Bitcoin ETFs Expected to Experience Significant Growth in 2025

The Bitcoin (BTC) market has shown significant recovery this year, primarily due to the rise of Bitcoin ETFs. BTC reached an all-time high of $73,000 in Q1, with a recent peak of $104,000.

Donald Trump's presidential election has notably influenced this increase, as he adopts a pro-crypto stance, promoting America as the "crypto capital of the world." His position has boosted investor optimism and increased buying pressure from major Bitcoin ETF providers like BlackRock and Fidelity. The top 12 Bitcoin ETFs have become the largest BTC holders, with assets exceeding $100 billion.

This represents one of the most successful ETF launches, with these 12 spot Bitcoin ETFs collectively owning approximately 1.1 million BTC, about 5% of all Bitcoin in circulation.

Bitcoin ETFs Expected To Surpass 2024 Inflows

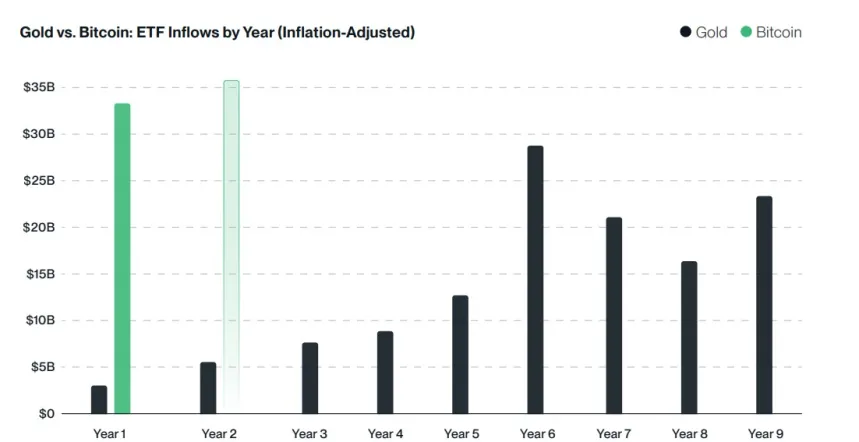

A recent report from Bitwise outlines three factors indicating continued growth for Bitcoin ETFs in 2025. The initial year of ETF operations is typically slow, with historical data from gold ETFs launched in 2004 showing increased inflows over subsequent years.

If the 12 spot Bitcoin ETFs follow a similar pattern, 2025 could see inflows surpassing those of 2024.

Another contributing factor is the expected involvement of major financial institutions such as Morgan Stanley, Merrill Lynch, Bank of America, and Wells Fargo. As regulatory environments improve under Trump, these firms are likely to promote Bitcoin ETFs to their clients, potentially channeling trillions into the crypto market.

Investors ‘Laddering Up’

Bitwise also highlights a trend of "laddering up," where initial small investments in Bitcoin lead to larger contributions over time. The firm posits that many investors who entered the Bitcoin ETF market in 2024 may increase their investments in 2025.

The assertion that "3% is the new 1%" reflects growing acceptance of Bitcoin as a legitimate asset class, which may prompt investors to allocate larger portions of their portfolios to cryptocurrencies.

As of now, BTC has consolidated above $100,900 following a 7% dip to $91,000 at the start of the month, with a nearly 4% price increase observed in the last 24 hours.

Featured image from DALL-E, chart from TradingView.com