5 0

Bitcoin Spot ETFs Face Worst Month Since February with $3.48B Outflows

Key Highlights on Bitcoin and Market Dynamics:

- Bitcoin ETFs experienced significant outflows in November, with $3.48 billion in net outflows and a single-day exit of $903 million on November 20.

- BlackRock's IBIT faced record-setting outflows of $523 million but remains its most profitable ETF with over $119 billion in assets.

- New cost-basis cluster formed around the $80,000 range, potentially acting as a strong support zone due to fresh accumulation.

- Market liquidity issues arose at the start of December, emphasized by low liquidity and algorithm activations.

- Analyst Michaël van de Poppe anticipates another test of crucial resistance levels, possibly leading to a breakout towards $100,000.

- Entrepreneur Shanaka Anslem Perera attributes recent Bitcoin price actions to shifts in Japan’s bond yields, impacting the yen carry trade.

- Whales accumulated approximately 375,000 BTC amidst reduced institutional exposure and decreased miner sales.

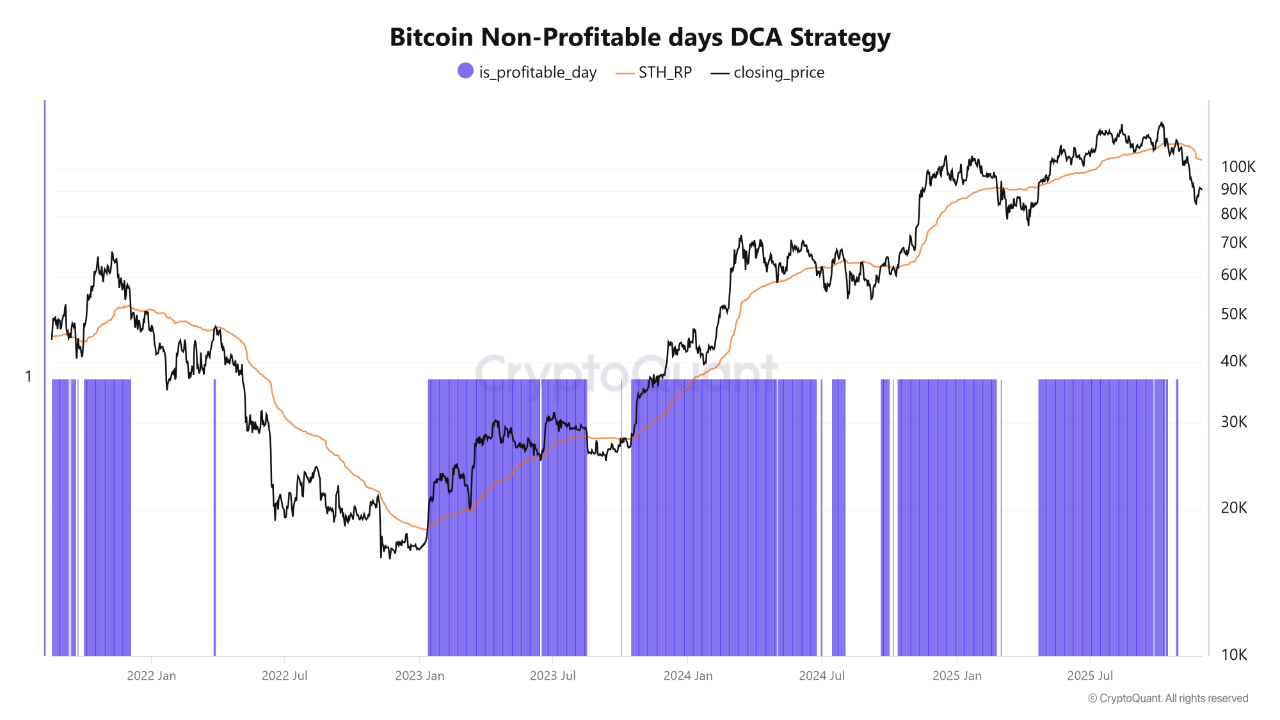

- CryptoQuant analysis suggests buying below the STH cost basis during stress phases can yield strong long-term results.