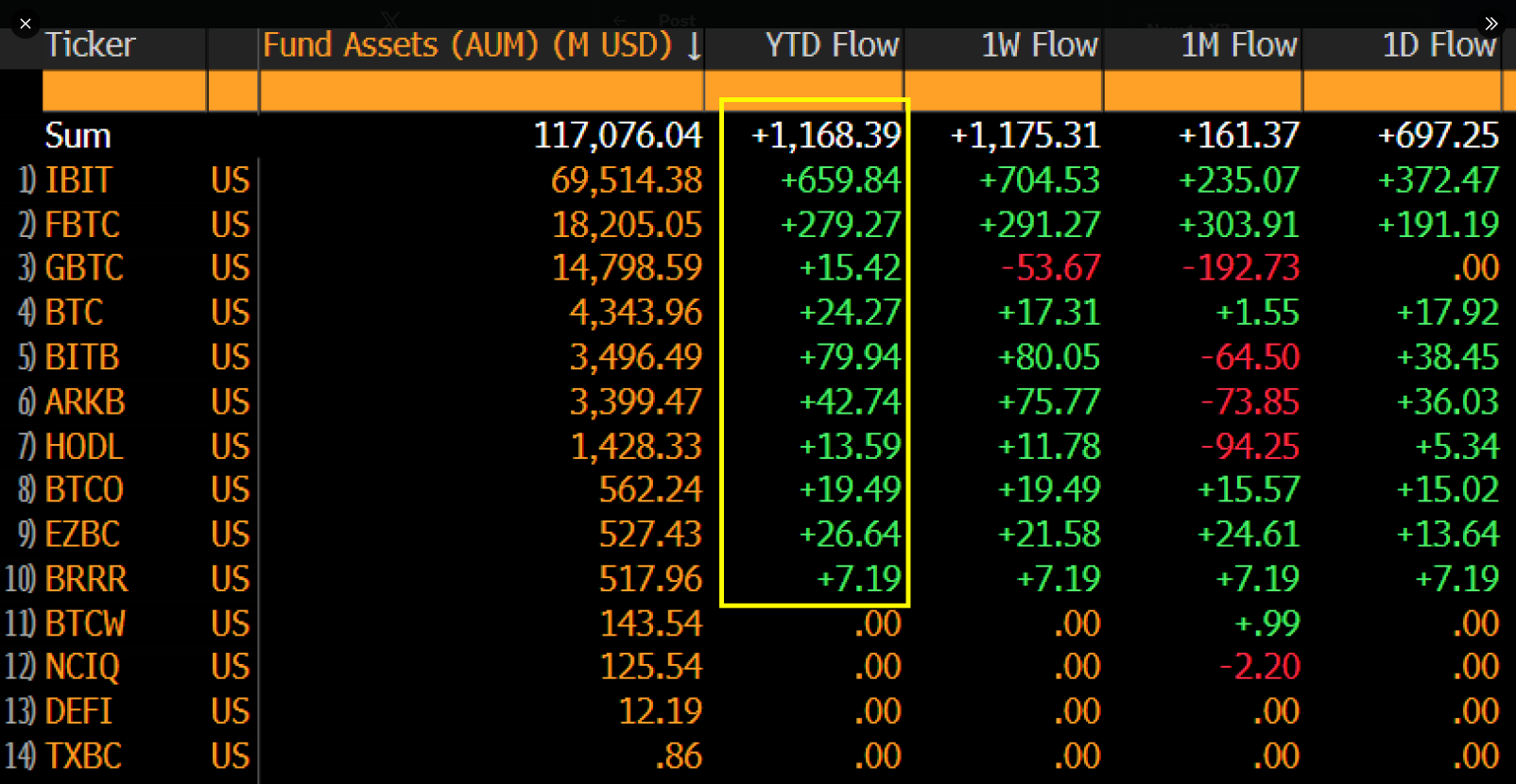

Bitcoin ETFs Attract $1.2 Billion in First Two Days of 2026

Spot Bitcoin ETFs in the US began 2026 with significant inflows, attracting over $1.2 billion in just two trading days, as reported by Bloomberg's Eric Balchunas. If this pace continues, annualized inflows could reach approximately $150 billion, a notable increase from 2025.

ETF Inflows

- Major spot Bitcoin ETFs experienced broad-based inflows.

- WisdomTree Bitcoin Fund (BTCW) was one of the few exceptions with lower demand.

- BlackRock’s iShares Bitcoin Trust (IBIT) captured a large share of previous year's buying.

Previous Performance

- In 2025, spot Bitcoin ETFs saw net inflows of over $21 billion, down from $35 billion in 2024.

- A recent single-day net inflow reached $697 million, the highest in three months.

- The surge coincided with Bitcoin prices rising above $90,000, leading to increased trading volume and position closures.

Institutional Developments

- Morgan Stanley filed to offer Bitcoin and Solana ETFs, joining established issuers.

- The firm manages around $8 trillion in advisory assets, permitting advisors to allocate to these products.

- The proposed Bitcoin trust will track the spot price without using leverage or derivatives.

Market Impact

- ETF demand may absorb circulating Bitcoin supply, potentially affecting market liquidity.

- Initial data indicated a substantial outflow from a Fidelity fund, suggesting possible daily net outflows.

Bitcoin Price Stability

- Despite geopolitical events, Bitcoin maintained stability around the low $90,000s, briefly surpassing $93,000.

- Price support attributed to short position liquidations and risk asset rebounds.

- Accumulation by larger holders noted, with markets treating news as concluded rather than disruptive.