7 0

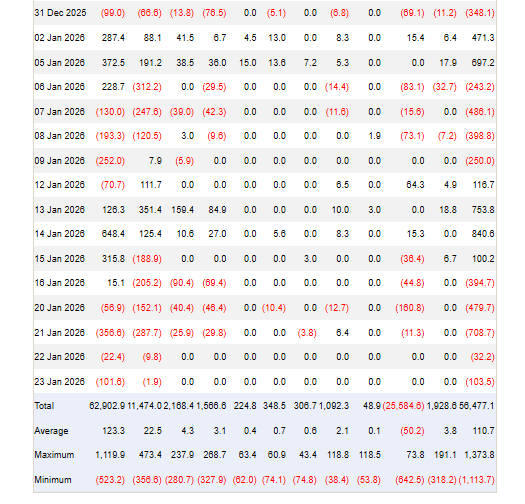

Bitcoin ETFs Lose $1.72 Billion Amid Investor Pullback in 5 Days

US-based spot Bitcoin exchange-traded funds (ETFs) saw outflows for the fifth consecutive day, totaling approximately $1.72 billion over the period. On Friday alone, around $103.5 million was withdrawn.

- Bitcoin traded near $89,160, below the $100,000 mark seen on November 13, indicating cautious investor behavior.

- ETF outflows may not only signify retail selling but also institutional rebalancing or tactical fund moves.

- The recent market activity was concentrated due to a four-day trading week in the US, influenced by Martin Luther King Jr. Day.

Market Sentiment and Alternative Assets

- The Crypto Fear & Greed Index showed an Extreme Fear score of 25, reflecting wary sentiment among traders.

- Gold and silver prices rose, with gold nearing $5,000 and silver approaching $100, adding pressure on confidence in crypto markets.

Bitcoin Price Movements

- Bitcoin's price fluctuated between $89,000 and $90,000 amid geopolitical tensions and trade concerns.

- Political indicators, such as tariff threats, affected market reactions more than direct conflicts.

Investor Caution and Potential Stabilization

- Bitcoin is behaving like a risk asset, aligning with equity movements during financial disruptions.

- Investors are evaluating short-term political risks against long-term macro trends and institutional interests.

- On-chain supply distribution and social indicators suggest reduced selling pressure, potentially stabilizing the market.