4 0

Bitcoin ETFs Experience Significant Outflows and Price Weakness Persists

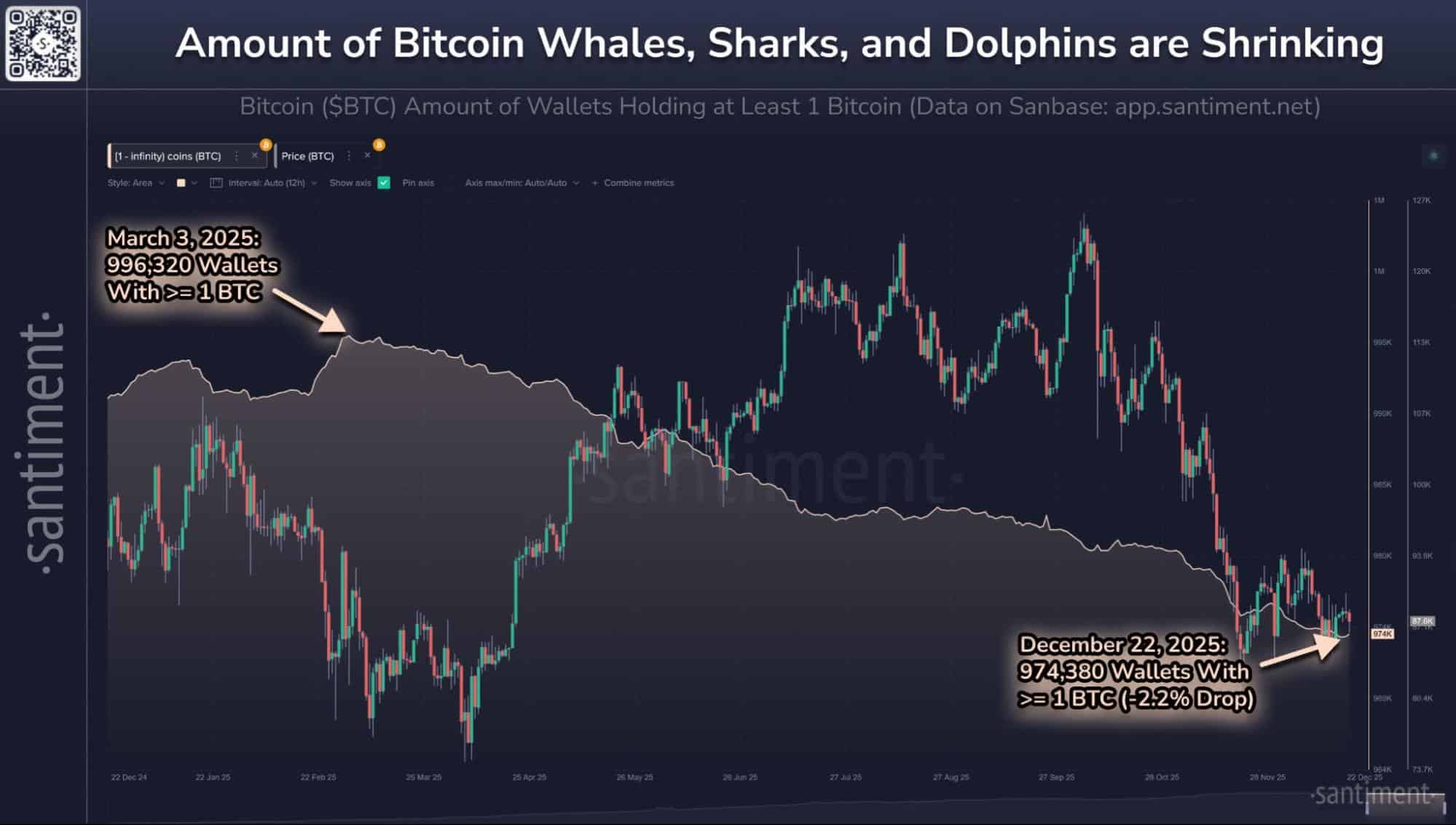

Bitcoin's price continues to struggle, with each recovery met by selling pressure. Current flirting around $87,000, on-chain data shows a decline in total wallet addresses among sharks and whales, indicating a bearish sentiment.

Repeating 2021 Price Pattern

- Analyst Tracer warns of a similar pattern to 2021, marked by a double top followed by a sell-off.

- Potential temporary bounce to $100K before another drop below $60K.

- Santiment reports a 2.2% decrease in wallets holding at least one Bitcoin since March peak.

- Wallets holding more than one Bitcoin increased holdings by approximately 136,670 BTC.

Bitcoin has shown a strong negative correlation with US tech stocks and metals like Gold and Silver. A recent bounce to $90,000 was rejected.

Bitcoin ETF Outflows

- US spot Bitcoin ETFs have experienced significant outflows, continuing from last week's $497 million.

- Total outflows across all US Bitcoin ETFs reached $188 million, with BlackRock iShares Bitcoin Trust seeing the largest at $157.3 million.

Overall, the current market dynamics indicate caution among investors as Bitcoin faces challenges both on-chain and from macroeconomic factors.